Expert Outlook: Trade Desk Through The Eyes Of 24 Analysts

During the last three months, 24 analysts shared their evaluations of Trade Desk (NASDAQ:TTD), revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 13 | 10 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 1 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 10 | 6 | 0 | 0 | 0 |

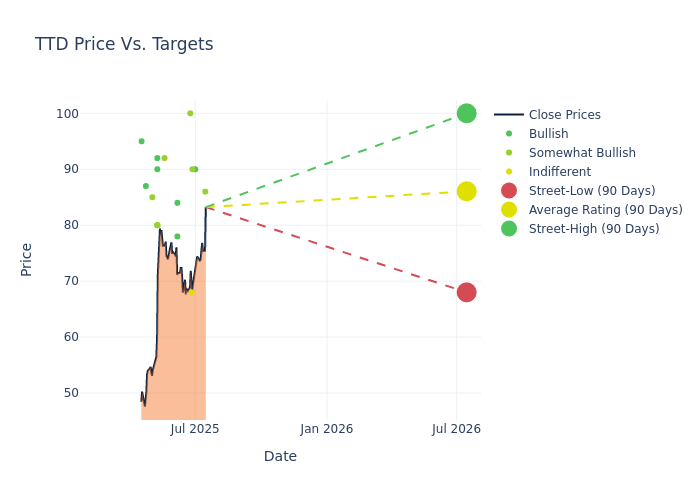

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $83.88, with a high estimate of $100.00 and a low estimate of $60.00. Highlighting a 8.26% decrease, the current average has fallen from the previous average price target of $91.43.

Investigating Analyst Ratings: An Elaborate Study

The perception of Trade Desk by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Devitt | Wedbush | Maintains | Outperform | $86.00 | $86.00 |

| Ygal Arounian | Citigroup | Raises | Buy | $90.00 | $82.00 |

| Mark Mahaney | Evercore ISI Group | Maintains | Outperform | $90.00 | $90.00 |

| Alec Brondolo | Wells Fargo | Lowers | Equal-Weight | $68.00 | $74.00 |

| Matthew Condon | JMP Securities | Maintains | Market Outperform | $100.00 | $100.00 |

| Barton Crockett | Rosenblatt | Raises | Buy | $78.00 | $77.00 |

| Laura Martin | Needham | Maintains | Buy | $84.00 | $84.00 |

| Tim Nollen | Macquarie | Raises | Outperform | $92.00 | $90.00 |

| Laura Martin | Needham | Maintains | Buy | $84.00 | $84.00 |

| Laura Martin | Needham | Maintains | Buy | $84.00 | $84.00 |

| Jason Helfstein | Oppenheimer | Raises | Outperform | $80.00 | $75.00 |

| Michael Morris | Guggenheim | Lowers | Buy | $90.00 | $110.00 |

| Matthew Cost | Morgan Stanley | Raises | Overweight | $80.00 | $60.00 |

| Jason Butler | JMP Securities | Lowers | Market Outperform | $100.00 | $115.00 |

| Tom White | DA Davidson | Lowers | Buy | $92.00 | $103.00 |

| Justin Patterson | Keybanc | Raises | Overweight | $80.00 | $67.00 |

| Laura Martin | Needham | Maintains | Buy | $84.00 | $84.00 |

| Matthew Swanson | RBC Capital | Lowers | Outperform | $85.00 | $100.00 |

| Barton Crockett | Rosenblatt | Announces | Buy | $77.00 | - |

| Ygal Arounian | Citigroup | Lowers | Buy | $63.00 | $70.00 |

| Mark Kelley | Stifel | Lowers | Buy | $87.00 | $122.00 |

| Laura Martin | Needham | Maintains | Buy | $84.00 | $84.00 |

| Matthew Cost | Morgan Stanley | Lowers | Overweight | $60.00 | $132.00 |

| Youssef Squali | Truist Securities | Lowers | Buy | $95.00 | $130.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Trade Desk. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Trade Desk compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Trade Desk's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Trade Desk's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Trade Desk analyst ratings.

Discovering Trade Desk: A Closer Look

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on devices like computers, smartphones, and connected TVs. It uses data in an iterative manner to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry, and it generates revenue from fees based on a percentage of what its clients spend on advertising.

A Deep Dive into Trade Desk's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, Trade Desk showcased positive performance, achieving a revenue growth rate of 25.4% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Trade Desk's net margin is impressive, surpassing industry averages. With a net margin of 8.23%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.79%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Trade Desk's ROA stands out, surpassing industry averages. With an impressive ROA of 0.86%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Trade Desk's debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TTD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Guggenheim | Initiates Coverage On | Buy | |

| Mar 2022 | Benchmark | Initiates Coverage On | Hold | |

| Feb 2022 | Keybanc | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings