-

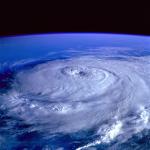

Hurricane Tailwinds May Have Blown Group 1 Auto Into An Unattractive Valuation

Monday, November 13, 2017 - 3:32pm | 319Read More...Group 1 Automotive, Inc. (NYSE: GPI) reported better-than-expected earnings Oct. 26 and the stock traded sharply higher. The Analyst The Buckingham Research Group's Glenn Chin downgraded the stock from Buy to Neutral and increased the price target from $77 to $86. The Thesis Hurricane...

-

CarMax Earnings Preview: Marginally Higher EPS Expected

Tuesday, December 20, 2011 - 7:42am | 618Read More...CarMax (NYSE: KMX) is scheduled to report fiscal third-quarter 2011 results tomorrow morning, December 21. Investors will be looking for the company to demonstrate that the earnings miss in the previous quarter was a fluke. Note that short interest is up from earlier this year and now is about 8.3...

-

Visa, Ross Stores and Five Other Stocks Worth a Look Now

Thursday, December 15, 2011 - 2:15pm | 902Read More...The stocks of the following dividend-paying companies are trading more than 20% higher than six months ago and all are within shouting distance of their 52-week highs. B&G Foods (NYSE: BGS): The New Jersey-based maker of shelf-stable foods, such as Cream of Wheat and Joan of Arc brands,...

-

Goldman Sachs Raises GPI Estimates

Friday, February 11, 2011 - 9:02am | 134Read More...Group 1 Automotive, Inc. (NYSE: GPI) 4Q10 EPS of $0.64 was slightly above “our expectation of $0.63 and the Street of $0.62,” Goldman Sachs reports. “We are raising our 2011/2012 estimates to $3.61/$4.53 from $3.46/$4.25. We are also introducing our 2013E EPS estimate of $4.86,” Goldman Sachs...

-

GPI 4Q Adjust EPS Slightly Ahead Of Consensus, J.P. Morgan Reports

Thursday, February 10, 2011 - 10:25am | 113Read More...Group 1 Automotive, Inc. (NYSE: GPI) reported 4Q adjusted EPS of $0.64, slightly ahead of JPMe ($0.62) and Bloomberg consensus ($0.61), J.P. Morgan reports. “Stronger-than-expected revenues ($1.44B vs. JPMe of $1.25B) were partially offset by lower gross margins (15.1% vs. JPMe of 16.6%) and higher...

-

Wells Fargo Takes A Cautious Stance On Public Auto Retailers

Monday, October 18, 2010 - 11:39am | 123Read More...Wells Fargo says that it is moving to a more cautious stance on the public auto retailers and downgrading Group 1 Automotive from Outperform to Market Perform. “Group 1 Automotive, Inc. (NYSE: GPI) shares are up approximately 30% over the past year versus the other public dealer groups, up...

-

Group 1 Automotive (GPI) Upgraded To Buy

Thursday, February 18, 2010 - 4:36pm | 80Read More...Shares of auto retailer Group 1 Automotive, Inc. (NYSE: GPI) are up nearly 5% for the day. Soleil Securities upgraded the shares from Hold to Buy and raised the price target from $35 to $36. Analysts believed that the recent drop in the company's stock was due to an overreaction to the possible...