An Overview of Ionis Pharmaceuticals's Earnings

Ionis Pharmaceuticals (NASDAQ:IONS) will release its quarterly earnings report on Wednesday, 2025-07-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Ionis Pharmaceuticals to report an earnings per share (EPS) of $0.01.

Ionis Pharmaceuticals bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Performance in Previous Earnings

Last quarter the company beat EPS by $0.10, which was followed by a 3.26% increase in the share price the next day.

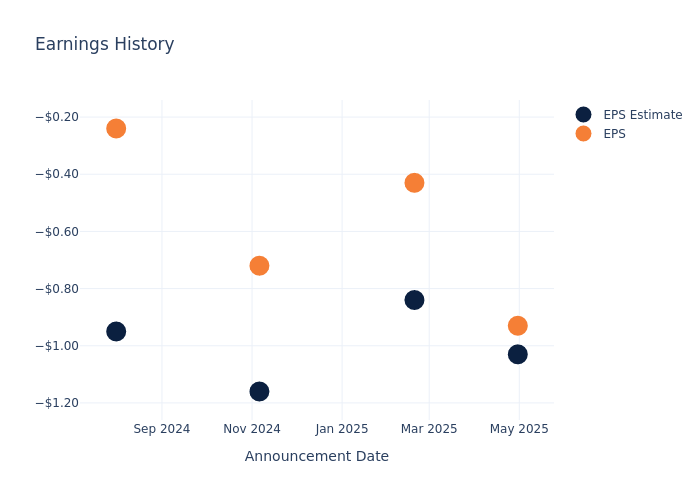

Here's a look at Ionis Pharmaceuticals's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -1.03 | -0.84 | -1.16 | -0.95 |

| EPS Actual | -0.93 | -0.43 | -0.72 | -0.24 |

| Price Change % | 3.0% | 3.0% | -1.0% | -4.0% |

Performance of Ionis Pharmaceuticals Shares

Shares of Ionis Pharmaceuticals were trading at $41.17 as of July 28. Over the last 52-week period, shares are down 16.4%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Take on Ionis Pharmaceuticals

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ionis Pharmaceuticals.

A total of 7 analyst ratings have been received for Ionis Pharmaceuticals, with the consensus rating being Buy. The average one-year price target stands at $53.43, suggesting a potential 29.78% upside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of Halozyme Therapeutics and Rhythm Pharmaceuticals, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Halozyme Therapeutics, with an average 1-year price target of $61.2, suggesting a potential 48.65% upside.

- Analysts currently favor an Buy trajectory for Rhythm Pharmaceuticals, with an average 1-year price target of $97.4, suggesting a potential 136.58% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Halozyme Therapeutics and Rhythm Pharmaceuticals, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ionis Pharmaceuticals | Buy | 10.14% | $130.11M | -27.62% |

| Halozyme Therapeutics | Neutral | 35.22% | $216.46M | 27.92% |

| Rhythm Pharmaceuticals | Buy | 25.94% | $29.06M | -249.88% |

Key Takeaway:

Ionis Pharmaceuticals ranks highest in Revenue Growth among its peers. It ranks lowest in Gross Profit and Return on Equity.

Get to Know Ionis Pharmaceuticals Better

Ionis Pharmaceuticals is the leading developer of antisense technology to discover and develop novel drugs. Its broad clinical and preclinical pipeline targets a wide variety of diseases, with an emphasis on cardiovascular, metabolic, neurological, and rare diseases. Ionis and Biogen brought Spinraza to market in 2016 as a treatment for spinal muscular atrophy, and Biogen launched ALS drug Qalsody in 2023. Ionis brought two additional drugs to market via its cardiovascular-focused subsidiary Akcea, including ATTR amyloidosis drug Tegsedi (2018) and cardiology drug Waylivra (Europe, 2019). Ionis and AstraZeneca launched polyneuropathy drug Wainua in 2024. Ionis received FDA approval in 2024 for Tryngolza for a rare high-triglyceride syndrome, marking its first independent launch.

Understanding the Numbers: Ionis Pharmaceuticals's Finances

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Ionis Pharmaceuticals's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 10.14%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ionis Pharmaceuticals's net margin is impressive, surpassing industry averages. With a net margin of -111.64%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Ionis Pharmaceuticals's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -27.62%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Ionis Pharmaceuticals's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -5.05%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Ionis Pharmaceuticals's debt-to-equity ratio surpasses industry norms, standing at 2.96. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Ionis Pharmaceuticals visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.