Top 3 Materials Stocks That Could Lead To Your Biggest Gains In Q3

The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

LSB Industries Inc (NYSE:LXU)

- On July 29, LSB Industries posted weaker-than-expected quarterly earnings. “We generated a 6% year-over-year increase in sales volumes during the second quarter,” stated Mark Behrman, LSB Industries’ Chairman & Chief Executive Officer. The company's stock fell around 10% over the past five days and has a 52-week low of $4.88.

- RSI Value: 29.3

- LXU Price Action: Shares of LSB Industries fell 13.2% to close at $7.56 on Wednesday.

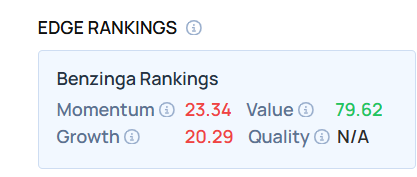

- Edge Stock Ratings: 23.34 Momentum score with Value at 79.62.

O-I Glass Inc (NYSE:OI)

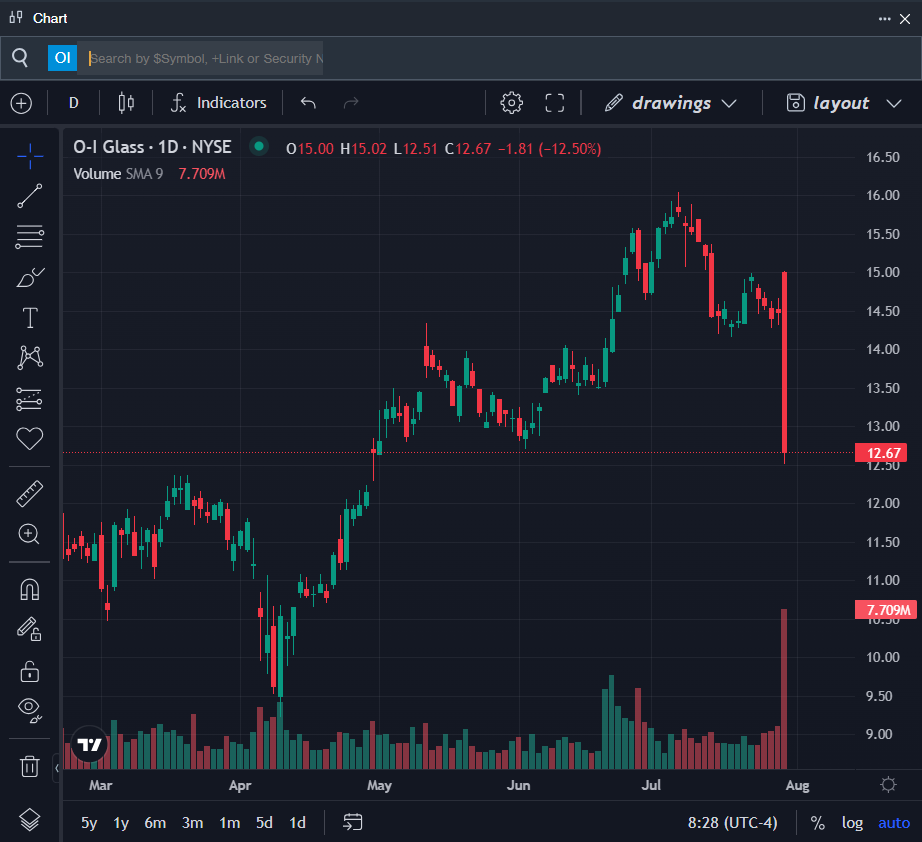

- On July 29, O-I Glass reported better-than-expected second-quarter financial results and raised its FY25 adjusted EPS guidance with its midpoint above estimates. “Our teams executed effectively to deliver a strong second quarter 2025 performance, despite a sluggish demand environment,” said Gordon Hardie, Chief Executive Officer of O-I Glass. The company's stock fell around 15% over the past five days and has a 52-week low of $9.23.

- RSI Value: 20

- OI Price Action: Shares of O-I Glass fell 12.5% to close at $12.67 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in OI stock.

Scotts Miracle-Gro Co (NYSE:SMG)

- On July 30, Scotts Miracle-Gro reported worse-than-expected third-quarter revenue results. “We delivered significant improvements in the financial metrics that are central to our fiscal ’25 plans, further putting us on the path to achieving our full-year guidance,” said Jim Hagedorn, chairman and chief executive officer. “Early in our fourth quarter, consumer POS remains steady, giving us momentum as we extend the lawn and garden season into the fall." The company's stock fell around 11% over the past five days and has a 52-week low of $45.61.

- RSI Value: 27.3

- SMG Ltd Price Action: Shares of Scotts Miracle-Gro fell 8.5% to close at $62.09 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SMG shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas materials Oversold StocksLong Ideas News Pre-Market Outlook Markets Trading Ideas