Top 3 Industrials Stocks That May Collapse In May

As of May 9, 2025, three stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

LYFT Inc (NASDAQ:LYFT)

- On May 8, Lyft reported better-than-expected first-quarter EPS results. Also, the company announced a $750 million share buyback plan. “Q1 marked Lyft’s 16th consecutive quarter of double-digit year on year Gross Bookings growth demonstrating the resilience and momentum of our customer-obsessed strategy,” said Lyft CEO David Risher. The company's stock jumped around 15% over the past month and has a 52-week high of $19.06.

- RSI Value: 70.4

- LYFT Price Action: Shares of Lyft gained 3.3% to close at $13.00 on Thursday.

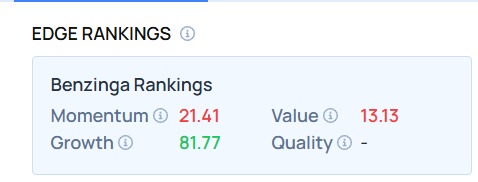

- Edge Stock Ratings: 21.41 Momentum score with Value at 13.13.

Matrix Service Co (NASDAQ:MTRX)

- On May 7, Matrix Service posted downbeat quarterly results. “Our third quarter results reflect accelerating revenue, supported by backlog growth which advances our return to profitability and enhances our visibility into future earnings,” said John Hewitt, President and Chief Executive Officer of Matrix Service Company. The company's stock gained around 25% over the past month and has a 52-week high of $15.75.

- RSI Value: 74.6

- MTRX Price Action: Shares of Matrix Service gained 11.3% to close at $13.65 on Thursday.

Manitowoc Company Inc (NYSE:MTW)

- On May 6, Manitowoc posted weaker-than-expected quarterly results. “First-quarter results exceeded our expectations. We began to see signs of a turnaround in our Europe tower crane business with machine orders up 68% year-over-year, marking the third consecutive quarter of year-over-year growth,” said Aaron Ravenscroft, President and Chief Executive Officer of The Manitowoc Company, Inc. The company's stock gained around 22% over the past month and has a 52-week high of $13.46.

- RSI Value: 78.3

- MTW Price Action: Shares of Manitowoc gained 14.7% to close at $9.82 on Thursday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas industrials Overbought stocksNews Short Ideas Pre-Market Outlook Markets Trading Ideas