Expert Outlook: Pebblebrook Hotel Through The Eyes Of 4 Analysts

Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Pebblebrook Hotel (NYSE:PEB) in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

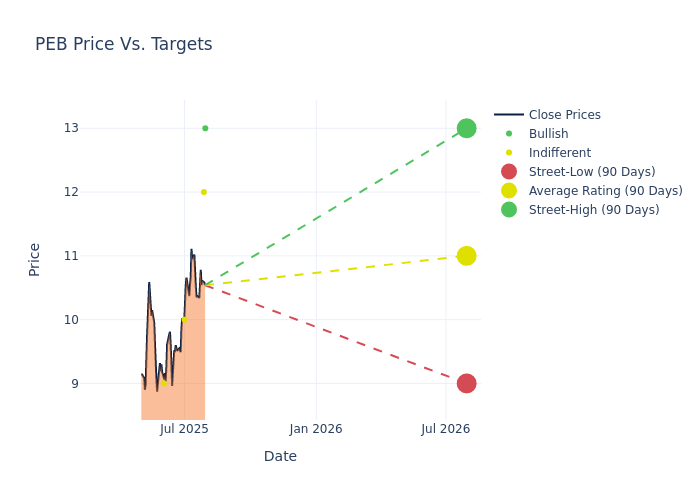

Analysts have recently evaluated Pebblebrook Hotel and provided 12-month price targets. The average target is $11.0, accompanied by a high estimate of $13.00 and a low estimate of $9.00. This upward trend is apparent, with the current average reflecting a 5.36% increase from the previous average price target of $10.44.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Pebblebrook Hotel among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Simon Yarmak | Stifel | Raises | Buy | $13.00 | $11.75 |

| Richard Hightower | Evercore ISI Group | Raises | In-Line | $12.00 | $11.00 |

| James Feldman | Wells Fargo | Raises | Equal-Weight | $10.00 | $9.00 |

| Gregory Miller | Truist Securities | Lowers | Hold | $9.00 | $10.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Pebblebrook Hotel. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Pebblebrook Hotel compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Pebblebrook Hotel's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Pebblebrook Hotel's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Pebblebrook Hotel analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Pebblebrook Hotel

Pebblebrook Hotel Trust currently owns upper upscale and luxury hotels with 11,933 rooms across 46 hotels in the United States. Pebblebrook acquired LaSalle Hotel Properties, which owned 10,451 rooms across 41 US hotels, in November 2018, though management has sold many of those hotels over the past few years. Pebblebrook's portfolio consists mostly of independent hotels with no brand affiliations, though the combined company does own and operate some hotels under Marriott, Starwood, InterContinental, Hilton, and Hyatt brands.

A Deep Dive into Pebblebrook Hotel's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Pebblebrook Hotel's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 1.97%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Pebblebrook Hotel's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -13.61%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Pebblebrook Hotel's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -1.63%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Pebblebrook Hotel's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.77%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Pebblebrook Hotel's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.97.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PEB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | B of A Securities | Downgrades | Buy | Neutral |

| Jan 2022 | Raymond James | Upgrades | Market Perform | Outperform |

| Jan 2022 | BMO Capital | Upgrades | Market Perform | Outperform |

Posted-In: BZI-AARAnalyst Ratings