5 Charts Solar Investors Need To See

The market continues to fear that the U.S. solar Investment Tax Credit (ITC) expiration at the end of 2016 will mean the end of growth in the U.S. solar industry.

In a new report, Morgan Stanley analyst Stephen Byrd included five sets of charts that shed some light on SolarCity and Sunrun, explaining what the market expects of the two companies in coming years. Here's a look at the five charts included in the report.

At recent trading levels, Byrd sees very little growth priced into the stocks beyond 2016.

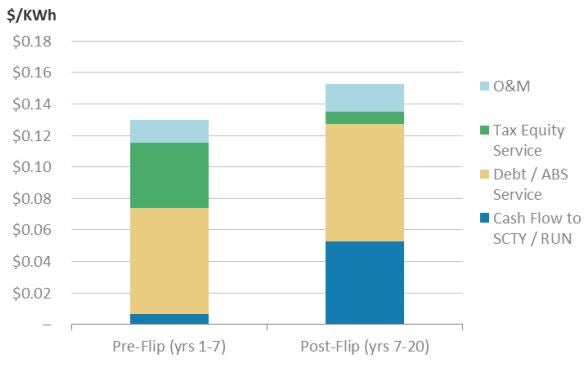

In terms of the underlying business, Byrd sees “significant margin” being created with each solar contract. The companies retain a large amount of power purchase agreement revenue.

After the ITC drops to 10 percent, the two companies will turn to cost cutting and asset-backed securities debt to make up for the drop-off in tax equity.

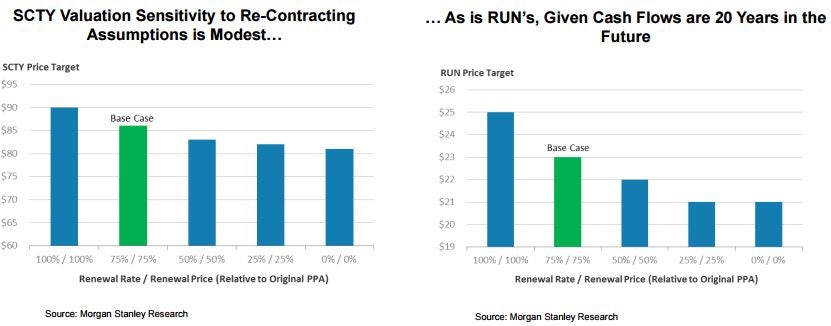

Byrd wonders if the market is overestimating the share price sensitivity that the two stocks have to renewal rates and prices. Morgan Stanley estimates a 75 percent renewal rate at 75 percent of the original contract price would reduce their SolarCity target price by only around 5.0 percent.

Byrd admits that rising interest rates will weigh on the two stocks, but he believes that the current share prices have more than discounted this potential headwind.

Despite the selloff, Byrd remains bullish on both stocks and believes the market has an overly pessimistic view. Morgan Stanley maintains Overweight ratings on both SolarCity and Sunrun.

Disclosure: The author holds no position in the stocks mentioned.

Image Credit: Public Domain

Latest Ratings for SCTY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Nov 2016 | Axiom Capital | Downgrades | Hold | Sell |

| Oct 2016 | Axiom Capital | Upgrades | Sell | Hold |

| Aug 2016 | Raymond James | Downgrades | Strong Buy | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: ITCAnalyst Color Long Ideas Reiteration Top Stories Analyst Ratings Tech Trading Ideas Best of Benzinga