Breaking Down Dow: 6 Analysts Share Their Views

Dow (NYSE:DOW) has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 1 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

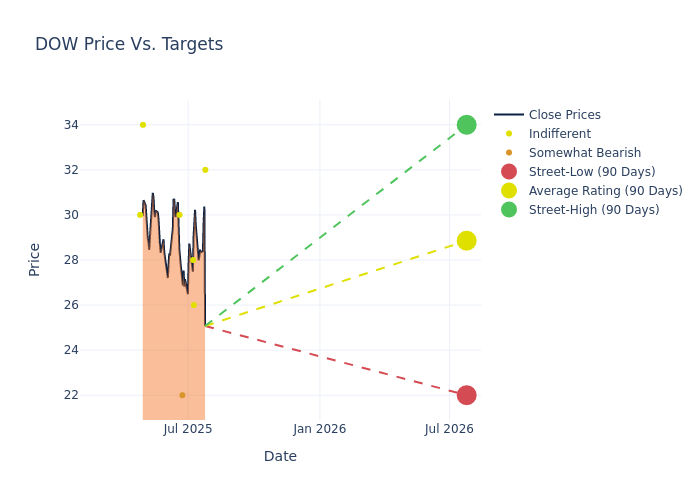

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $28.67, along with a high estimate of $34.00 and a low estimate of $22.00. A decline of 23.75% from the prior average price target is evident in the current average.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Dow among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Eric Boyes | Evercore ISI Group | Lowers | In-Line | $32.00 | $56.00 |

| Joshua Spector | UBS | Lowers | Neutral | $26.00 | $28.00 |

| Patrick Cunningham | Citigroup | Lowers | Neutral | $28.00 | $30.00 |

| John McNulty | BMO Capital | Lowers | Underperform | $22.00 | $29.00 |

| Frank Mitsch | Fermium Research | Announces | Hold | $30.00 | - |

| Duffy Fischer | Goldman Sachs | Lowers | Neutral | $34.00 | $45.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dow. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Dow compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dow's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Dow's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Dow analyst ratings.

Discovering Dow: A Closer Look

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

Financial Insights: Dow

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Challenges: Dow's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -3.1%. This indicates a decrease in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Materials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -2.97%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Dow's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -1.82%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Dow's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.54% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.07.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for DOW

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Goldman Sachs | Maintains | Neutral | |

| Jan 2022 | Goldman Sachs | Maintains | Neutral | |

| Jan 2022 | Mizuho | Maintains | Neutral |

Posted-In: BZI-AARAnalyst Ratings