2 Major Reasons Real Estate Investors Should Watch Portugal And Spain

If the axiom "great minds often think alike" is true, then real estate investors should pay attention when alternative asset manager The Blackstone Group L.P. (NYSE: BX) and global logistics giant Prologis Inc (NYSE: PLD) are both thinking about Portugal and Spain.

On December 2, Blackstone announced that one of its European real estate funds had acquired five additional shopping centers in Portugal, a total of approximately 700,000 square feet, to be managed the firm's Multi Corporation retail platform.

This is in addition to the award winning Forum Sintra center near Lisbon that Multi already owns and operates. Forum Sintra is a 592,000 SF, 3-story mall containing 188 stores, a supermarket, a 20 restaurant food court and seven-screen cinema.

Furthermore, Blackstone announced that the same fund, Blackstone Real Estate Partners Europe IV, had acquired its first industrial assets in Portugal. These five industrial properties totaling around 1.99 million SF, will be managed by Logicor, Blackstone's European industrial platform company.

This increases Logicor's portfolio in Spain in Portugal to over 8.9 million SF. Currently, Logicor operates a portfolio of over 64.5 million SF of industrial space located in 12 European countries.

Blackstone Group had previously announced the purchase of 14 shopping centers in the Netherlands from CBRE Global Investors L.L.C. and reported the sale of its U.S. IndCor Properties Inc. industrial portfolio to an Asian group for $8.1 billion.

Prologis Snags Build-To-Suit

By way of comparison, San Francisco based Prologis is the leading provider of industrial real estate in Spain, with approximately 9.6 million SF of logistics and distribution space as of September 30, 2014.

On December 3, Prologis announced that it had reached an agreement with TNT Express to build a 139,000 SF facility about 15 minutes from central Madrid and adjacent to Madrid–Barajas Airport.

Source: TNT Corporate - typical facility

Source: TNT Corporate - typical facility

"We are pleased to extend our relationship with TNT to 6 markets on three continents," said Francois Rispe, regional head, Prologis Southern Europe. "This agreement reflects the lack of supply of Class-A logistics facilities in Madrid. As the market recovers, our well-located land bank will be attractive to customers seeking expansion or relocation opportunities."

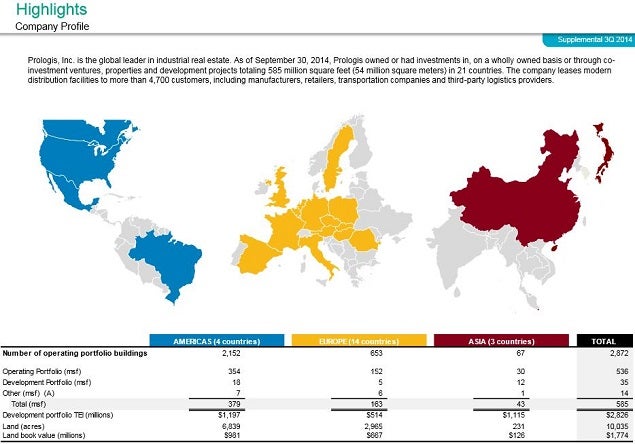

Prologis is the largest U.S. based industrial REIT. The company leases Class-A distribution facilities to more than 4,700 customers, including manufacturers, retailers, transportation companies, and third-party logistics providers.

As of September 30, 2014, Prologis owned or had investments in, properties and development projects expected to total approximately 585 million square feet in 21 countries.

Final Thoughts

During a CNBC interview on December 3, Blackstone Chairman and CEO Steve Schwarzman commented on how "terrific" real estate has been for the firm. Of particular note, Schwarzman commented that:

1. Regarding the IndCor sale: Blackstone assembled the second largest warehouse company in the U.S. through 14 transactions beginning in 2010. The firm invested $1.7 billion and got out $2.2 billion.

2. Regarding Europe: Slow growth and pessimism has created buying opportunities. Blackstone is getting good cash on cash returns on European real estate investments, then even better when the firm adds in leverage.

Schwartzman also commented that when the Fed raises interest rates in the future -- if the public markets over-react -- it may once again create an opportunity for Blackstone to buy publicly traded REITs and take them private.

Image credit: Michael M, Flickr.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: IndCor Properties Steve Schwarzman TNT ExpressLong Ideas REIT Trading Ideas General Real Estate Best of Benzinga