Cheaper Than 2008—Is This Wall Street's Forgotten Sector A Screaming 'Buy'?

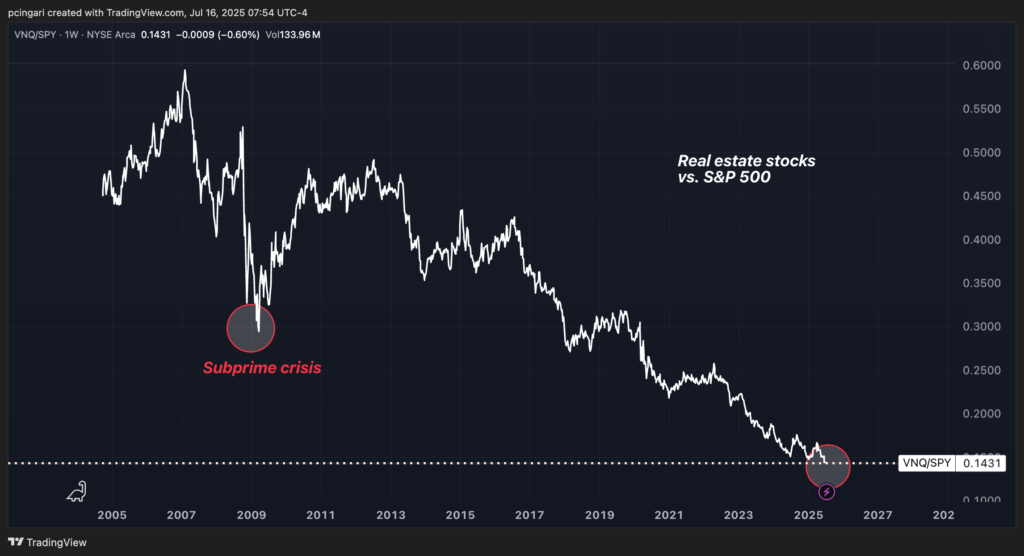

After years of underperformance and with prices stuck at levels not seen since the global financial crisis, the real estate sector is flashing signals of extreme weakness.

The numbers are brutal. The Vanguard Real Estate ETF (NYSE:VNQ), a bellwether for U.S. real estate stocks, has underperformed the SPDR S&P 500 ETF Trust (NYSE:SPY) by 5% so far in 2025.

That marks the ninth time in the past 10 years that the sector has lagged the broader market.

Compared to its 2007 highs relative to the S&P 500, real estate has lost about 75% of its value in relative terms.

That’s a wipeout worse than the 2008 housing crisis, and yet, the sector remains largely unloved by investors.

Are Real Estate Stocks Cheap Now?

Surprisingly, no. Despite the steep underperformance, real estate stocks aren't trading at bargain-bin prices.

As of July 16, the trailing price-to-earnings (P/E) ratio for the S&P 500 real estate sector stood at 35.04—second only to tech, which trades at 35.48.

Even more telling, the forward P/E ratio stands at 36.23, just below its five-year average of 36.70.

So, while prices may look beaten down on the chart, valuations suggest this isn't a classic deep-value play. It's more of a waiting game for the right macro catalyst.

Sector

Trailing 12-Month P/E Ratio

Information Technology

35.48

Real Estate

35.04

Consumer Discretionary

26.64

Industrials

26.07

Health Care

25.28

Materials

25.16

Consumer Staples

22.87

Utilities

20.71

Communication Services

20.08

Financials

17.33

Energy

15.37

Housing Data Paints A Gloomy Picture

Fundamentals in the real economy haven't helped sentiment.

U.S. housing starts fell by a sharp 9.8% in May to an annualized pace of 1.256 million units—the lowest since May 2020, back when the country was grappling with the pandemic's first wave. The drop reflects weakening builder confidence as high mortgage rates and excess housing inventory take their toll.

Meanwhile, mortgage applications—a leading indicator of future housing activity—plunged 10% in early July, completely reversing the prior week's gain. Refinancing activity fell by 12%, and applications for new home purchases slipped 7%, according to the Mortgage Bankers Association.

This was the steepest weekly drop in nearly three months, amplified by a modest uptick in mortgage rates and a general atmosphere of economic caution.

Could Rate Cuts Spark A Reversal?

That's the real hope for real estate bulls.

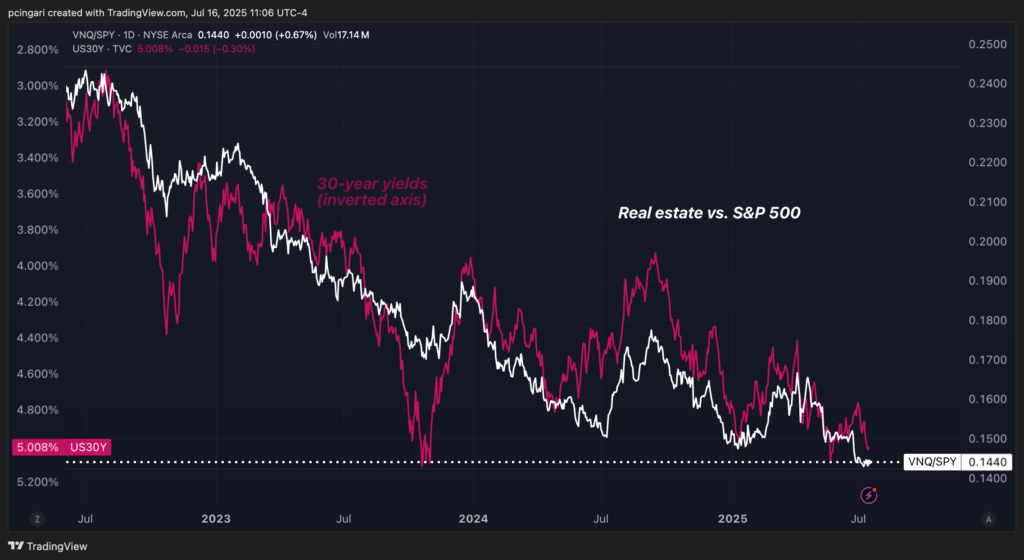

Over the past three years, real estate stocks have consistently lagged the broader market, closely mirroring the climb in 30-year Treasury yields—a trend clearly illustrated in the chart below.

As long-term borrowing costs rose, interest rate-sensitive sectors, such as real estate, struggled under the weight of higher financing costs, weaker demand for mortgages, and declining investor appetite for income-generating assets.

However, rate cuts aren't expected until later this year.

The Federal Reserve is widely expected to keep rates steady at 4.25–4.50% in July, yet market participants are pricing in two cuts by the end of the year. If that plays out—and borrowing costs fall—it could be the spark that reignites interest in the rate-sensitive real estate sector.

Falling rates would lower financing costs for developers, reduce mortgage rates for homebuyers, and potentially stimulate demand across commercial and residential markets.

In turn, that could breathe life back into real estate stocks, especially those tied to rental income or property development.

Currently, real estate is a sector that nobody seems to want.

It's trailing the market, missing the AI-fueled tech rally, and pricing in a stagnant future. However, if rate cuts occur and economic fears subside, sentiment could shift rapidly.

For contrarian investors, this may not be the perfect setup, but it could be good enough to start paying attention.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Macro Economic Events REIT Sector ETFs Econ #s Economics ETFs Real Estate