Trump Shock Treatment Ignites Copper Boom—And It's Only Getting Started

They call it Dr. Copper for a reason. When the reddish-brown metal surges, it’s often a sign that the global economy is firing on all cylinders.

Its role in everything from wiring and housing to electric vehicles makes it a bellwether for growth, investment and industrial demand. But this time, the diagnosis is political—not economic.

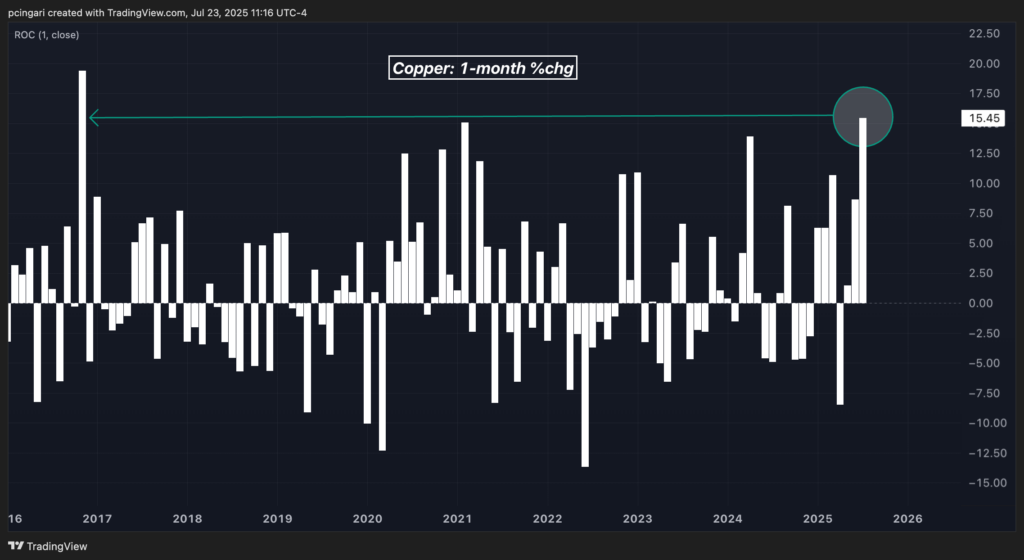

On July 23, copper — as tracked by the United States Copper Index Fund (NYSE:CPER) — spiked to a new record high of $5.85 per pound, rising 15.5% month-to-date. It’s on track for the strongest monthly performance in nearly a decade.

And the catalyst? Not China. Not infrastructure. But tariffs.

Trump’s Copper Tariffs Trigger A Supply Panic

President Donald Trump's decision to slap a 50% tariff on copper imports—announced on July 8—has sent shockwaves through global metal markets, creating an arbitrage condition never seen before.

A 50% tariff on copper imports makes foreign copper dramatically more expensive—effectively inflating prices and triggering a sharp squeeze on U.S. domestic supply.

U.S. COMEX copper futures are now trading at a 30% premium to London Metal Exchange (LME) contracts, as domestic buyers scramble to secure supply before tariffs hit. That spread is the widest on record.

Historically, pricing on the two exchanges has been similar, but in recent months, the U.S. premium has reflected market expectations for tariffs—and this spread has only widened.

According to Goldman Sachs analyst Eoin Dinsmore, the pricing gap reflects "a rush to front-run the tariff," as buyers hoard copper to avoid the looming import cost hike.

He expects that "shipments into the U.S. will further accelerate ahead of the deadline," driving the arbitrage trade wider.

“Critical minerals, which are essential for a range of energy technologies and for the broader economy, have become a major focus in global policy and trade discussions,” wrote the International Energy Association (IEA) in its latest Global Critical Minerals Outlook 2025.

‘None Of Us Own Enough Copper’

Otavio Costa, macro analyst at Crescat Capital, says copper has now entered a "price discovery phase," noting that despite record highs, the metal is still historically cheap relative to gold.

The copper-to-gold ratio is approaching a key breakout level, and Costa sees plenty of room to run.

"None of us own enough copper," he posted, sharing an Elon Musk‘s image of AI servers loaded with industrial cabling—suggesting copper demand from data centers and electrification is booming.

Copper's 30% US Premium Is A Goldmine For These Miners

The historic divergence between copper prices in New York and London—now above 30%—has opened a rare profit window for a select group of miners.

U.S. copper buyers are paying a steep premium as they rush to secure domestic supplies ahead of Trump’s 50% import tariff, which takes effect on Aug. 1.

That's a game-changer for producers with U.S.-based operations or short-haul logistics from Mexico or South America.

Top of the list is Freeport-McMoRan Inc. (NYSE:FCX), which owns mines in Arizona and Peru and is considered the biggest beneficiary of the COMEX-LME spread. Then there's Southern Copper Corp. (NYSE:SCCO), a major producer with strong exposure to Mexico and the U.S. market.

Also worth watching: Lundin Mining Corp. (OTCPK: LUNMF), a smaller player with strategic output in Michigan and Chile.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Copper Donald TrumpSpecialty ETFs Commodities Econ #s Top Stories Economics ETFs