A Look Ahead: A.O. Smith's Earnings Forecast

A.O. Smith (NYSE:AOS) is preparing to release its quarterly earnings on Thursday, 2025-07-24. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect A.O. Smith to report an earnings per share (EPS) of $0.98.

The market awaits A.O. Smith's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

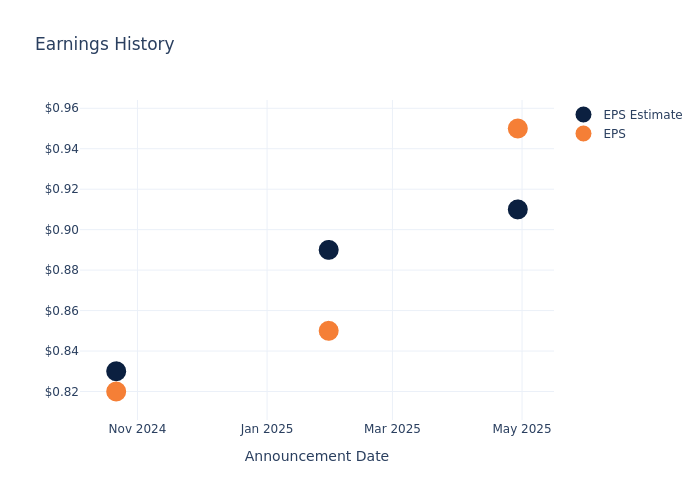

Overview of Past Earnings

The company's EPS beat by $0.04 in the last quarter, leading to a 1.77% increase in the share price on the following day.

Here's a look at A.O. Smith's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.91 | 0.89 | 0.83 | 1.06 |

| EPS Actual | 0.95 | 0.85 | 0.82 | 1.06 |

| Price Change % | 2.0% | -0.0% | -1.0% | 0.0% |

Performance of A.O. Smith Shares

Shares of A.O. Smith were trading at $71.1 as of July 22. Over the last 52-week period, shares are down 12.94%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Views on A.O. Smith

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding A.O. Smith.

A.O. Smith has received a total of 4 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $76.25, the consensus suggests a potential 7.24% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Advanced Drainage Systems, Owens-Corning and Allegion, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Advanced Drainage Systems, with an average 1-year price target of $143.0, suggesting a potential 101.13% upside.

- Analysts currently favor an Outperform trajectory for Owens-Corning, with an average 1-year price target of $174.86, suggesting a potential 145.94% upside.

- Analysts currently favor an Neutral trajectory for Allegion, with an average 1-year price target of $150.67, suggesting a potential 111.91% upside.

Peers Comparative Analysis Summary

In the peer analysis summary, key metrics for Advanced Drainage Systems, Owens-Corning and Allegion are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| A.O. Smith | Buy | -1.52% | $375.40M | 7.31% |

| Advanced Drainage Systems | Outperform | -5.82% | $226.25M | 4.88% |

| Owens-Corning | Outperform | 25.43% | $725M | -1.87% |

| Allegion | Neutral | 5.37% | $422.50M | 9.54% |

Key Takeaway:

A.O. Smith ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity.

Discovering A.O. Smith: A Closer Look

A.O. Smith manufactures a broad lineup of water heaters, boilers, and water treatment products. The company has two reporting segments: North America (75% of sales) and rest of world (25% of sales). A.O. Smith is the leading manufacturer of water heaters in North America for the residential and commercial markets, with approximately 37% and 54% market share, respectively. Residential water heaters account for most of North American sales and are distributed equally through wholesale and retail channels. Most of A.O. Smith's international revenue is from China, a market the company entered during the mid-1990s.

A.O. Smith: Financial Performance Dissected

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Challenges: A.O. Smith's revenue growth over 3 months faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -1.52%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: A.O. Smith's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.17%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.31%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): A.O. Smith's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.2%, the company showcases efficient use of assets and strong financial health.

Debt Management: A.O. Smith's debt-to-equity ratio is below the industry average at 0.16, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for A.O. Smith visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.