Apple To Shut Down China Retail Store For First Time Ever, Citing Shifting Mall Landscape Amid Consumer Slowdown

Apple Inc. (NASDAQ:AAPL) will close one of its retail locations in China next month, marking the first store closure in the country since the tech giant entered the market in 2008.

What Happened: On Monday, the company announced it will shut down its store at Parkland Mall in Dalian City's Zhongshan District on Aug. 9, citing a broader decline in the mall’s retail presence, reported the New York Times.

Several major brands, including Michael Kors and Armani, have already exited the location, and locals have described the mall as struggling.

"Given the departure of several retailers at the Parkland Mall, we have made the decision to close our store," said Apple spokesperson Brian Bumbery in a statement. "We love serving the Dalian community, and all of our valued team members will have the opportunity to continue their roles with Apple."

See Read: Apple Undergoing Major Management Overhaul, But CEO Tim Cook To Stay On

The company said it will continue operating its second Dalian location at Olympia 66 and remains committed to its presence in the region. A new Apple Store is set to open in Shenzhen later this month.

Why It's Important: The closure signals growing challenges for Apple in its second-largest market, where it has reported six consecutive quarters of declining sales.

Last year, revenue from Greater China fell to $66.95 billion, down nearly 10% from its 2022 peak.

Apple is also under increasing pressure from Chinese smartphone competitors such as Huawei Technologies, Xiaomi (OTC:XIACF) and Vivo, which have eaten into its market share.

According to Counterpoint Research, Apple's share of China's smartphone market dropped to 15.5% in 2024, down from 17.9% the year before.

With the Parkland Mall closure, Apple will still end 2025 with 58 stores in China, maintaining its current store count despite the strategic exit.

Price Action: Apple shares inched up 0.079% during Monday's regular session and rose another 0.028% after hours, according to Benzinga Pro.

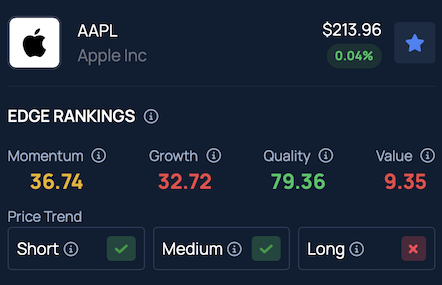

Benzinga's Edge Stock Rankings indicate that AAPL shows strong momentum over the short and medium term, though it trends downward over the long run. Despite boasting a solid quality score, the stock continues to carry a relatively weak value rating. More detailed performance insights are available here.

Read Next

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Tech