Behind the Scenes of Estee Lauder Cos's Latest Options Trends

Investors with a lot of money to spend have taken a bearish stance on Estee Lauder Cos (NYSE:EL).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with EL, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Estee Lauder Cos.

This isn't normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $75,670, and 6 are calls, for a total amount of $1,404,167.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $110.0 for Estee Lauder Cos over the last 3 months.

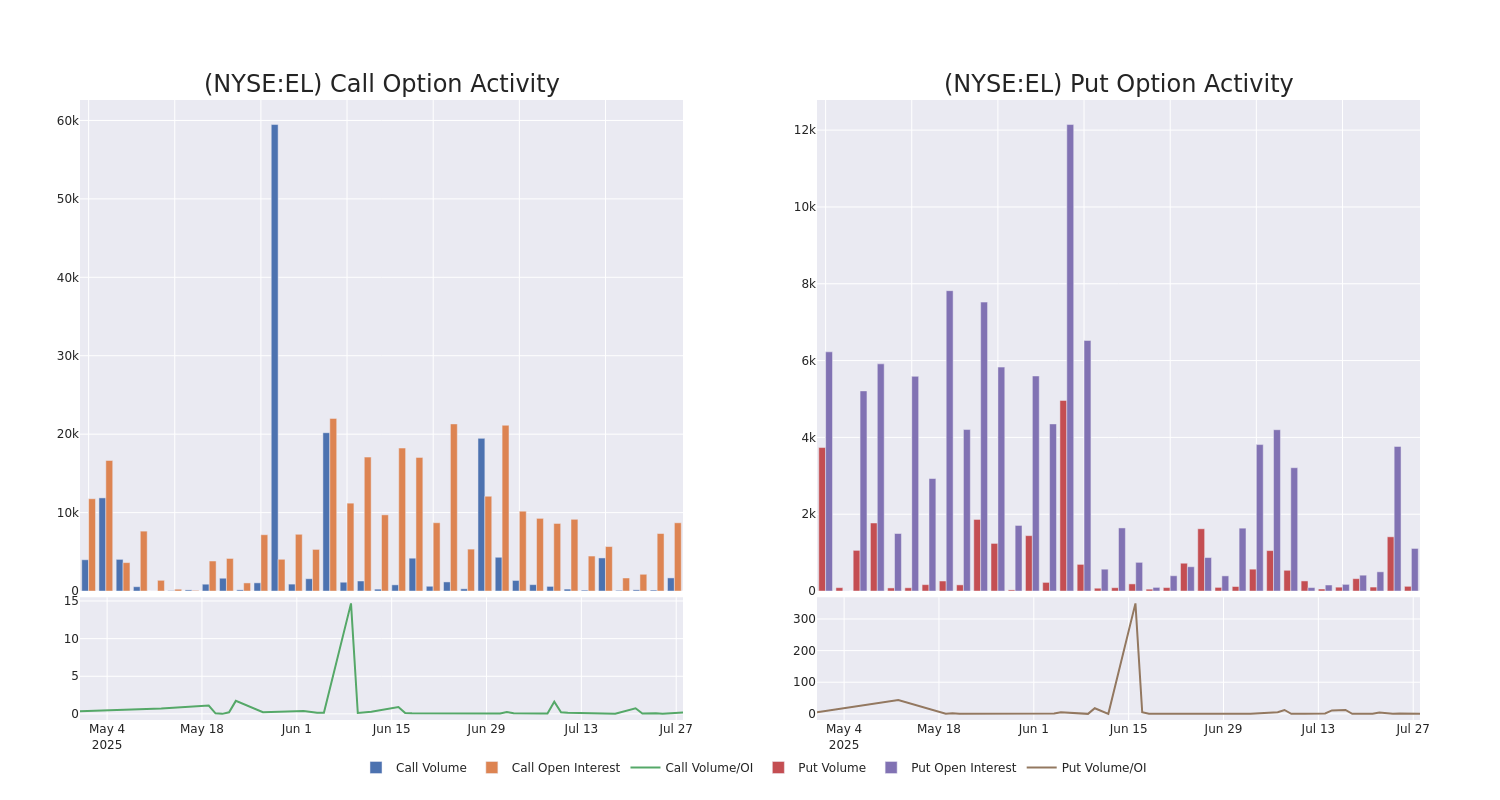

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Estee Lauder Cos's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Estee Lauder Cos's significant trades, within a strike price range of $55.0 to $110.0, over the past month.

Estee Lauder Cos Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EL | CALL | TRADE | BEARISH | 01/15/27 | $13.6 | $13.25 | $13.35 | $110.00 | $667.5K | 2.2K | 500 |

| EL | CALL | TRADE | BEARISH | 10/17/25 | $6.5 | $6.4 | $6.38 | $95.00 | $510.4K | 2.9K | 851 |

| EL | CALL | TRADE | BEARISH | 08/22/25 | $5.95 | $5.8 | $5.8 | $92.00 | $87.0K | 46 | 165 |

| EL | CALL | TRADE | BEARISH | 08/29/25 | $14.7 | $14.3 | $14.3 | $80.00 | $57.2K | 14 | 43 |

| EL | CALL | SWEEP | BULLISH | 09/19/25 | $6.9 | $6.9 | $6.9 | $90.00 | $48.3K | 3.2K | 82 |

About Estee Lauder Cos

Estée Lauder is a leader in the global prestige beauty market, participating across skin care (51% of fiscal 2024 sales), makeup (29%), fragrance (16%), and hair care (4%) categories, with top-selling brands such as Estée Lauder, Clinique, M.A.C, La Mer, Jo Malone London, Aveda, Bobbi Brown, and Origins. The firm operates in more than 150 countries, generating 30% of revenue from the Americas, 39% from Europe, the Middle East and Africa (including travel retail), and 31% from Asia-Pacific. Estée Lauder sells its products through department stores, travel retail, specialty multibrand beauty stores, brand-dedicated freestanding stores, e-commerce, salons/spas, and perfumeries.

Present Market Standing of Estee Lauder Cos

- With a trading volume of 1,990,971, the price of EL is up by 0.1%, reaching $90.49.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 23 days from now.

Professional Analyst Ratings for Estee Lauder Cos

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $93.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS persists with their Neutral rating on Estee Lauder Cos, maintaining a target price of $93.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Estee Lauder Cos with a target price of $90.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Estee Lauder Cos with a target price of $99.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Estee Lauder Cos, targeting a price of $84.

* An analyst from JP Morgan has elevated its stance to Overweight, setting a new price target at $101.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Estee Lauder Cos, Benzinga Pro gives you real-time options trades alerts.