Where IQVIA Hldgs Stands With Analysts

Providing a diverse range of perspectives from bullish to bearish, 9 analysts have published ratings on IQVIA Hldgs (NYSE:IQV) in the last three months.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 3 | 0 | 0 |

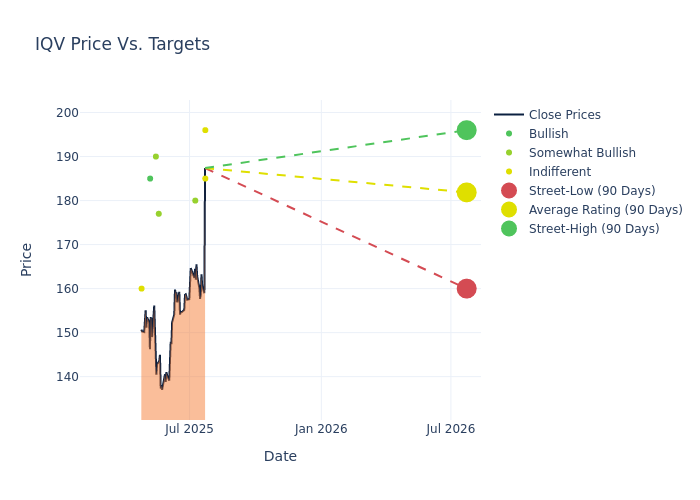

Analysts have recently evaluated IQVIA Hldgs and provided 12-month price targets. The average target is $177.67, accompanied by a high estimate of $196.00 and a low estimate of $160.00. Experiencing a 11.95% decline, the current average is now lower than the previous average price target of $201.78.

Exploring Analyst Ratings: An In-Depth Overview

The perception of IQVIA Hldgs by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Luke Sergott | Barclays | Raises | Equal-Weight | $185.00 | $165.00 |

| Eric Coldwell | Baird | Raises | Neutral | $196.00 | $159.00 |

| Elizabeth Anderson | Evercore ISI Group | Raises | Outperform | $180.00 | $170.00 |

| Anne Samuel | JP Morgan | Lowers | Overweight | $177.00 | $232.00 |

| Ann Hynes | Mizuho | Lowers | Outperform | $190.00 | $210.00 |

| Eric Coldwell | Baird | Lowers | Neutral | $161.00 | $195.00 |

| Dan Leonard | UBS | Lowers | Buy | $185.00 | $255.00 |

| Luke Sergott | Barclays | Lowers | Equal-Weight | $165.00 | $170.00 |

| Rajesh Kumar | HSBC | Lowers | Hold | $160.00 | $260.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to IQVIA Hldgs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of IQVIA Hldgs compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for IQVIA Hldgs's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of IQVIA Hldgs's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on IQVIA Hldgs analyst ratings.

Discovering IQVIA Hldgs: A Closer Look

Iqvia is the result of the 2016 merger of Quintiles, a leading global contract research organization, and IMS Health, a leading healthcare data and analytics provider. The research and development segment focuses primarily on providing outsourced late-stage clinical trials for pharmaceutical, device, and diagnostic firms. The technology and analytics segment provides aggregated information and technology services to clients in the healthcare industry, including pharmaceutical companies, providers, payers, and policymakers, as well as data and analytics capabilities for clinical trials, including virtual trials. The company also has a small contract sales business.

Unraveling the Financial Story of IQVIA Hldgs

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: IQVIA Hldgs displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 2.46%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: IQVIA Hldgs's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.5%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.13%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): IQVIA Hldgs's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.92%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 2.43, IQVIA Hldgs faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for IQV

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Piper Sandler | Maintains | Neutral | |

| Feb 2022 | Morgan Stanley | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings