-

Mohamed El-Erian Flags Political Narratives Affecting Federal Reserve's 'Institutional Integrity And Operational Credibility'

2025 Jun 27, 4:19am | 745Read More...Mohamed El-Erian, a prominent economist and former CEO of PIMCO, has voiced significant concerns regarding the Federal Reserve, asserting that it is “getting harder to convince people that the Fed is apolitical.” What Happened: In a recent Substack post, El-Erian identifies three...

-

Trump Appointing A 'Shadow Chair' At The Fed Has Put Dollar Under Pressure, Meanwhile China Is Dumping The Greenback And Hoarding Gold

2025 Jun 26, 10:53pm | 690Read More...China is accelerating its move away from U.S. dollar-denominated assets, with the share of U.S. Treasuries and the Dollar in the country’s reserves reaching its lowest levels in over a decade. What Happened: On Thursday, The Kobeissi Letter, in a post on X, captured this dramatic shift,...

-

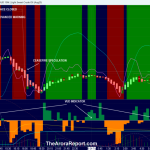

Nvidia's New High Shows More Room For AI Trade, Buying On Trump's Move To Make Powell Miserable

2025 Jun 26, 12:19pm | 1502Read More...To gain an edge, this is what you need to know today. Room In AI Trade Please click here for an enlarged chart of NVIDIA Corp (NASDAQ:NVDA). Note the following: This article is about the big picture, not an individual stock. The chart of NVDA stock is being used to illustrate the point. The...

-

Trump's Fed Chairman Shortlist Is In: What Investors Need To Know

2025 Jun 26, 9:28am | 1002Read More...President Donald Trump's shortlist for the next Federal Reserve chair is heating up, fueling bets on deep rate cuts, pressuring the dollar and reigniting concerns over the Fed's long-guarded independence. According to a Wall Street Journal report, Trump is considering the following names to replace...

-

Elizabeth Warren Blames Trump's 'Dumb Trade War' For Fed's Grim Outlook: The President Is 'Standing In The Way Of Lower Rates And Lower Costs'

2025 Jun 25, 10:25pm | 712Read More...Sen. Elizabeth Warren (D-Mass.) is placing the blame for the Federal Reserve’s increasingly grim economic outlook on President Donald Trump’s trade and tariff policies. What Happened: On Wednesday, Warren posted on X, citing Fed Chair Jerome Powell’s recent Congressional testimony...

-

Fed's Schmid Says 'Wait-and-See' Approach Right For Rate Policy As Tariff Fallout Still Unclear

2025 Jun 25, 12:59am | 459Read More...Kansas City Federal Reserve President Jeff Schmid said on Tuesday that the central bank has sufficient time to analyze rising import tariff impacts on inflation and economic growth before implementing further interest rate cuts.What Happened: “The current posture of monetary policy, which has...

-

Deploy Cash And Reduce Hedges; Highest Probability Scenario Comes True; NATO Contention

2025 Jun 24, 12:42pm | 1426Read More...Deploy Cash And Reduce Hedges Our highest probability scenario has come true in the Israel Iran war. This scenario was given in advance as the highest probability scenario on June 13 morning, just after Israel’s first attack. Our readers were once again ahead of the curve and had clarity at a...

-

Will The Fed Cut Rates In 2025? Powell Says It All Depends On Tariffs

2025 Jun 24, 11:37am | 701Read More...Federal Reserve Chair Jerome Powell told Congress Tuesday that while inflation has cooled from its 2022 peak, it remains “somewhat elevated,” and the central bank is not ready to adjust interest rates, yet. However, he said the Fed is "well positioned to wait" for more clarity before...

-

US Bonds Trailed S&P 500 For 5 Straight Years — Will Iran Shock Snap The Streak?

2025 Jun 23, 12:40pm | 1076Read More...U.S. bonds are on track to log ten straight six-month periods of underperformance relative to stocks, a record-breaking stretch of underperformance since 2020 that’s rippling through markets and shaking up traditional investor portfolios. The streak spans five years and reflects a regime...

-

War, Oil, And S&P 500: Here's How The Stock Market Behaves In Energy Crises

2025 Jun 23, 11:18am | 733Read More...The U.S. strike on Iran's nuclear facility on June 21 has raised the specter of a new oil crisis, reviving investor fears of energy-driven inflation and testing whether the stock market can withstand another geopolitical shock. Historical precedent offers a guide to how the S&P 500 index...

-

Stocks May Not Need A Fed Rate Cut—But Bonds Could Be In Trouble, Says Sage Advisory

2025 Jun 23, 5:14am | 470Read More...The Federal Reserve held interest rates steady at 4.25%-4.50% during Wednesday’s June meeting, with Chair Jerome Powell signaling no urgency to cut rates as officials monitor potential tariff-driven inflation impacts. What Happened: Sage Advisory managing partner Thomas Urano told Yahoo...

-

Wall Street Wavers As Geopolitical Tensions Flare, Trump Renews Attacks On Fed Chair Powell: This Week In Markets

2025 Jun 20, 3:30pm | 745Read More...Investor caution dominated Wall Street this week, as escalating tensions between Israel and Iran fueled fears of potential U.S. involvement. Plus, the Federal Reserve's decision to keep rates as is peeved President Donald Trump. The Federal Reserve kept interest rates steady at 4.25%-4.5% for the...

-

How Investors Can Navigate Higher-for-Longer Rates Amid Uncertainty

2025 Jun 20, 12:58pm | 1037Read More...During a 2025 that's been punctuated by uncertainty, the last thing US investors will have wanted to hear is that expectations for further Federal Reserve interest rate cuts are balanced on a knife’s edge. After putting the odds of a June rate cut at ‘50/50', economist Jon Faust has...

-

Anti-Powell Crusade Rages On As Housing Sector Demands Fed Chair Resignation

2025 Jun 19, 9:38am | 669Read More...The Federal Reserve's decision on Wednesday to hold interest rates steady at 4.25%-4.50% for the fourth consecutive meeting has triggered an escalating backlash, with both political and industry voices now demanding that Chairman Jerome Powell step down immediately. What began as a political feud...

-

Peter Schiff Predicts 'Worse Financial Crisis Than 2008' As Fed Holds Rates: 'The Solution Involves Much Higher Interest Rates' As Years of Easy Money Trigger Stagflation And Investor Exodus

2025 Jun 19, 4:20am | 516Read More...Economist Peter Schiff issued warnings about America’s economic trajectory during Wednesday’s Federal Reserve meeting, predicting the central bank’s decade-long policies will trigger an unavoidable crisis worse than 2008. What Happened: The Federal Open Market Committee kept...