Expert Outlook: Freeport-McMoRan Through The Eyes Of 9 Analysts

In the last three months, 9 analysts have published ratings on Freeport-McMoRan (NYSE:FCX), offering a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 3 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

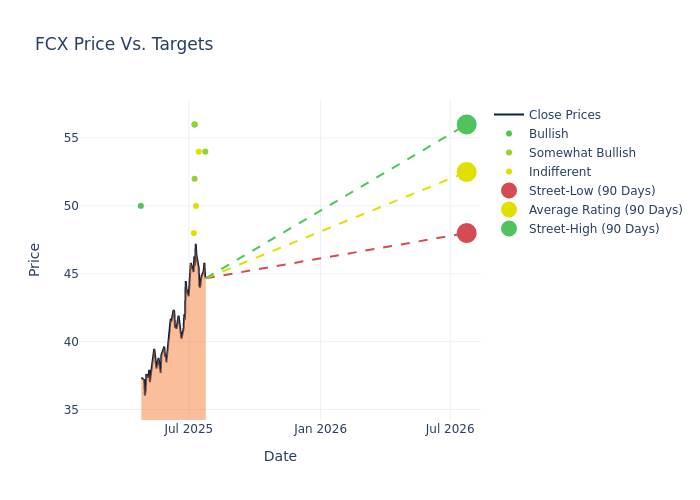

In the assessment of 12-month price targets, analysts unveil insights for Freeport-McMoRan, presenting an average target of $51.22, a high estimate of $56.00, and a low estimate of $43.00. Surpassing the previous average price target of $45.25, the current average has increased by 13.19%.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Freeport-McMoRan among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Katja Jancic | BMO Capital | Lowers | Outperform | $54.00 | $55.00 |

| Carlos De Alba | Morgan Stanley | Raises | Equal-Weight | $54.00 | $45.00 |

| Curt Woodworth | UBS | Raises | Neutral | $50.00 | $45.00 |

| Orest Wowkodaw | Scotiabank | Raises | Sector Outperform | $52.00 | $48.00 |

| Paul Forward | Stifel | Announces | Buy | $56.00 | - |

| Bill Peterson | JP Morgan | Raises | Overweight | $56.00 | $42.00 |

| Alexander Hacking | Citigroup | Raises | Neutral | $48.00 | $44.00 |

| Orest Wowkodaw | Scotiabank | Raises | Sector Outperform | $48.00 | $43.00 |

| Orest Wowkodaw | Scotiabank | Raises | Sector Perform | $43.00 | $40.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Freeport-McMoRan. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Freeport-McMoRan compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Freeport-McMoRan's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Freeport-McMoRan's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Freeport-McMoRan analyst ratings.

About Freeport-McMoRan

Freeport-McMoRan owns stakes in 10 copper mines, led by its 49% ownership of the Grasberg copper and gold operations in Indonesia, 55% of the Cerro Verde mine in Peru, and 72% of Morenci in Arizona. It sold around 1.2 million metric tons of copper (its share) in 2024, making it the one of the world's largest copper miners by volume. It also sold about 900,000 ounces of gold, mostly from Grasberg, and 70 million pounds of molybdenum. It had about 25 years of copper reserves at the end of December 2024. We expect it to sell similar amounts of copper midcycle in 2029, though we expect gold volumes to decline to about 700,000 ounces then due to falling production at Grasberg.

Freeport-McMoRan's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Freeport-McMoRan's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -9.38%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: Freeport-McMoRan's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 6.15%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Freeport-McMoRan's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.0%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Freeport-McMoRan's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.64%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Freeport-McMoRan's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FCX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Mar 2022 | Jefferies | Maintains | Buy | |

| Jan 2022 | Deutsche Bank | Maintains | Hold |

Posted-In: BZI-AARAnalyst Ratings