All Is Calm Ahead Of The Federal Reserve This Afternoon

Good Morning Everyone!

Remember, today at 2pm, a group of middle-aged financial experts determines whether or not millions of Robinhood traders get margin called.

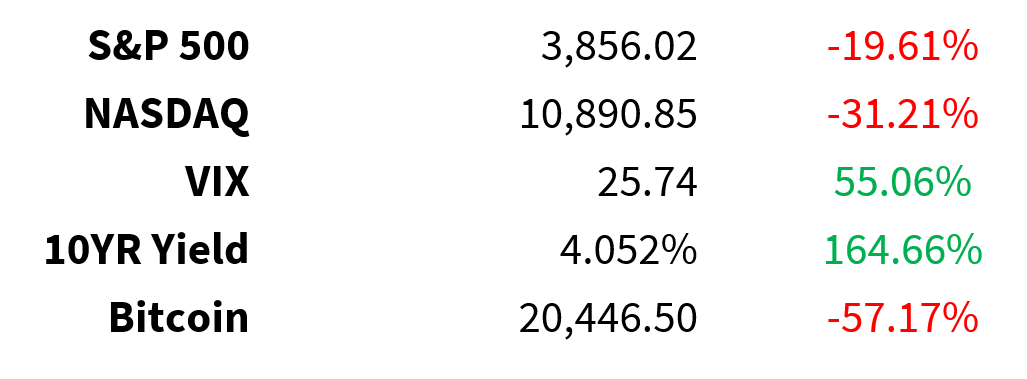

Prices as of 4 pm EST, 11/1/22; % YTD

MARKET UPDATE

2 p.m. Fed Reserve Rate decision

-

Volatility is relatively LOW heading into the Fed Meeting

-

4th straight rate hike of 75 basis points expected

-

More important: messaging on how the Fed proceeds from here

-

2:30 p.m. Powell press conference

-

Will Powell say: we are not done

-

Powell can’t be happy about the spectacular rally in the DOW in October / this is not what Powell wants

China orders a 7-day lockdown of iPhone City (Foxconn’s main plant in Zhengzhou)

-

Foxconn had a Covid flare-up that forced 200,000 staff into quarantine

-

Lockdown will last until November 9

-

The abrupt action reflects Beijing’s Covid Zero approach

-

Apple (NASDAQ: AAPL) pre-market is down 1%

Russia

-

said it would resume participation in the Ukrainian grain deal

-

Wheat down 6%, Corn down 2%

Crude 88 flat

-

API Crude and product inventories out last night had little impact on Crude

-

Fed Day is more important

Maersk container vessels

-

A bellwether for global trade

-

Believes global demand will shrink by 4% in 2022 and will be down in 2023

Amazon (NASDAQ: AMZN) hit a new year-to-date low yesterday

-

Amazon paused hiring in their Ad business

-

Any cost cutting measures will be viewed positive by investors

Autos

-

U.S. supply 32 days 18 month high

-

U.S. SAAR 15.3 million units 17 month high

-

Incentives were down 47% year-over-year but up 2.7% month-over-month

-

Inventory days supply is 32 days vs. 30 days last month and 23 days last year

-

Mix remains strong favouring trucks: Car vs. light truck mix at 21% / 79%

Opioid Settlement

-

Final settlement positive for pharmacies

-

$12-13.8 billion for the big three retail pharmacies

-

$21 billion announced in 2021 for the big 3 distributors

-

CVS (NYSE: CVS) + 2%

-

Walgreens Boots Alliance (NASDAQ: WBA) +2%

-

Walmart (NYSE: WMT) flat

Earnings

-

Advanced Micro Devices (NASDAQ: AMD)

-

Mondelez (NASDAQ: MDLZ)

-

Airbnb (NASDAQ: ABNB) beat but guide below street

-

McKesson (NYSE: MCK)

-

Public Storage (NYSE: PSA)

-

Devon Energy (NYSE: DVN) Earnings and FCF beat, capex below consensus

-

AIG (NYSE: AIG) EPS beat

-

Prudential (NYSE: PRU) EPS beat

-

Energy Transfer (NYSE: ET)

-

CVS Health (NYSE: CVS) agreed to pay $5 billion to settle opioid lawsuits

-

Estee Lauder (NYSE: EL) -8%, guide down to 2023

-

Progressive Insurance (NYSE: PGR)

-

Humana (NYSE: HUM)

CRYPTO UPDATE

International regulation

-

G-20 will prioritize crypto regulation

-

Third objective of India’s G-20 presidency

-

Year-long presidency

-

Takes over starting in December

-

-

Hong Kong warming up to crypto

-

Exploring giving access to retail crypto trading and ETFs

-

Considering range of pro-crypto measures

-

Mainland China much more strict

-

Blanket ban on all crypto in September 2021

-

-

Recent crypto trademark filings

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Autos contributors Cypto MarketCryptocurrency News Small Cap Markets