What Prudent Investors Should Know As All-Time-Market-Highs Mix With Extreme Sentiment

To gain an edge, this is what you need to know today.

Contrary Indicator

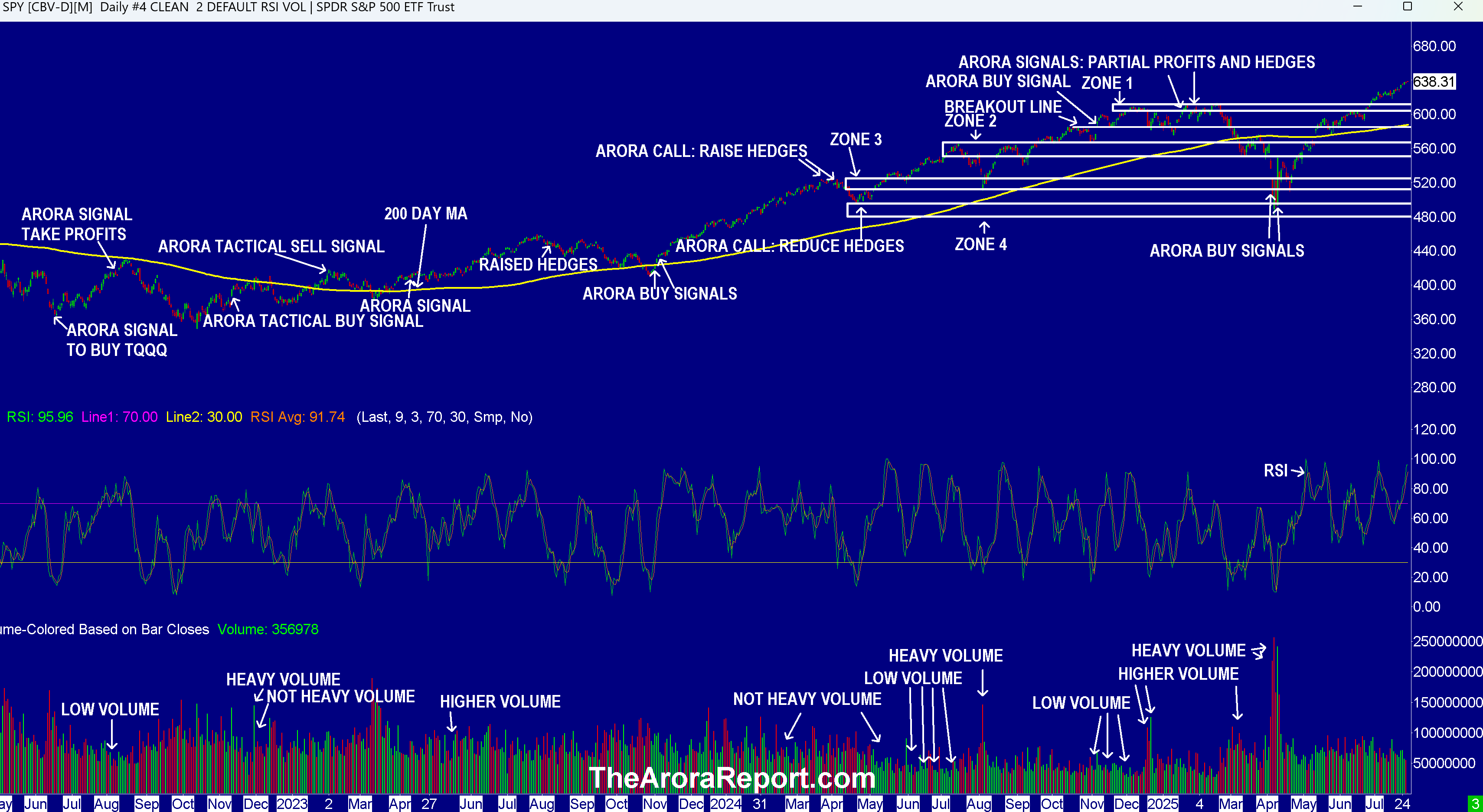

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust (NYSE:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The stock market continues to hit new all time highs.

- The chart shows the stock market is comfortably above zone 1 (support).

- RSI on the chart shows the stock market is extremely overbought. Overbought markets are susceptible to a pullback.

- Sentiment in the stock market remains extremely positive. When sentiment is in the extreme positive zone, it is a contrary signal because almost everyone who is going to buy in the short term has already bought it. When negative news comes, there are no buyers left to cushion the fall. In plain English, this means to be cautious. It is important to remember sentiment is not a precise timing indicator.

- Important earnings this morning from UnitedHealth Group Inc (UNH), PayPal Holdings Inc (PYPL), Spotify Technology SA (SPOT), United Parcel Service Inc (UPS), Sysco Corp (SYY), and Royal Caribbean Cruises Ltd (RCL) are below whisper numbers. So far, the momo crowd is oblivious. Even non-momo crowd investors do not seem to be concerned as they are focused on earnings from Microsoft Corp (MSFT), Meta Platforms Inc (META), Apple Inc (AAPL), and Amazon.com, Inc. (AMZN) later this week.

- The FOMC meeting starts today under extreme pressure to cut interest rates. The Fed will announce its interest rate decision tomorrow at 2pm ET followed by a press conference by Fed Chair Powell at 2:30pm ET. Tomorrow may be one of the few times there is dissent at the Fed if there is not a rate cut. The consensus is for no rate cut. However, in our analysis, a surprise rate cut cannot be ruled out.

- Trade talks between the U.S. and China are continuing.

- The E.U. and the U.S. are nailing down details of the trade deal.

- Consumer confidence and JOLTS job openings were released at 10am ET.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Amazon (AMZN) and NVIDIA Corp (NVDA).

In the early trade, money flows are neutral in Apple (AAPL), Meta (META), and Microsoft (MSFT).

In the early trade, money flows are negative in Alphabet Inc Class C (GOOG) and Tesla Inc (TSLA).

In the early trade, money flows are positive in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 (QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (GLD). The most popular ETF for silver is iShares Silver Trust (SLV). The most popular ETF for oil is United States Oil ETF (USO).

Bitcoin

Bitcoin is seeing buying.

Our Protection Band And What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Please click here to sign up for a free forever Generate Wealth Newsletter.

Posted-In: contributors Expert IdeasEquities Market Summary Broad U.S. Equity ETFs Opinion Markets Trading Ideas