We'll Do It Live

Hold onto your coffee cups, 'cause we're kicking off the day with GREAT news! GDP soars to 2.4% in Q2 2023. This is up from 2% in Q1. The “for sure recession" is nowhere in sight - it vanished like a magician's trick!

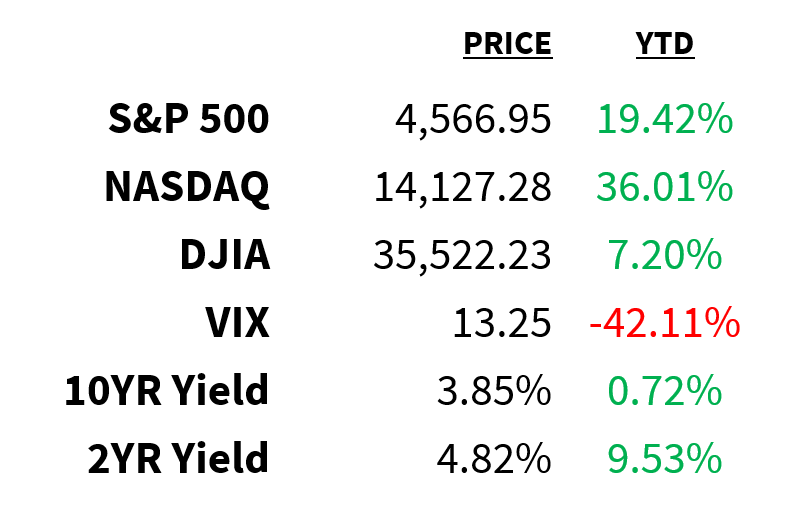

Market

Prices as of 4 pm EST, 7/26/23

Macro

Sales of new single-family US homes fell 2.5% in June to 697k.

-

The previous month’s sales were also revised down significantly from 763k to 715k.

-

The median sales price fell 4% YoY to $415,400.

-

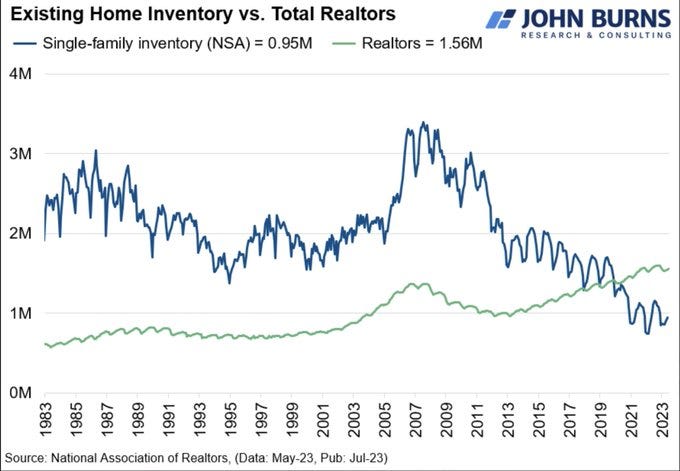

Keeping the market tight is a shortage of inventory.

-

In fact, according to John Burns, there are 600k more realtors in the US than there are homes for sale:

John Burns

The Fed raised interest rates to the highest in 21 years yesterday.

-

FOMC officials voted unanimously to hike by 25bps to 5.25-5.50.

-

The move surprised exactly no one.

-

At the presser, Powell stressed upcoming meetings would be “live” (i..e, no decisions have been made).

-

He suggested that target inflation (2%) wouldn’t be reached until at least 2025.

-

He also noted that staff are no longer predicting a recession as their base case.

NYT

Stocks

As we noted yesterday, the Fed’s rate increase was mostly priced in ahead of the official decision.

-

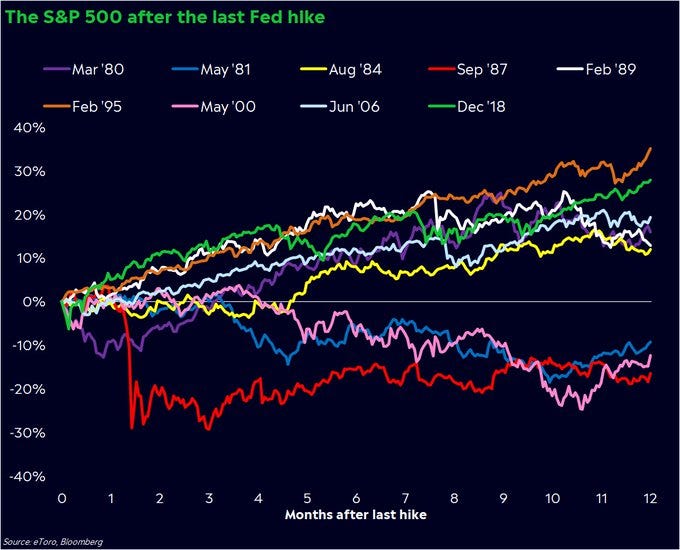

If yesterday’s hike proves to be the last, what can we expect from stocks?

-

The S&P has gained an average of 7.6% in the 12 months following the end of a rate hike cycle (chart).

-

Zooming out further, the S&P has gained an average of 46.2% and 70.6% in the 3- and 5-year periods after the last hike.

@callieabost

Global equities have seen back-to-back months of inflows for the first time since March 2022.

-

Leading the way lately is the Dow, which has posted 13 straight sessions of gains—the longest streak since 1987.

-

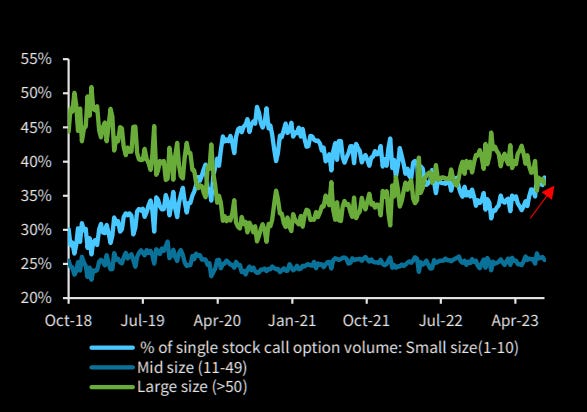

Also leading the way are retail investors whose demand for equities has been rising.

-

In fact, retail investors are now buying more call options than institutions are (chart).

-

Smart money is now playing catchup.

-

Even so, equity allocations from both retail and institutional investors remain far from excessive, according to Barclays.

Barclays

Energy

Crude is up this morning following yesterday’s inventory draw.

-

Crude inventories fell by 600k barrels (vs. 2.2 million expected).

-

Cushing, gasoline, and distillates stocks also declined.

-

Both WTI and Brent prices are at their highest since mid-April.

EIA/Zero Hedge

Earnings

Yesterday’s highlights:

Meta (NASDAQ: META): $2.98 EPS (vs. $2.91 expected), $32 billion in sales (vs. $31.12B expected).

-

Meta saw growth across daily active users (DAUs), monthly active users (MAUs), and average revenue per user (ARPU).

-

The company guided current quarter revenue above analysts’ estimates and suggests 15% YoY growth.

Boeing (NYSE: BA): -$0.82 (vs. -$0.88 expected), $19.75 billion in sales (vs. $18.45B expected).

-

The jet maker posted better-than-expected cash flow and reiterated its guidance for the full year.

-

It also plans to boost production to help meet booming travel demand.

What we’re watching today:

-

Mastercard (NYSE: MA)

-

AbbVie (NYSE: ABBV)

-

McDonald’s (NYSE: MCD)

-

Shell

-

Linde (NYSE: LIN)

-

Comcast (NYSE: CMSA)

-

T-Mobile (NASDAQ: TMUS)

-

TotalEnergies (NYSE: TTE)

-

Intel (NASDAQ: INTC)

-

Honeywell (NASDAQ: HON)

-

S&P Global (NYSE: SPGI)

-

Bristol-Myers Squibb (NYSE: BMY)

-

Mondelez (NASDAQ: MDLZ)

Top Headlines

-

UK retail: Retail sales in the UK declined at their fastest pace in over a year.

-

ECB decision: The European Central Bank is expected to raise rates by 25bps today.

-

EV partnership: Several big automakers are teaming up to invest in building ~30k EV chargers throughout the US.

-

Chinese EVs: China’s automakers are eyeing US markets for their cheap EVs.

-

Chinese equities: Hedge funds are rushing into Chinese stocks after the politburo signaled stimulus ahead.

-

Maps battle: Meta, Microsoft, and Amazon are teaming up to take on Apple and Google in maps.

-

Unprofitable reality: Meta’s Reality Labs has lost more than $21 billion since the start of last year.

-

Not cool: A group of hedge funds is seeking to intercept a ~$1 billion payout meant for opioid addiction victims.

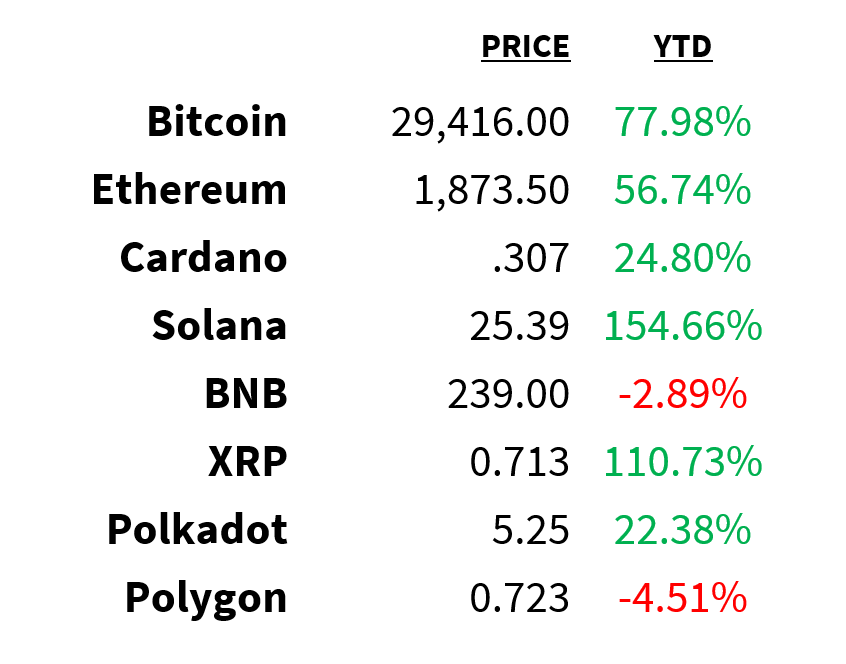

Crypto

Prices as of 4 pm EST, 7/26/23

-

Crypto bills: The US House Financial Services Committee voted in favor of 2 crypto-related bills.

-

SBF charges: Prosecutors have dropped campaign finance charges against Sam Bankman-Fried.

-

Rekt: Immunefi, Polygonn Labs, and Solana have jointly introduced “Rekt Test”, a baseline security standard for web3.

-

Institutional interest: Bitcoin and Ether futures saw record participation from institutional investors in Q2.

-

Compliance: Binance has exited Germany, the Netherlands, and Cyprus as it prepares to comply with new EU MiCA rules.

Deals

-

Teams probe: Microsoft is facing an EU probe over unfair bundling of its Teams app with Office 365 packages.

-

Bank M&A: JPMorgan will purchase $1.8 billion of mortgages to facilitate Banc of California’s PacWest purchase.

-

Lifeline: Carlyle is providing iRobot with a $200 million loan to help keep it afloat during the review process of its acquisition by Amazon.

-

Healthcare sale: The owners of the Plan-B pill are considering selling for over $4 billion.

-

Private funding: Private capital fundraising in Asia Pacific is on track to hit a 10-year low in 2023.

Meme Of The Day

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: contributors energy FOMCMacro Economic Events News Economics Federal Reserve Markets