Forecasting The Future: 15 Analyst Projections For Hyatt Hotels

In the last three months, 15 analysts have published ratings on Hyatt Hotels (NYSE:H), offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 8 | 0 | 2 |

| Last 30D | 1 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 1 | 0 | 1 |

| 2M Ago | 0 | 0 | 4 | 0 | 1 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

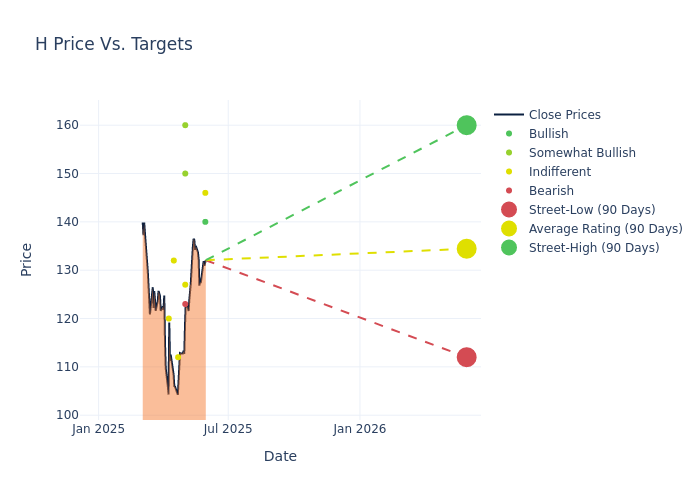

Insights from analysts' 12-month price targets are revealed, presenting an average target of $137.8, a high estimate of $175.00, and a low estimate of $110.00. Observing a downward trend, the current average is 8.97% lower than the prior average price target of $151.38.

Decoding Analyst Ratings: A Detailed Look

The standing of Hyatt Hotels among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Bellisario | Baird | Raises | Neutral | $146.00 | $142.00 |

| Patrick Scholes | Truist Securities | Lowers | Buy | $140.00 | $156.00 |

| Brandt Montour | Barclays | Raises | Equal-Weight | $127.00 | $122.00 |

| Chad Beynon | Macquarie | Lowers | Outperform | $150.00 | $155.00 |

| Lizzie Dove | Goldman Sachs | Raises | Sell | $123.00 | $110.00 |

| Duane Pfennigwerth | Evercore ISI Group | Lowers | Outperform | $160.00 | $175.00 |

| Brandt Montour | Barclays | Lowers | Equal-Weight | $122.00 | $151.00 |

| Stephen Grambling | Morgan Stanley | Lowers | Equal-Weight | $112.00 | $127.00 |

| Simon Yarmak | Stifel | Lowers | Hold | $132.00 | $156.75 |

| Lizzie Dove | Goldman Sachs | Lowers | Sell | $110.00 | $150.00 |

| David Katz | Jefferies | Lowers | Hold | $120.00 | $161.00 |

| Patrick Scholes | Truist Securities | Lowers | Buy | $156.00 | $163.00 |

| Lizzie Dove | Goldman Sachs | Lowers | Neutral | $150.00 | $170.00 |

| Duane Pfennigwerth | Evercore ISI Group | Maintains | Outperform | $175.00 | $175.00 |

| Stephen Grambling | Morgan Stanley | Lowers | Equal-Weight | $144.00 | $157.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Hyatt Hotels. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Hyatt Hotels compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Hyatt Hotels's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Hyatt Hotels's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Hyatt Hotels analyst ratings.

Get to Know Hyatt Hotels Better

Hyatt is an operator of owned (3% of total rooms) and managed and franchised (97%) properties across about 30 upscale luxury brands, which includes vacation brands (Apple Leisure Group, Hyatt Ziva, and Hyatt Zilara), the recently launched full-service lifestyle brand Hyatt Centric, the soft lifestyle brand Unbound, the wellness brand Miraval, and the midscale extended-stay brand Studios. Hyatt acquired Two Roads Hospitality in 2018 and Apple Leisure Group in 2021. The regional exposure as a percentage of total rooms is 63% Americas, 15% rest of world, and 22% Asia-Pacific.

A Deep Dive into Hyatt Hotels's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Hyatt Hotels showcased positive performance, achieving a revenue growth rate of 0.23% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Hyatt Hotels's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 1.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Hyatt Hotels's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.57%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Hyatt Hotels's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.15%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.33, Hyatt Hotels adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for H

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Wells Fargo | Maintains | Overweight | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Macquarie | Upgrades | Neutral | Outperform |

Posted-In: BZI-AARAnalyst Ratings