This Is What Whales Are Betting On Sweetgreen

Benzinga's options scanner has just identified more than 9 option transactions on Sweetgreen (NYSE:SG), with a cumulative value of $407,059. Concurrently, our algorithms picked up 4 puts, worth a total of 234,604.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.0 to $20.0 for Sweetgreen during the past quarter.

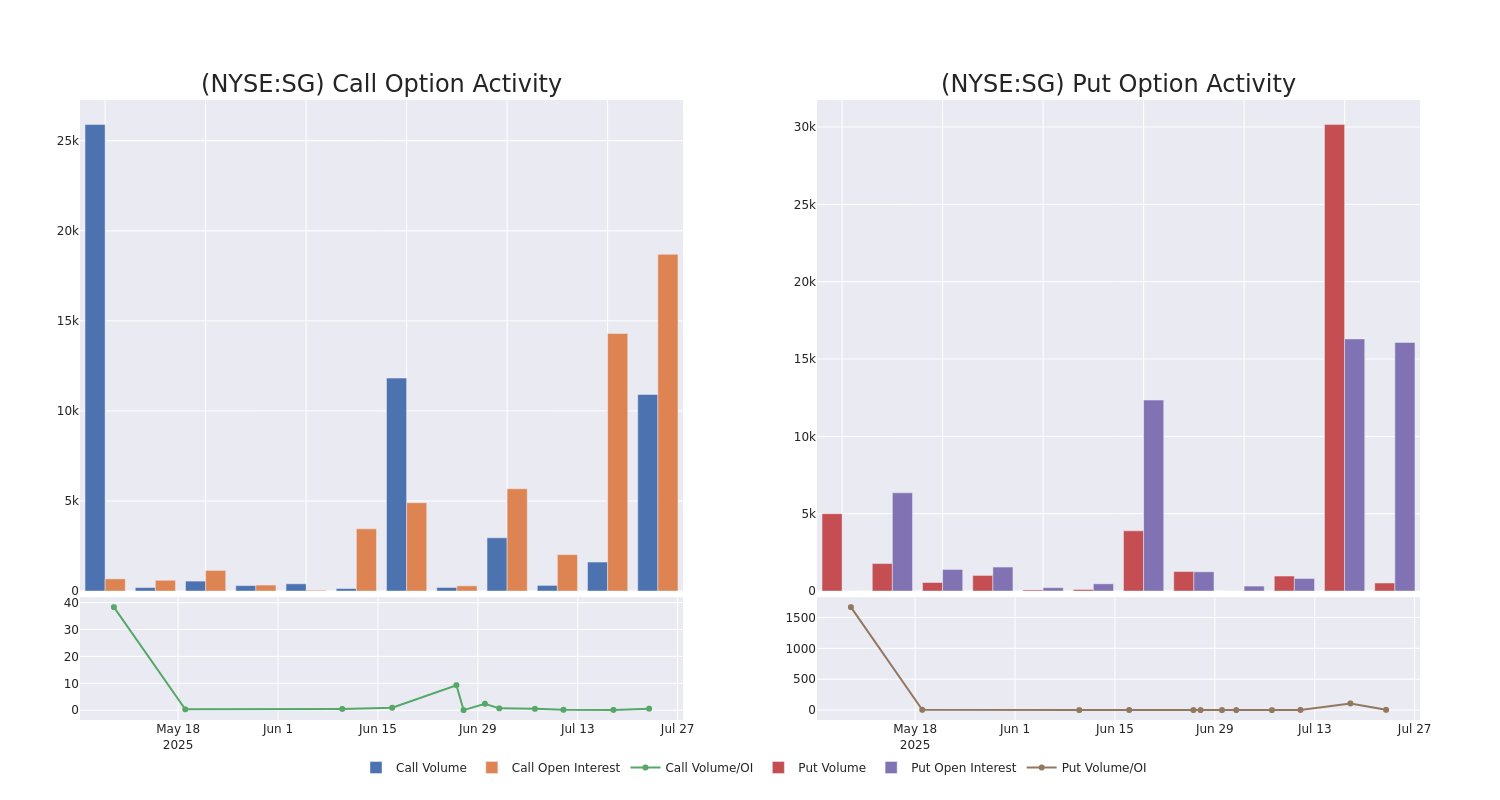

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sweetgreen's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sweetgreen's significant trades, within a strike price range of $12.0 to $20.0, over the past month.

Sweetgreen Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SG | PUT | TRADE | BULLISH | 08/08/25 | $5.7 | $5.5 | $5.57 | $20.00 | $111.4K | 3 | 200 |

| SG | PUT | TRADE | BULLISH | 08/08/25 | $5.8 | $5.6 | $5.64 | $20.00 | $56.4K | 3 | 445 |

| SG | CALL | SWEEP | BULLISH | 01/15/27 | $4.7 | $4.4 | $4.6 | $20.00 | $54.1K | 1.6K | 2 |

| SG | CALL | TRADE | BULLISH | 01/15/27 | $4.6 | $4.5 | $4.58 | $20.00 | $51.2K | 1.6K | 263 |

| SG | CALL | SWEEP | BULLISH | 01/16/26 | $4.1 | $1.35 | $4.1 | $15.00 | $40.9K | 11.6K | 0 |

About Sweetgreen

Sweetgreen Inc is a mission-driven, next-generation restaurant and lifestyle brand that serves healthy food at scale. Its bold vision is to be as ubiquitous as traditional fast food, but with the transparency and quality that consumers increasingly expect. It is creating plant-forward, seasonal, and earth-friendly meals from fresh ingredients and produce that prioritizes organic, regenerative, and local sourcing.

Having examined the options trading patterns of Sweetgreen, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Sweetgreen Standing Right Now?

- Currently trading with a volume of 3,308,897, the SG's price is down by -4.67%, now at $15.5.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 14 days.

What The Experts Say On Sweetgreen

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $18.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from TD Securities has revised its rating downward to Hold, adjusting the price target to $15.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Sweetgreen with a target price of $17.

* An analyst from Wells Fargo persists with their Overweight rating on Sweetgreen, maintaining a target price of $19.

* An analyst from Barclays persists with their Equal-Weight rating on Sweetgreen, maintaining a target price of $17.

* An analyst from B of A Securities persists with their Buy rating on Sweetgreen, maintaining a target price of $22.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Sweetgreen, Benzinga Pro gives you real-time options trades alerts.