These Analysts Increase Their Forecasts On Manhattan Associates After Strong Q2 Results

Manhattan Associates, Inc. (NASDAQ:MANH) reported better-than-expected second-quarter financial results and raised its FY25 guidance above estimates on Tuesday.

Manhattan Associates reported quarterly earnings of $1.31 per share which beat the analyst consensus estimate of $1.13 per share. The company reported quarterly sales of $272.42 million which beat the analyst consensus estimate of $263.61 million.

“Manhattan delivered record second quarter results. Solid demand drove Q2 cloud revenue growth of 22% and RPO surpassing the $2 billion milestone,” said Manhattan Associates president and CEO Eric Clark. “While the global macro environment remains challenging, we believe our cloud platform leadership advantage positions Manhattan as the clear choice for modern supply chain commerce solutions. We remain optimistic about our business fundamentals and our sustained growth opportunity. As technology and innovation cycles continue to accelerate, our unified cloud platform allows us to increase our leadership advantage over our competitors, expand our addressable market, and drive optimal results for our customer.”

Manhattan Associates raised its FY2025 adjusted EPS guidance from $4.54-$4.64 to $4.76-$4.84 and also increased its sales guidance from $1.06 billion-$1.07 billion to $1.07 billion-$1.07 billion.

Manhattan Associates shares gained 6.2% to trade at $215.41 on Wednesday.

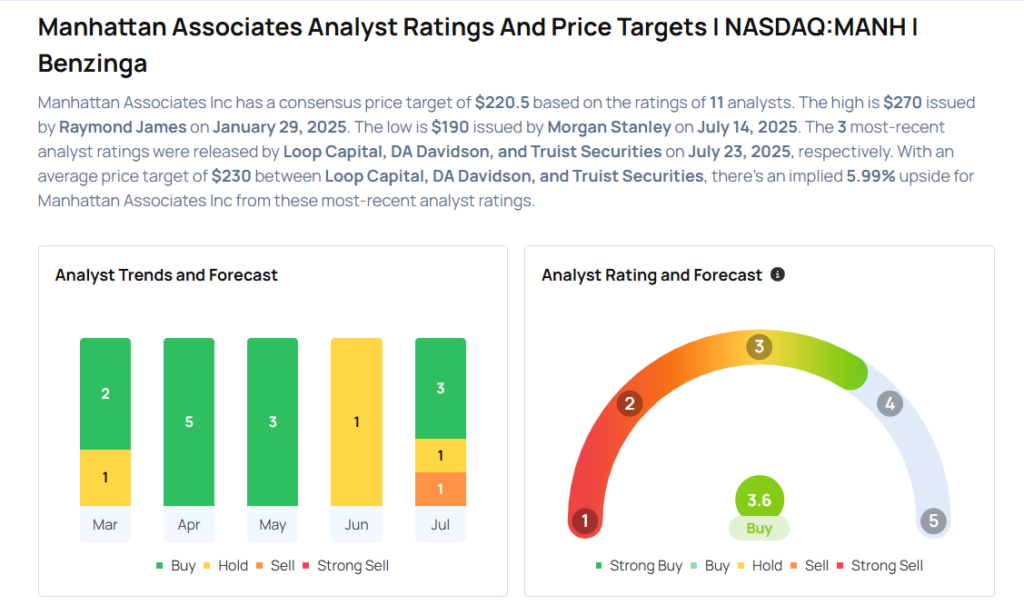

These analysts made changes to their price targets on Manhattan Associates following earnings announcement.

- Truist Securities analyst Terry Tillman maintained Manhattan Associates with a Buy and raised the price target from $210 to $230.

- DA Davidson analyst Gil Luria maintained the stock with a Buy and raised the price target from $225 to $250.

- Loop Capital analyst Mark Schappel maintained Manhattan Associates with a Hold and raised the price target from $200 to $210.

Considering buying MANH stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for MANH

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Rosenblatt | Maintains | Buy | |

| Jul 2021 | Rosenblatt | Maintains | Buy | |

| May 2021 | Benchmark | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas