-

Warren Buffett Favors 5% Treasury Bills Over Buybacks As Berkshire Hathaway's Cash Pile Balloons To $334 Billion: 'The Rate Of Change… That's Most Telling,' Says Expert

Sunday, February 23, 2025 - 11:03pm | 611Read More...Berkshire Hathaway Inc.’s (NYSE:BRK) (NYSE:BRK) share repurchases have dropped dramatically as Warren Buffett appears to prefer 5% Treasury bills over buying back company stock. What Happened: Berkshire’s buybacks fell to $2.9 billion in 2024 from $9.2 billion in 2023 and $7.9 billion...

-

Is Warren Buffett Bearish Or Waiting To Pounce? Berkshire Now Owns More T-Bills Than Federal Reserve, Several Countries

Wednesday, August 7, 2024 - 4:02pm | 482Read More...Billionaire Warren Buffett‘s Berkshire Hathaway Inc (NYSE:BRK) (NYSE:BRK) surprised many observers by offloading a significant portion of Berkshire’s Apple Inc (NASDAQ:AAPL) holdings in the second quarter. Berkshire Hathaway’s balance sheet is now substantially weighted to United...

-

What Warren Buffett Says You Should Buy Right Now After Berkshire Hathaway Meeting

Monday, November 6, 2023 - 1:48pm | 411Read More...Legendary investor Warren Buffett is making a strategic, albeit surprising, move by reducing exposure to equities and increasing his cash holdings on the heels of appealing interest rates. According to the latest quarterly financial results of his conglomerate, Berkshire Hathaway Inc. (NYSE:BRK),...

-

How To Earn $500 Monthly Income With These Cash-Like Treasury ETFs

Monday, October 9, 2023 - 12:40pm | 1043Read More...In a world where cash is once again king, investors are turning their attention to cash-like funds and ETFs. One universe garnering notable interest is the U.S. Treasury market, where yields on short-term bonds have climbed to levels not seen in nearly two decades. As of now, the annual yield on U....

-

CSHI: The Options-Based Cash Alternative Everyone Needs To Know About Right Now

Monday, September 25, 2023 - 11:44am | 1829Read More...TL;DR The NEOS Enhanched Income Cash Alternative ETF (ARCA: CSHI) seeks to generate monthly income in a tax-efficient manner. The put option strategy allows them to distribute ~1.5% in additional yield while offering a favorable risk-to-reward ratio to investors. These mid-single-digit...

-

Treasury Bills At 5% Yield: Retail Investors Jump On The Risk-Free Bandwagon

Tuesday, September 12, 2023 - 9:12am | 630Read More...Treasury bills, those often-overlooked short-term securities, are back with a bang. Treasury yields are surpassing the 5% mark for maturities spanning from one month to two years. This resurgence is enticing investors to shift their funds from stagnant bank accounts and into the world of cash-like...

-

Investors Bet $7B On Ultra-Short Term Bond ETFs, Chase 5% Returns Amid Market Volatility

Thursday, August 31, 2023 - 4:41pm | 689Read More...August’s unpredictable market swings have led investors to seek solace in cash-equivalent ETFs, marking the most significant influx in recent months. Billions Flow into Ultra-Short Bond ETFs Investors have funneled a whopping $7 billion into ultra-short bond ETFs in August, as per Bloomberg...

-

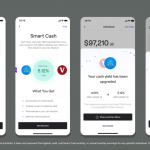

Titan Targets High-Yield Seekers With Automated Smart Cash Solution: What T-Bill Investors Need To Know

Wednesday, July 12, 2023 - 4:54pm | 595Read More...Since its inception, Titan, an asset management platform, has been a game-changer in democratizing wealth management. The company is now shaking up the cash management industry with its latest offering, Smart Cash. Benzinga spoke with Titan co-founder and co-CEO Clayton Gardner about the new...

-

Traders Unwind Fed Rate Cut Bets This Year After Powell's Hawkish Stance

Tuesday, June 27, 2023 - 3:46am | 412Read More...Traders appear to be backing out on the idea that the Federal Reserve will trim rates this year, as is apparent from the U.S. short-term interest-rates market, a report stated. Options open interest, which shows the amount of risk held by traders, declined sharply across a number of strikes shown...

-

More Rate Hikes Ahead? Hedge Funds Keep Shorting T-Bills Relentlessly

Monday, June 12, 2023 - 3:28am | 431Read More...Hedge funds continue to extend their short positions on short-term Treasury Bills at a time when there is a widespread opinion that the Federal Reserve's rate hiking cycle may not be over yet. Leveraged investors increased their net-short two-year Treasury positions for an eleventh straight week in...

-

T-Bill Deluge Ahead? Why This Portfolio Manager Thinks US Could Have Its Own Bank Of England Moment

Tuesday, May 30, 2023 - 4:00am | 520Read More...Otavio Costa, a portfolio manager at Crescat Capital, believes the United States is primed to have its own Bank of England moment given that the Federal Reserve may have to end up buying Treasury Bills as a last resort. This is because a deluge of bonds is anticipated to hit the market in the...

-

Default Fears Push Yields On Short-Term T-Bills To Over 7% — JPMorgan Says 1-in-4 Chance US Will Hit Date X

Wednesday, May 24, 2023 - 11:28pm | 434Read More...The continuing political stand-off in debt ceiling negotiations has begun taking its toll on short-term treasuries with yields on soon-to-mature papers reportedly topping 7%. The impasse has also hurt appetite for short-term treasuries as the possibility of a default is something that investors...

-

'Rich Dad, Poor Dad' Author Highlights Record Yield On 1-Month T-Bill: 'OMG…Stick With Gold, Silver, Bitcoin'

Monday, May 8, 2023 - 12:01am | 568Read More...‘Rich Dad, Poor Dad' author Robert Kiyosaki has cautioned about the significant rise in the yield on one-month treasury bill asking his Twitter followers to stick with gold, silver and Bitcoin (CRYPTO: BTC). "OMG. "The best collateral "in the world, the 1 month T-Bill went up by 100 basis points....

-

As JPMorgan Pays Literally Nothing On Deposits, Elon Musk Rues People's Poor Money Management: 'So Bizarre'

Wednesday, April 26, 2023 - 3:14am | 324Read More...Tesla CEO Elon Musk on Tuesday chimed in on the prevailing bank rates and also offered his take on what could be the most viable option for depositors. What Happened: Conservative financial blog site Zerohedge tweeted that JPMorgan Chase & Co. (NYSE:JPM) may have had to shell out $90 billion...