14 Analysts Have This To Say About Las Vegas Sands

Ratings for Las Vegas Sands (NYSE:LVS) were provided by 14 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 6 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 6 | 6 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

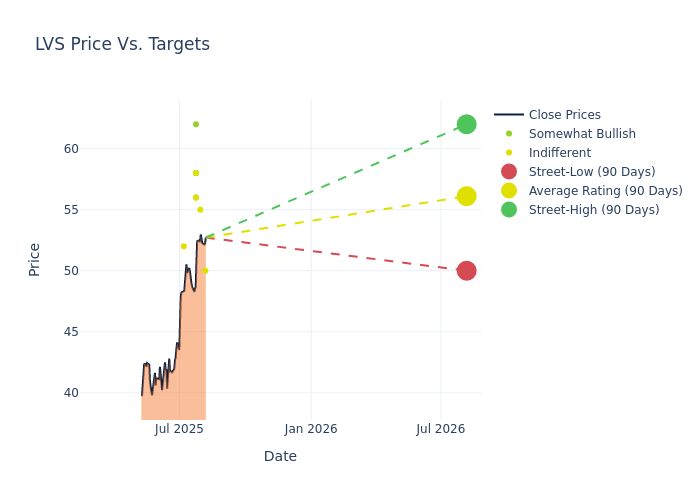

Analysts have set 12-month price targets for Las Vegas Sands, revealing an average target of $54.43, a high estimate of $62.00, and a low estimate of $47.00. Observing a 7.7% increase, the current average has risen from the previous average price target of $50.54.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Las Vegas Sands by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Grambling | Morgan Stanley | Raises | Equal-Weight | $50.00 | $47.00 |

| Robin Farley | UBS | Raises | Neutral | $55.00 | $48.00 |

| Chad Beynon | Macquarie | Raises | Outperform | $58.00 | $52.00 |

| Ben Chaiken | Mizuho | Raises | Outperform | $56.00 | $47.00 |

| Daniel Politzer | JP Morgan | Raises | Neutral | $56.00 | $47.00 |

| Joseph Stauff | Susquehanna | Raises | Positive | $62.00 | $58.00 |

| Brandt Montour | Barclays | Raises | Overweight | $58.00 | $57.00 |

| Shaun Kelley | B of A Securities | Raises | Neutral | $58.00 | $52.50 |

| Joseph Stauff | Susquehanna | Lowers | Positive | $58.00 | $59.00 |

| Brandt Montour | Barclays | Raises | Overweight | $57.00 | $51.00 |

| Stephen Grambling | Morgan Stanley | Raises | Equal-Weight | $47.00 | $45.00 |

| Robin Farley | UBS | Raises | Neutral | $48.00 | $43.00 |

| Lizzie Dove | Goldman Sachs | Announces | Neutral | $52.00 | - |

| Daniel Politzer | JP Morgan | Announces | Neutral | $47.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Las Vegas Sands. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Las Vegas Sands compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Las Vegas Sands's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Las Vegas Sands's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Las Vegas Sands analyst ratings.

Discovering Las Vegas Sands: A Closer Look

Las Vegas Sands is the world's largest operator of fully integrated resorts, featuring casino, hotel, entertainment, food and beverage, retail, and convention center operations. The company owns the Venetian Macao, Sands Macao, Londoner Macao, Four Seasons Hotel Macao, and Parisian Macao, as well as the Marina Bay Sands resort in Singapore. We expect Sands to open a fourth tower in Singapore in 2031. Its Venetian and Palazzo Las Vegas assets in the US were sold to Apollo and Vici in 2022. After the sale of its Vegas assets, the company generates all its EBITDA from Asia, with its casino operations generating the majority of sales.

Financial Milestones: Las Vegas Sands's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Las Vegas Sands's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 14.99%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Las Vegas Sands's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.52%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Las Vegas Sands's ROE stands out, surpassing industry averages. With an impressive ROE of 19.66%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Las Vegas Sands's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.14% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 7.95, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for LVS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | CBRE | Maintains | Hold | |

| Jan 2022 | Deutsche Bank | Maintains | Buy | |

| Jan 2022 | UBS | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings