What Analysts Are Saying About Plains GP Holdings Stock

Ratings for Plains GP Holdings (NASDAQ:PAGP) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

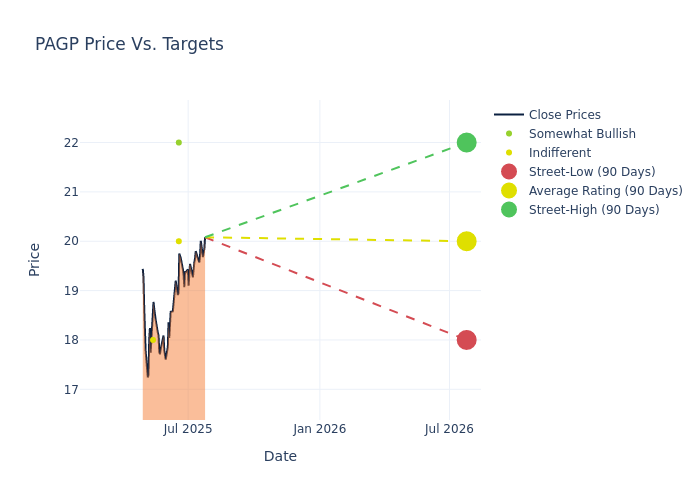

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $20.0, a high estimate of $22.00, and a low estimate of $18.00. Experiencing a 1.23% decline, the current average is now lower than the previous average price target of $20.25.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive Plains GP Holdings is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Gabriel Moreen | Mizuho | Raises | Outperform | $22.00 | $20.00 |

| Jeremy Tonet | JP Morgan | Raises | Neutral | $20.00 | $19.00 |

| Gabriel Moreen | Mizuho | Lowers | Outperform | $20.00 | $21.00 |

| Spiro Dounis | Citigroup | Lowers | Neutral | $18.00 | $21.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Plains GP Holdings. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Plains GP Holdings compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Plains GP Holdings's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Plains GP Holdings's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Plains GP Holdings analyst ratings.

About Plains GP Holdings

Plains GP Holdings LP provides transportation, storage, processing, fractionation, and marketing services for crude oil, refined products, natural gas liquids, liquefied petroleum gas, and related products. The group manages its operations through two operating segments: Crude Oil and NGL.

Plains GP Holdings: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Plains GP Holdings's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 0.13%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Plains GP Holdings's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 0.7%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Plains GP Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 6.21%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Plains GP Holdings's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.3%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Plains GP Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 6.62. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PAGP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | B of A Securities | Maintains | Underperform |

Posted-In: BZI-AARAnalyst Ratings