Vlad Tenev Says Robinhood Working With US Regulators To Unlock 'Real Opportunity' In Tokenized Stocks, Downplays Impact On Crypto Prices

Robinhood Markets Inc. (NASDAQ:HOOD) CEO Vlad Tenev expressed a positive outlook towards the future of equity tokenization in the U.S. on Wednesday, despite the potential regulatory hurdles that may arise.

What Happened: During the company’s second-quarter earnings call, Tenev said that the “real opportunity” in the U.S. lies in tokenizing assets that were previously inaccessible, such as private markets and related real-world assets.

“We’re working with regulators to make that possible,” he stated. “We need to look at accreditation laws. “We also are on a good path with securities tokenization, but that has to continue, and we think we can unlock that opportunity.”

See Also: Tokenization Of Gold: How Blue Gold And TripleBolt Are Taking It To The Next Level

Tenev viewed that as more infrastructure moves from centralized legacy counterparties to blockchain, the cost of operating the business would decrease, eventually benefiting customers.

When asked if tokenized securities would have any effect on spot cryptocurrency prices, Tenev said, “I don't think that we're likely to see any impact. We just don't feel like there's much of a connection between how customers are even thinking about pricing in these various asset classes.”

Why It Matters: Robinhood unveiled a suite of products during its event in France for its European customers, the highlight of which was blockchain-powered tokenized equities of companies like OpenAI and SpaceX. The offerings, however, ran into a controversy after OpenAI denied involvement with Robinhood regarding them.

Robinhood has been building a case to tokenize private stocks, encouraging policymakers to explore the untapped potential of blockchains in the U.S. capital markets. In May, it proposed a federal framework to the SEC for bringing real-world assets on-chain.

The company reported its second-quarter financials after the market close, with crypto revenue nearly doubling. The overall revenue rose 45% year-over-year, beating analysts’ expectations.

Price Action: Shares of Robinhood dipped 0.64% in after-hours trading after closing 2.77% higher at $106.18 during Wednesday's regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained 184.76%.

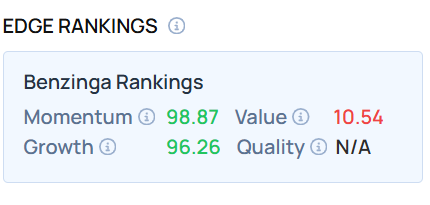

HOOD demonstrated high Momentum and Growth scores as of this writing. Want to know how it compares to your favorite stock in your portfolio? Go to Benzinga Edge Stock Rankings.

Read Next:

Photo Courtesy: Sergei Elagin on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency