Earnings Preview For Kraft Heinz

Kraft Heinz (NASDAQ:KHC) will release its quarterly earnings report on Wednesday, 2025-07-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Kraft Heinz to report an earnings per share (EPS) of $0.64.

Investors in Kraft Heinz are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

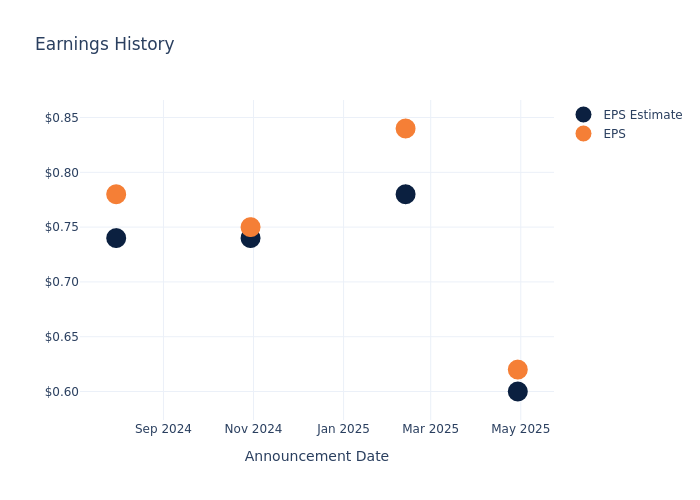

Overview of Past Earnings

The company's EPS beat by $0.02 in the last quarter, leading to a 0.8% increase in the share price on the following day.

Here's a look at Kraft Heinz's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.60 | 0.78 | 0.74 | 0.74 |

| EPS Actual | 0.62 | 0.84 | 0.75 | 0.78 |

| Price Change % | 1.0% | 2.0% | -1.0% | 1.0% |

Kraft Heinz Share Price Analysis

Shares of Kraft Heinz were trading at $28.25 as of July 28. Over the last 52-week period, shares are down 18.83%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Observations about Kraft Heinz

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Kraft Heinz.

Analysts have provided Kraft Heinz with 7 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $28.0, suggesting a potential 0.88% downside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of Hershey, Kellanova and General Mills, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Hershey, with an average 1-year price target of $164.75, suggesting a potential 483.19% upside.

- Analysts currently favor an Neutral trajectory for Kellanova, with an average 1-year price target of $83.5, suggesting a potential 195.58% upside.

- Analysts currently favor an Neutral trajectory for General Mills, with an average 1-year price target of $55.33, suggesting a potential 95.86% upside.

Snapshot: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Hershey, Kellanova and General Mills, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Kraft Heinz | Neutral | -6.43% | $2.06B | 1.44% |

| Hershey | Neutral | -13.75% | $944.27M | 4.77% |

| Kellanova | Neutral | -3.66% | $1.06B | 7.91% |

| General Mills | Neutral | -3.35% | $1.47B | 3.07% |

Key Takeaway:

Kraft Heinz ranks in the middle for consensus rating. It is at the bottom for revenue growth. It is at the top for gross profit. It is at the bottom for return on equity.

Delving into Kraft Heinz's Background

In July 2015, Kraft merged with Heinz to create one of North America's largest food and beverage manufacturers. Beyond its namesake brands, its portfolio has since included Oscar Mayer, Velveeta, and Philadelphia. While the retail channel drives around 85% of its total sales, the firm also maintains a growing foodservice presence. Outside North America, Kraft Heinz's global reach includes a distribution network in Europe and emerging markets that drives nearly 25% of its consolidated sales base, as its products are sold in more than 190 countries and territories.

Kraft Heinz's Economic Impact: An Analysis

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Negative Revenue Trend: Examining Kraft Heinz's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -6.43% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Kraft Heinz's net margin is impressive, surpassing industry averages. With a net margin of 11.87%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.44%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.8%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.44, Kraft Heinz adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Kraft Heinz visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.