Bank of New York Mellon Analysts Raise Their Forecasts After Upbeat Earnings

Bank of New York Mellon Corp. (NYSE:BK) on Tuesday reported better-than-expected second-quarter 2025 results, topping both revenue and earnings estimates.

The firm reported second-quarter adjusted earnings of $1.94 per share, up 28% from a year ago and above the Street estimate of $1.76. Revenue rose 9% year over year (YoY) to $5.03 billion, topping analysts' forecast of $4.83 billion.

"BNY's ongoing transformation has significant momentum. Only one year after the launch of our new commercial model last summer, we delivered two consecutive quarters of record sales in the first half of the year. It is also notable that the parts of the company that were the first to transition to our platform's operating model in the spring of last year have displayed faster delivery times, enhanced service quality, increased innovation along with greater efficiency," commented Robin Vince, CEO.

Bank of New York Mellon shares fell 0.8% to trade at $94.44 on Wednesday.

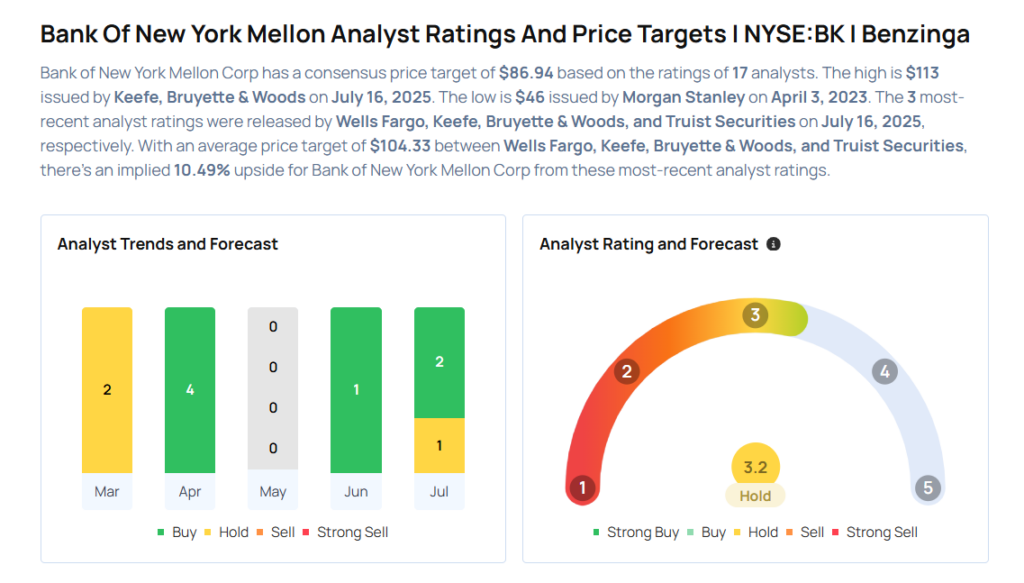

These analysts made changes to their price targets on Bank of New York Mellon following earnings announcement.

- Keefe, Bruyette & Woods analyst David Konrad maintained Bank of New York Mellon with an Outperform rating and raised the price target from $105 to $113.

- Morgan Stanley analyst Betsy Graseck maintained the stock with an Overweight rating and raised the price target from $95 to $101.

- Truist Securities analyst David Smith maintained Bank of New York Mellon with a Hold and raised the price target from $97 to $100.

- Wells Fargo analyst Mike Mayo maintained the stock with an Equal-Weight rating and raised the price target from $96 to $100..

Considering buying BK stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for BK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | Seaport Global | Maintains | Buy |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas