Euro/Dollar In Consolidation

By RoboForex Analytical Department

The EUR/USD pair is gently declining towards 1.0858 on Tuesday but remains within a medium-term range.

This week sees few significant US statistics releases, which could provide investors with insights into future interest rate movements. However, numerous speeches from US Federal Reserve members are expected. Investors will be keenly listening for any indications about the Fed's monetary policy.

On Monday, several Fed officials advocated for maintaining a cautious monetary policy strategy, despite last week's data showing a reduction in inflationary pressures in April.

It is likely that all forthcoming comments from Fed officials will echo a similar sentiment—that the Fed remains patient and consistent. The Fed requires time to gather more data on easing price pressures. While there are indications of such easing, they are not yet systemic. This cautious approach has done little to alter investor expectations significantly. The market now anticipates that the Fed will lower rates twice before the end of the year, with the first cut expected in September.

EUR/USD Technical Analysis

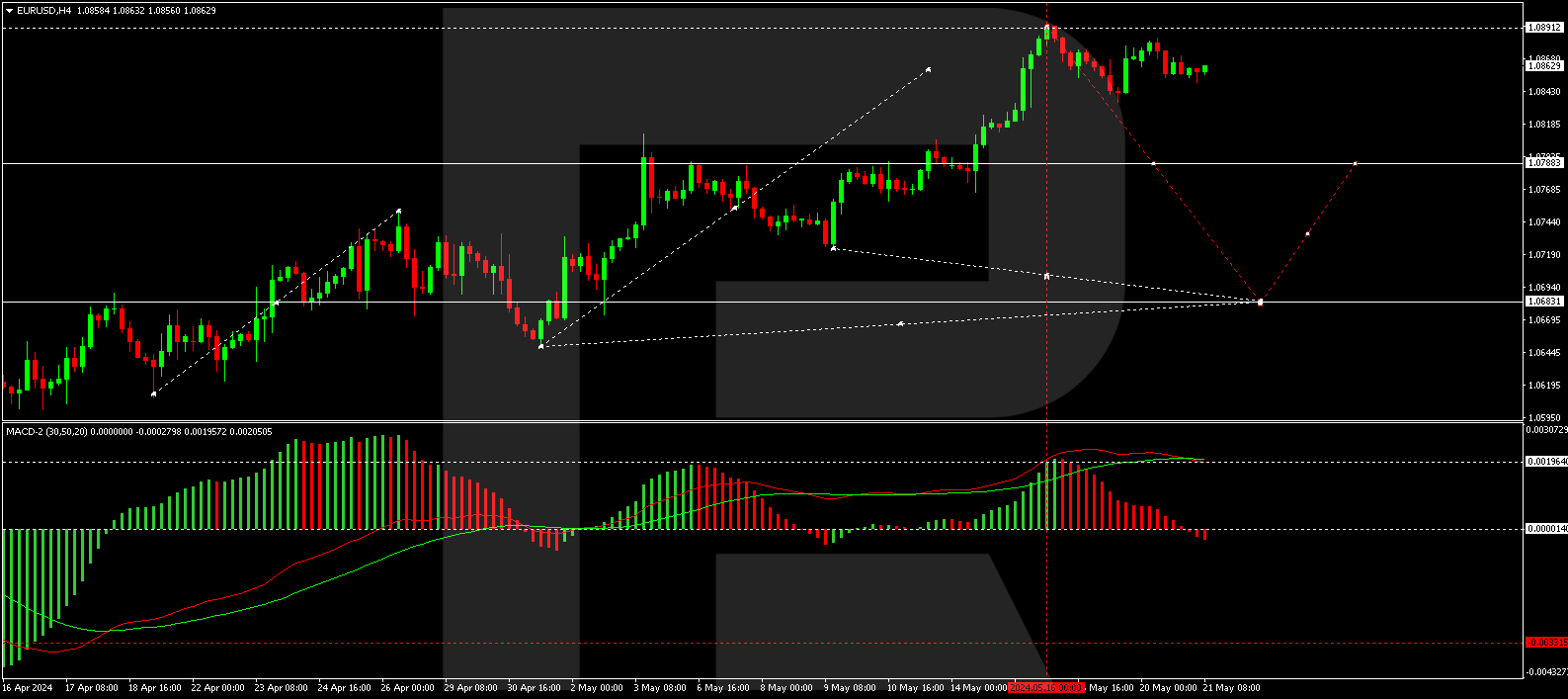

On the H4 chart, EUR/USD has formed a consolidation range below the level of 1.0890. A downward exit from this range could lead to a continuation of the downward wave to 1.0784. Breaking this level might further extend the trend to 1.0683, which is the first target of the decline wave. This scenario is technically supported by the MACD indicator, with its signal line at the maximums while the histograms are below the zero mark and continue to decline.

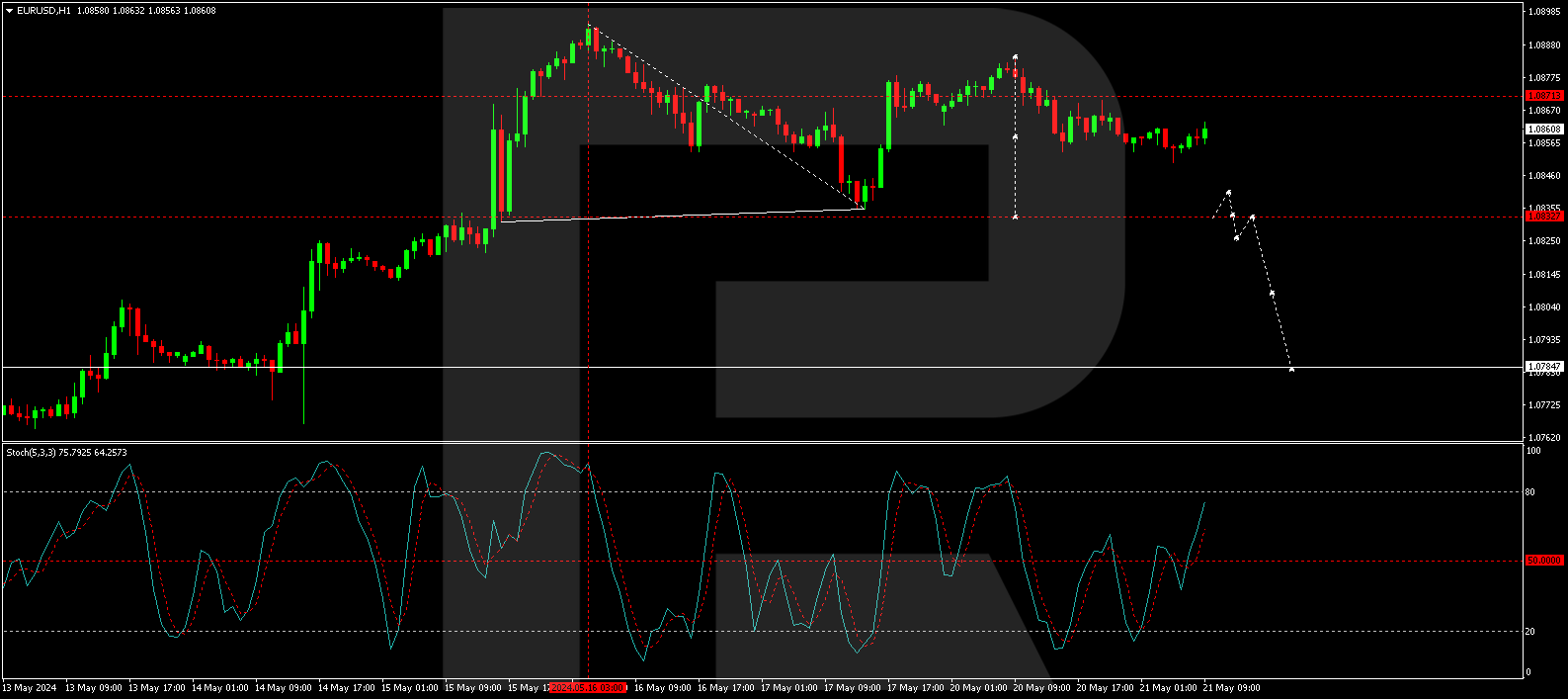

On the H1 chart, the correction to 1.0883 has been completed. Currently, the structure of a downside wave to 1.0833 is forming. After reaching this level, a narrow consolidation range around it is expected. A downward exit from this range could open the potential for a further decline to 1.0785, which is the local target of the downward wave. This scenario is technically confirmed by the Stochastic oscillator, with its signal line below 80 and expected to decline to 20.

Summary

The EUR/USD pair remains in a consolidation phase with a gentle downward movement. Technical indicators suggest potential for further declines, but market participants will be closely watching Fed communications for any hints on future monetary policy, which could influence the pair's direction.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors euro Expert IdeasTechnicals Forex Markets Trading Ideas General