UnitedHealth CEO, Other Insiders Buy Millions In Stock As It Sinks Over 23% In A Week: Move Gets 'Mixed' Reaction

As shares of UnitedHealth Group Inc. (NYSE:UNH) witness a steep decline, company insiders are stepping up to the plate with a series of insider buys, which analysts and experts say is “a strong signal.”

What Happened: On Saturday, popular investment newsletter The Kobeissi Letter shared a post on X highlighting UnitedHealth’s new CEO, Stephen Hemsley, acquiring a significant stake in the company, worth $25 million, according to filings with the Securities and Exchange Commission.

“He is the latest of multiple insiders to begin buying shares amid the historic decline,” the post says, referring to the three directors, Timothy Flynn, Kristen Gil and John Noseworthy, who purchased shares worth $491,786, $1,003,329 and $93,647, respectively, in the company last week.

This is in addition to UnitedHealth’s CFO, John Rex, who bought shares worth $5 million, according to SEC filings.

Replying to the post, investment manager Mike Shell says that investing personal capital after a sharp decline is a “strong signal” that management perceives “positive asymmetry” in the stock, suggesting limited downside risks, relative to its recovery potential.

Why It Matters: UnitedHealth shares have witnessed a steep decline since its disappointing first quarter results last month, when the company narrowly missed expectations, posting earnings of $7.20 per share versus the consensus estimate of $7.29.

However, it’s been under scrutiny ever since the assassination of its insurance unit CEO, Brian Thompson, in December 2024, by a disgruntled insurance patient, Luigi Mangione.

The stock once again witnessed a pullback last week, following the abrupt departure of its CEO, Andrew Witty. Former CEO Hemsley was reinstated, and the company subsequently withdrew its full-year guidance.

To make matters worse, a Wall Street Journal report claimed that UnitedHealth was under a federal criminal investigation focusing on its Medicare Advantage business practices. The company refuted these claims, stating that it has not been notified of any supposed criminal investigation by the Department of Justice.

While several experts see this string of insider buying as a sign of a turnaround to come, investor Jeremy Lefebvre posted on X, calling the company “straight trash.”

Lefebvre says the company will go through years of investigation, and that it will “be a mess,” before drawing parallels with Boeing Co. (NYSE:BA), which he says “is still a mess even now.”

UnitedHealth Group Inc. (NYSE:UNH)

7 Days

Month

Year-To-Date

12 Months

-23.41%

-31.37%

-42.14%

-43.56

Price Action: Shares of UnitedHealth were up 6.40% on Friday, following news of insider buying, but are down 1.46% pre-market. The stock remains down by 42.14% year-to-date, and 53.8% from its all-time high in November last year.

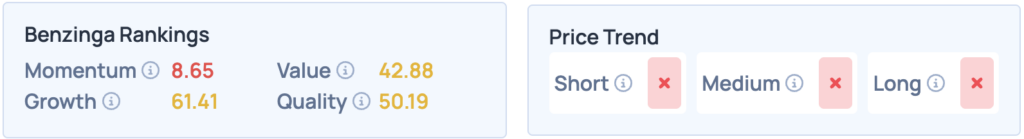

According to Benzinga’s Edge Stock Rankings, UnitedHealthcare group has an unfavorable price trend in the short, medium, and long term. You can check more comprehensive metrics here.

Shutterstock/The Image Party

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Andrew Witty Brian Thompson Jeremy Lefebvre John Noseworthy John RexHealth Care Insider Trades Markets