Big Retailers Report

Good Morning Everyone!

Customers are setting banks on fire in Lebanon because they can’t get their money out.

Inflation is at +170%.

This is what a currency collapse looks like:

In Lebanon people are burning down financial institutions and politicians' homes to reclaim their own money which has been frozen by the banks.

Keep in mind with CBDC the financial establishment has the ability to freeze your money with a push on a button..... pic.twitter.com/kNIn8Z1Gbh

— Richard (@ricwe123) February 19, 2023

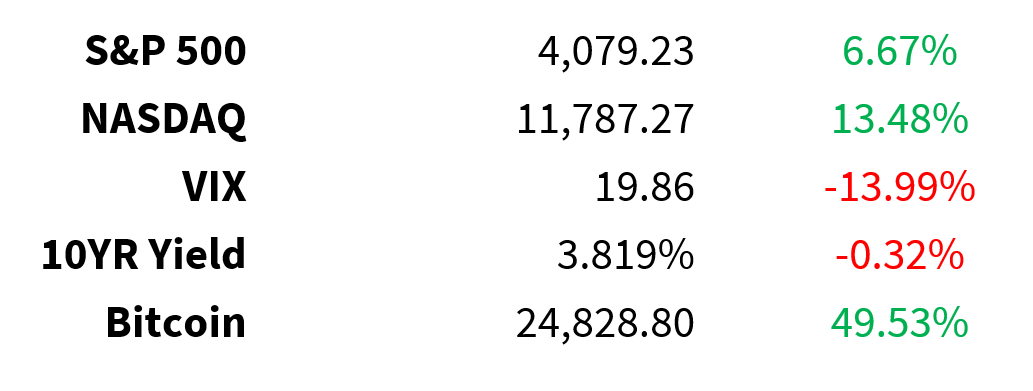

Prices as of 4 pm EST, 2/17/23; % YTD

MARKET UPDATE

Today:

-

9:45: S&P Global Flash PMIs (Composite, Manufacturing, Services)

-

10:00: Existing home sales

This week:

-

Tuesday: FOMC minutes

-

Thursday: Q4 GDP estimate, initial jobless claims

-

Friday: Personal income/spending, PCE, New home sales, Consumer sentiment

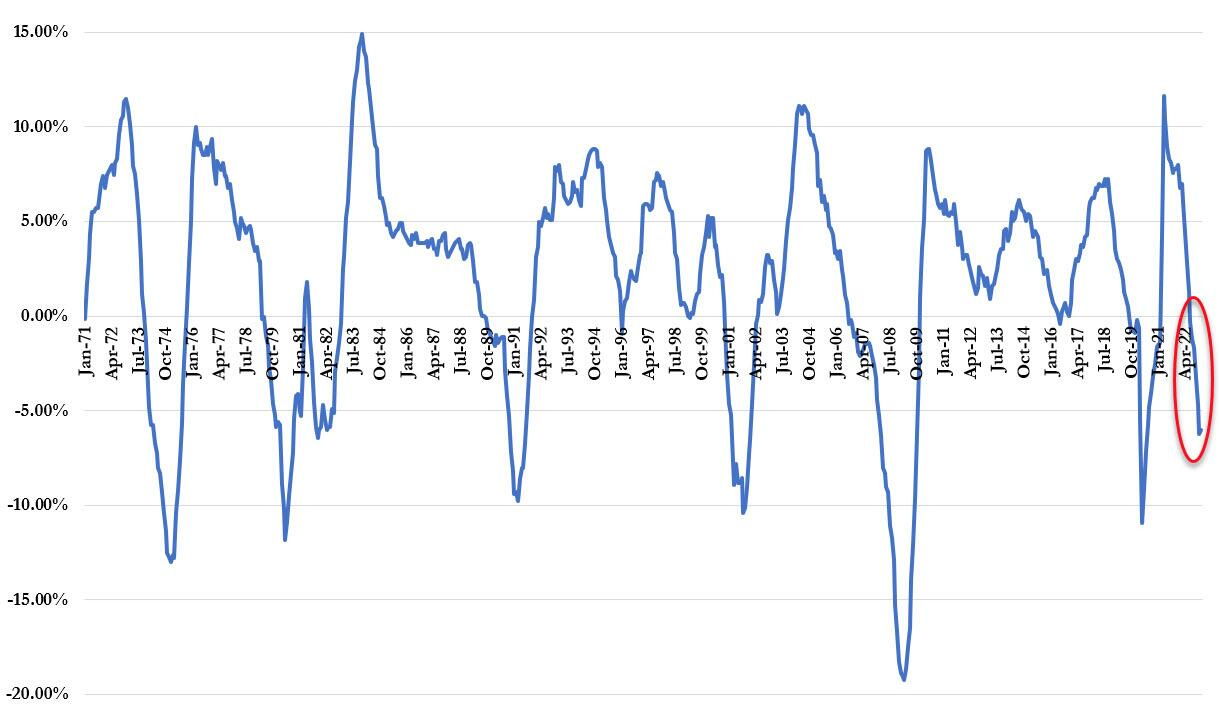

Leading Economic Indicator (LEI)

-

Conference Board's LEI fell 0.3% in January

-

-6% YoY…outside of Covid, close to biggest drop since Lehman (2008)

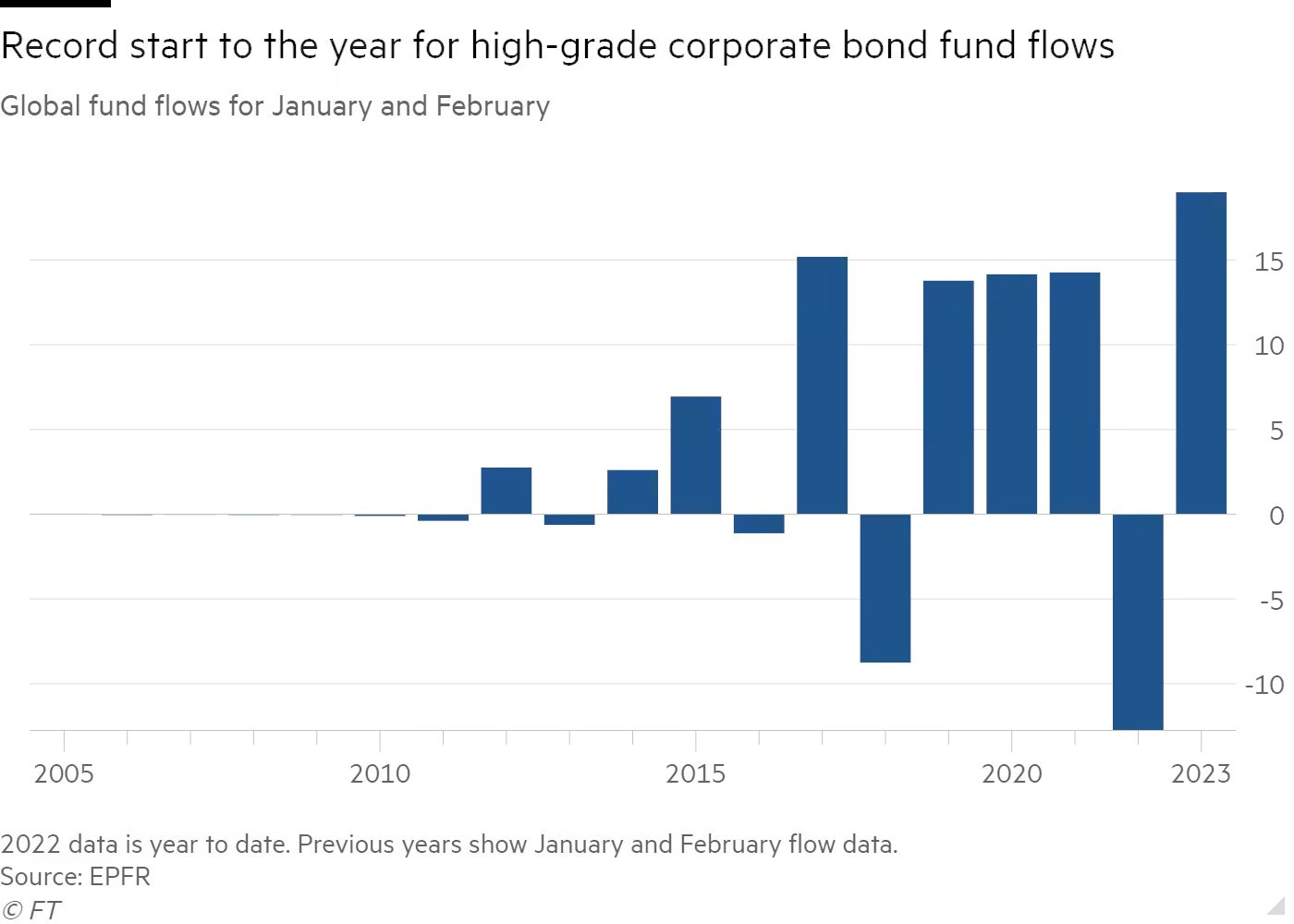

High-grade corporate bonds

-

IG corporate bonds have seen $19 billion inflows YTD

-

Investors seeking low risk…higher yields now attractive

-

Avg yields ~5.45% up from 3.1% a year ago

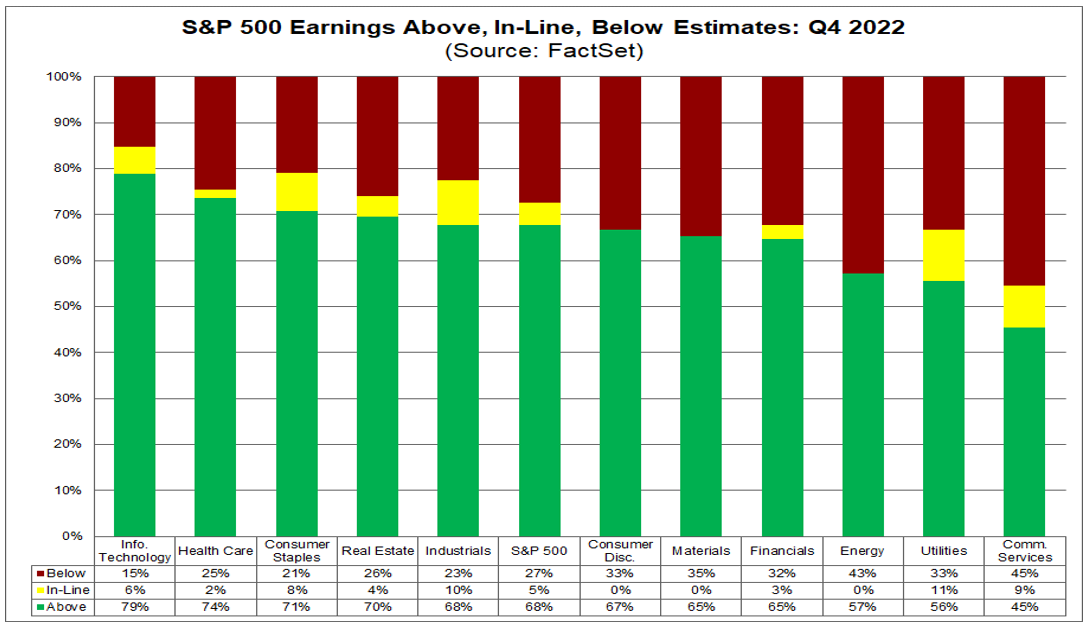

Q4 earnings update

-

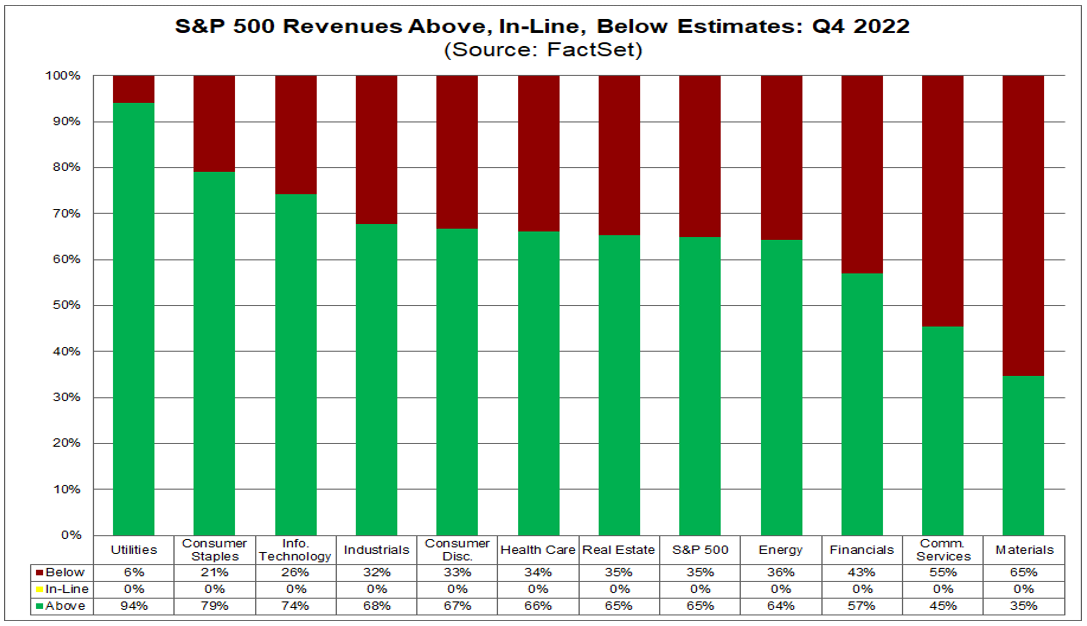

82% of S&P 500 has reported

-

68% beat EPS estimates (below 5- and 10-year averages)

-

65% beat sales estimates (below 5-year avg, above 10-year avg)

-

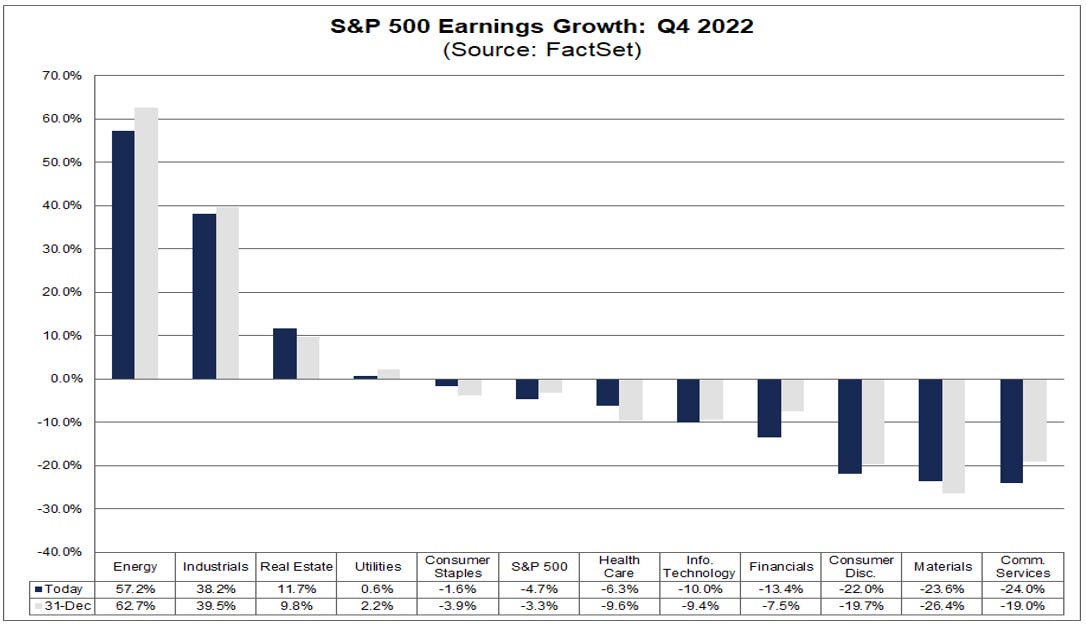

Blended earnings growth: -4.7%

-

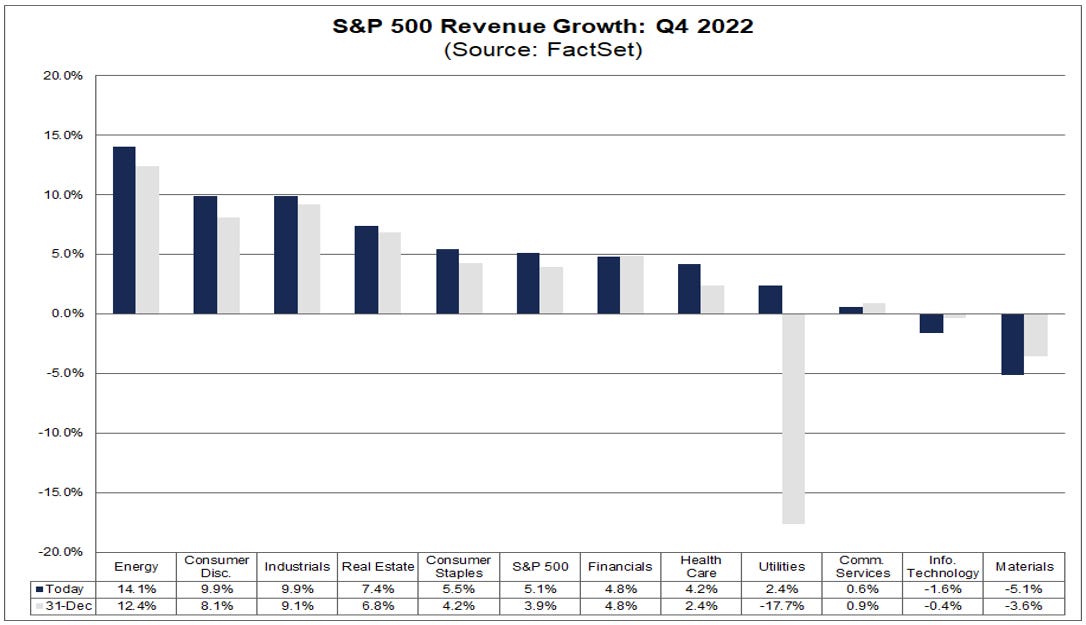

Blended sales growth: 5.1%

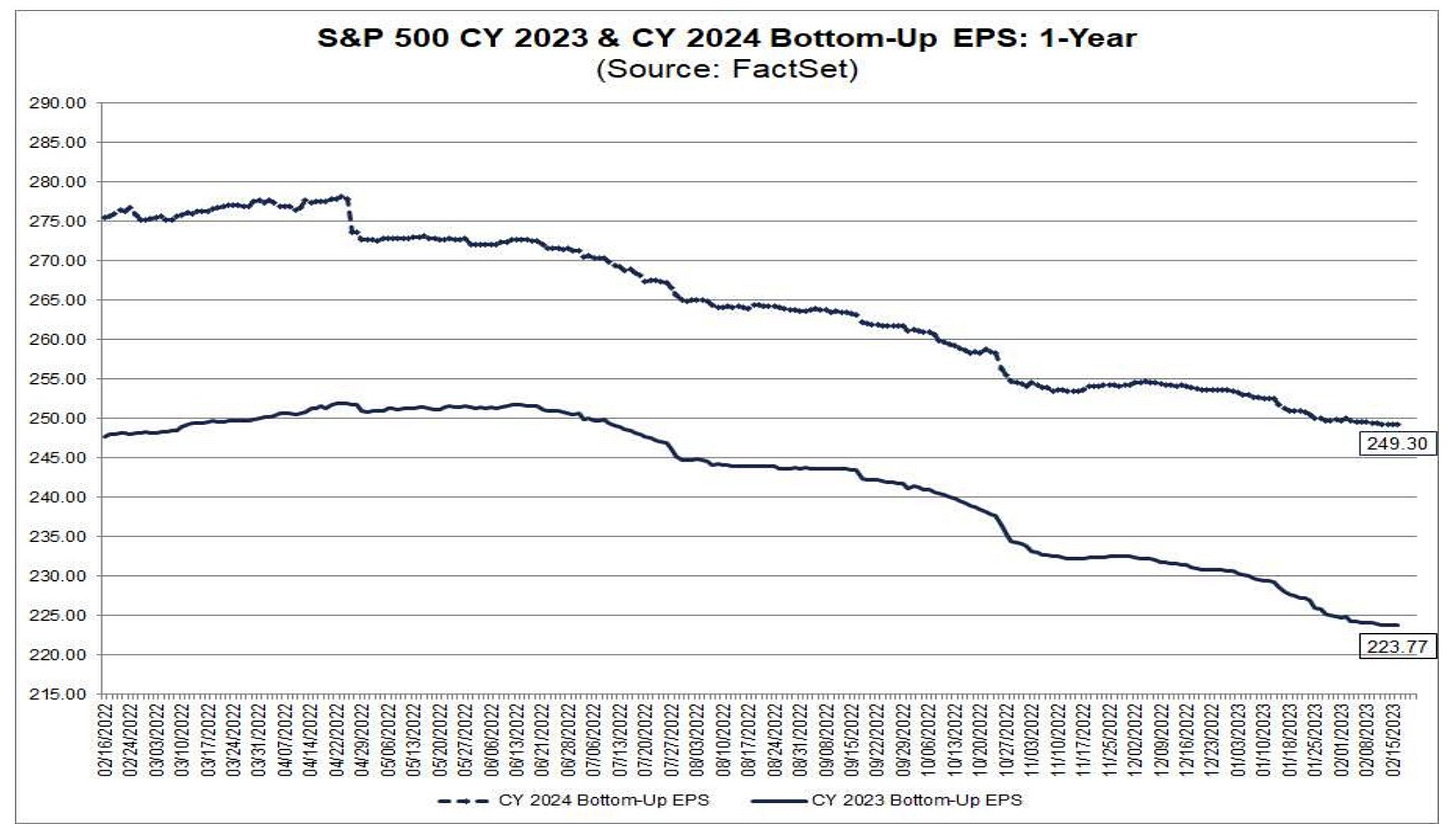

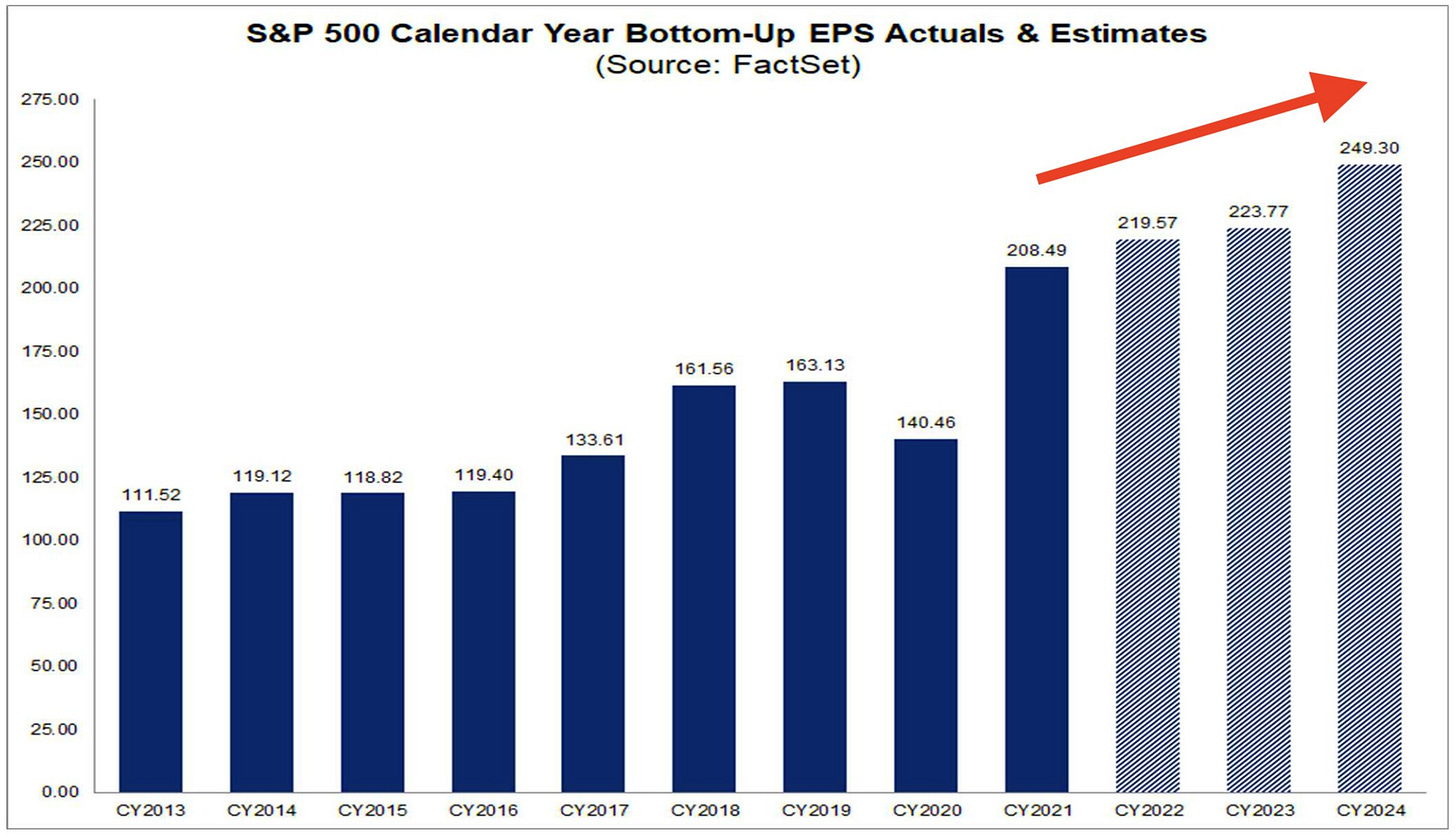

Earnings outlook

-

Consensus forward EPS estimates have come down

-

But…still suggest growth ahead:

John Deere (NYSE: DE)

-

Expects demand to stay strong

-

More than doubled quarterly income

-

Raised profit forecast

-

Farmers expected to plant more this year

-

CFO: "The supply chain is showing early signs of improvement but remains fragile"

Meta (NASDAQ: META)

-

Taking a page out of Elon's playbook

-

Launching paid verification subscriptions for Facebook, Instagram

-

$11.99 (web) vs. $14.99 (iOS) per month

-

-

Zuck: "This new feature is about increasing authenticity and security across our services"

HomeDepot (NYSE: HD)

-

Beat EPS, missed revenue

-

Attributes miss to drop in lumber prices

-

Muted outlook for 2023

-

Flat sales expected

-

Mid-single digit decline in EPS

-

Walmart (NYSE: WMT)

-

Double beat

-

Strong holiday quarter but cautious for 2023, beyond

-

Margins to compress on: lower prices, discounts, weak consumer sentiment, increase to employee wages

-

Outlook disappointed, below estimates

Earnings

-

Walmart

-

Home Depot

-

Medtronic (NYSE: MDT)

-

Teck Resources (NYSE: TECK)

-

Fluor (NYSE: FLR)

-

Crestwood Equity (NYSE: CEQP)

-

Harmoy Biosciences (NASDAQ: HRMY)

-

Hunstman (NYSE: HUN)

-

Dana Incoporated (NYSE: DAN)

-

Dillard's (NYSE: DDS)

-

Lincoln Electric (NASDAQ: LECO)

-

Middleby (NASDAQ: MIDD)

-

Walker & Dunlop (NYSE: WD)

-

Donnelly Financial (NYSE: DFIN)

-

Ingersoll-Rand (NYSE: IR)

CRYPTO UPDATE

Blur overtakes OpenSea

-

Blur: upstart marketplace

-

Incentivizes traders to treat NFTs like DeFi tokens

-

+$460 worth of Ethereum NFT trades over past 7 days

-

Vs OpenSea $107 million

-

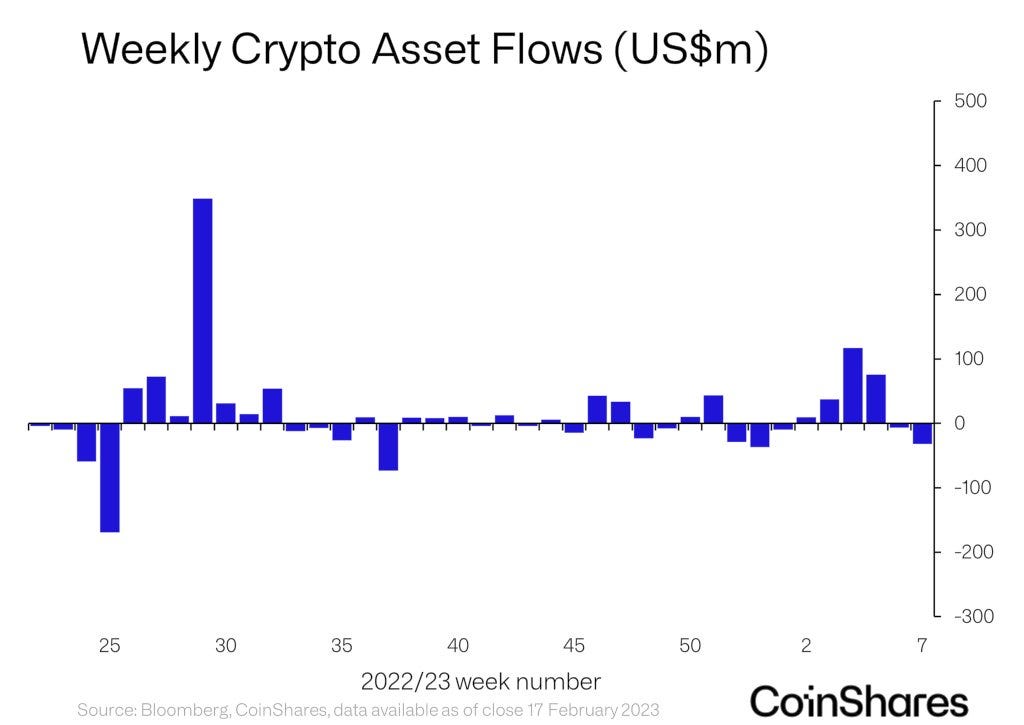

Digital asset fund flows

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: contributors LebanonCryptocurrency Earnings News Bonds Small Cap Markets