Starbucks Turnaround Under New CEO Brian Niccol Gains Momentum, Preps For Protein Push As 'Back to Starbucks' Investments Squeeze Q3 Profits (CORRECTED)

Starbucks Corp. (NASDAQ:SBUX) is signaling a confident stride in its “Back to Starbucks” turnaround strategy under CEO Brian Niccol, despite reporting a significant squeeze on third-quarter fiscal year 2025 profits.

Check out the current price of SBUX stock here.

What Happened: The company’s consolidated net revenue reached $9.5 billion, a 3% increase year-over-year, yet global comparable store sales declined by 2%.

This profit contraction is largely attributed to substantial investments in the foundational “Back to Starbucks” plan, including an allocation of over $0.5 billion in additional labor hours over the next year and a one-time investment in its Leadership Experience 2025 event.

“It’s clear, Back to Starbucks is the right plan. It is grounded in feedback from our customers and partners, and it’s rooted in what has always set us apart,” stated Brian Niccol during the earnings call.

The strategy prioritizes operational improvements. The “Green Apron Service” model, which Starbucks calls its “biggest investment ever in operating standards and customer service,” is now accelerating its rollout across all U.S. company-operated coffeehouses by mid-August.

Early pilots of this service have yielded promising results, showing improvements in transactions, sales, and customer service times. Additionally, its international business posted record-breaking quarterly revenue of over $2 billion during the third quarter.

Looking ahead, Starbucks is preparing a wave of innovation for 2026. This includes a robust menu pipeline with offerings like “protein cold foam,” which features 15 grams of protein with no added sugar, set to launch in late fourth quarter, alongside reimagined artisanal baked goods and new coffee experiences.

The Starbucks Rewards program is also slated for “significant innovations” to enhance loyalty and engagement beyond discounting. “We’re not just getting Back to Starbucks. We are building a better Starbucks, where everyone can experience the best of Starbucks, one that is stronger, more resilient and consistently growing,” Niccol affirmed.

Why It Matters: Starbucks announced its third-quarter revenue came in at $9.46 billion, surpassing analyst estimates of $9.29 billion.

However, the coffee giant reported third-quarter adjusted earnings of 50 cents per share, which fell short of analyst estimates of 65 cents per share.

Price Action: SBUX shares fell 0.76% on Tuesday but rose 4.61% in after-hours. The stock is up 0.86% year-to-date and 22.41% over the past year.

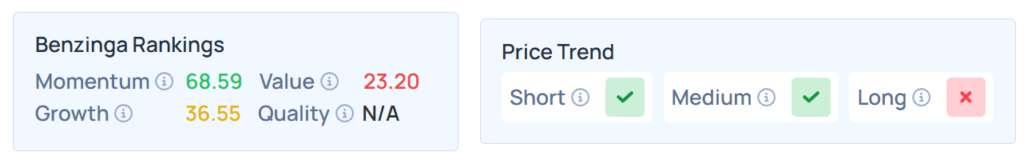

Benzinga's Edge Stock Rankings indicate that Starbucks maintains solid momentum across the short and medium term but a weaker trend over the long term. The stock scores poorly on value rankings, and its growth rating remains moderate at the 36.55th percentile. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended lower on Tuesday. The SPY was down 0.26% at $635.26, while the QQQ declined 0.15% to $567.26, according to Benzinga Pro data.

On Wednesday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Ned Snowman/Shutterstock

Editor’s Note: This article was updated to correct the CEO’s last name in the title.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings