Friday's Jobs Data Could Unleash A Dollar Short Squeeze Not Seen In Decades

At the start of July, the dollar was left for dead.

Fresh off its worst half-year performance since 1991 and facing a barrage of bearish bets, the U.S. currency looked set to fall deeper amid fears of President Donald Trump‘s tariffs and pressure on the Federal Reserve to cut rates.

But in just a few short weeks, the greenback has done a stunning rebound—and now, with one key data point left this week, it faces a setup that could spark a historic short squeeze.

Did Wall Street Get It Wrong On The Dollar?

At the end of June, net speculative positions in U.S. dollar index futures had collapsed to just 6,034 contracts—the lowest level since March 2021—after a sharp unwinding from over 16,800 in late March.

It was the clearest sign yet that traders were convinced the greenback was heading lower.

But the tide turned in dramatic fashion.

A combination of stronger-than-expected inflation, a hawkish Fed pause, resilient labor data, and perceived trade advantages from the latest U.S.-EU deal ignited a surge in the greenback.

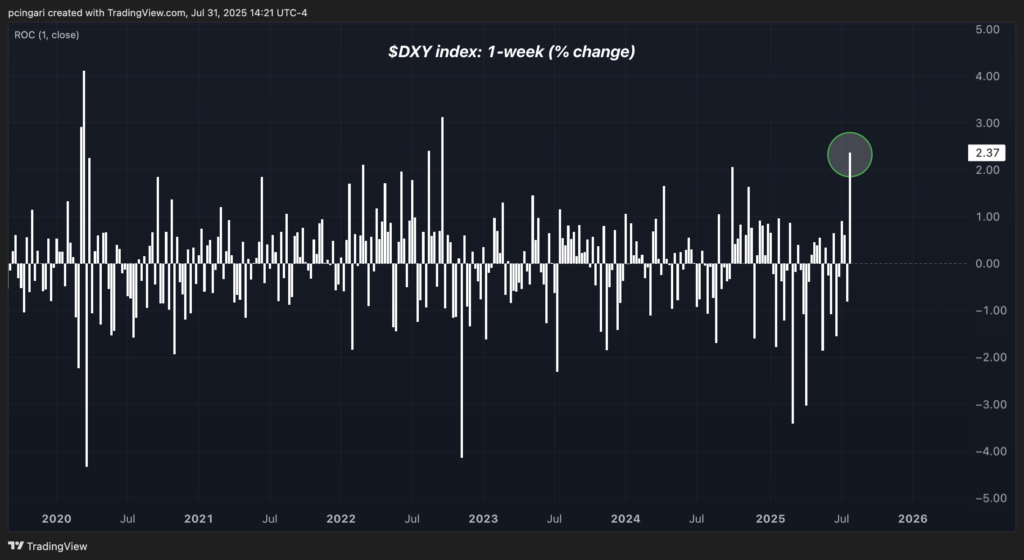

This week alone, the U.S. dollar index, as tracked by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP), jumped 2.4%, on pace for its best weekly performance since September 2022.

The greenback has also rallied for five straight sessions, putting July on track to be its first positive month of 2025.

Dollar Eyes Strongest Week Of Gains Since 2022

All Eyes on Friday’s Jobs Report

The question now is whether Friday's nonfarm payrolls data will add fuel to the rally.

Wall Street expects July's report to be soft.

Economists expect payrolls to slow from 147,000 in May to 110,000 in June, largely due to a pullback in government jobs.

The unemployment rate is forecast to increase from 4.1% to 4.2%, while average hourly earnings are expected to rise by 0.3% month-over-month and 3.8% year-over-year.

But the risks lean in one direction: a positive surprise.

Bank of America economist Shruti Mishra expects just 60,000 new jobs, but sees private payrolls rebounding to 85,000.

Goldman Sachs’ Ronnie Walker estimates 100,000 new jobs, roughly in line with consensus. Yet, he also flagged a potential revision lower to June's numbers, citing distortions in the education sector.

The Setup For A Short Squeeze?

If the official numbers exceed expectations—particularly on wages and private-sector jobs—the market reaction could be explosive as short sellers could find themselves scrambling to cover.

With positioning still skewed toward weakness, even a modest upside surprise might be enough to drive the dollar higher into early August, a month known for thin liquidity and sharp swings.

August has historically been one of the most volatile months for markets. The S&P 500 index has averaged a 0.56% decline over the past 30 years in August, and performance in the first year of a presidential term has been even worse, down 1.38% on average.

Friday's jobs report isn't just about employment figures. It could rewrite the greenback's 2025 narrative—and send shockwaves across currency, commodities and equity markets.

Read Next:

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Econ #s