Earnings Outlook For SoFi Techs

SoFi Techs (NASDAQ:SOFI) is set to give its latest quarterly earnings report on Tuesday, 2025-07-29. Here's what investors need to know before the announcement.

Analysts estimate that SoFi Techs will report an earnings per share (EPS) of $0.06.

Anticipation surrounds SoFi Techs's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.02, leading to a 5.73% drop in the share price the following trading session.

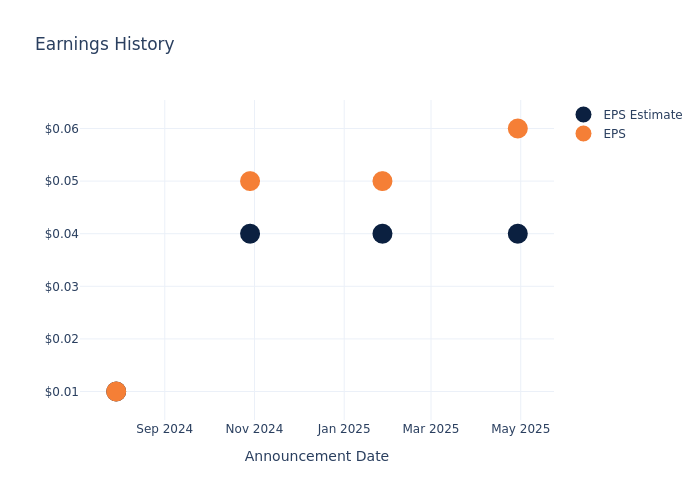

Here's a look at SoFi Techs's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.04 | 0.04 | 0.04 | 0.01 |

| EPS Actual | 0.06 | 0.05 | 0.05 | 0.01 |

| Price Change % | -6.0% | 1.0% | 7.000000000000001% | 2.0% |

Market Performance of SoFi Techs's Stock

Shares of SoFi Techs were trading at $21.2 as of July 25. Over the last 52-week period, shares are up 181.87%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on SoFi Techs

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding SoFi Techs.

SoFi Techs has received a total of 9 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $16.72, the consensus suggests a potential 21.13% downside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Dave and Enova International, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Dave, with an average 1-year price target of $234.73, suggesting a potential 1007.22% upside.

- Analysts currently favor an Buy trajectory for Enova International, with an average 1-year price target of $129.5, suggesting a potential 510.85% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Dave and Enova International, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Kaspi.kz | Outperform | 48.67% | $430.02B | 15.62% |

| Dave | Buy | 46.65% | $100.87M | 15.06% |

| Enova International | Buy | 2.48% | $345.64M | 6.28% |

Key Takeaway:

SoFi Techs ranks highest in Revenue Growth among its peers. It also leads in Gross Profit. However, it ranks lower in Return on Equity compared to its peers.

Get to Know SoFi Techs Better

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

Breaking Down SoFi Techs's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining SoFi Techs's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 31.74% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 9.21%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): SoFi Techs's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.08%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): SoFi Techs's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.19%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.47.

To track all earnings releases for SoFi Techs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.