Why Apple Could Fall Another 11%: Fundamentals & Technicals Suggest Investors Should Stay Away

Shares of Apple Inc. (NASDAQ: AAPL) have been trading close to two-year lows in the past few days. On Thursday, the stock hit lowest point since June 2014. Following this event, Oppenheimer technical analyst Ari Wald and Bryn Mawr Trust's chief investment officer Ernie Cecilia were on CNBC to discuss the issue.

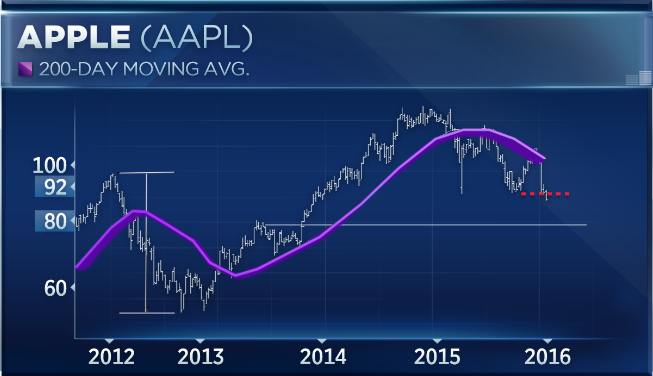

The charts aren't looking good, Wald started, pointing out "the bear trend is still intact," and thus recommending to stay away from the shares. A look at the chart below provides a great proxy for trends. The stock’s 200-day moving average is sloped lower.

Source: CNBC

"That 92-level breakdown, that's now resistance,” Wald assured. "You're going to see people looking to break even, people trying to buy at those lows. On the downside, we see very little support until you get down to the low $80 range… That would mark about a 40 percent decline [which] we have seen before," in 2012-2013, when the decline reached 25 percent. This has left investors one important lesson - wait for this stock to stabilize,” the expert concluded.

Agreeing with Wald, Cecilia disclosed that his firm has been reducing its clients’ Apple exposure for the last 12 months. The expert highlighted the dependency of the company on iPhone sales, which can be a tricky issue. He added, "We think that Apple has to focus on recurring revenues as opposed to the market being focused on just, if you will, a new innovation — which is going to be difficult each time.”

Having said this, Cecilia concluded Apple’s stock is attractively valued, but “would concur with the technical analysis, and would stay on the sidelines.”

Disclosure: Javier Hasse holds no positions in any of the securities mentioned above.

Latest Ratings for AAPL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Equal-Weight | |

| Feb 2022 | Tigress Financial | Maintains | Strong Buy | |

| Jan 2022 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Ari WaldAnalyst Color Long Ideas Short Ideas Analyst Ratings Movers Media Trading Ideas Best of Benzinga