Best Stocks For A Deflationary Environment (NEM, ABX, GG, DLTR, FDO, MRK, JNJ)

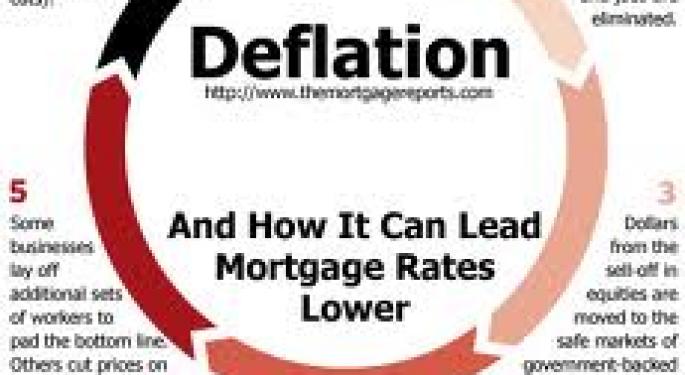

In a deflationary environment, stocks tend to go down as consumers and companies stop spending. Here is a list of stocks that I think will outperform should the economy take another turn for a worse and go into a double-dip recession.

The jobs report came out for July and it was much weaker than expected, with the economy losing 131,000 jobs last month. If the economy goes back into a deflationary environment, earnings will contract and thus stocks will go down -- but not all stocks. People still need to spend, and you can have hedges against a deflationary environment. Here are a few stocks to take a look at:

Gold Miners: Companies like Barrick Gold (NYSE: ABX), Newmont Mining (NYSE: NEM), and Goldcorp (NYSE: GG) are all low cost gold miners and gold is a currency hedge against deflation and inflation. The name I like the best here is Barrick, as it is completely unhedged and will directly benefit from any significant move higher in gold prices.

Dollar Stores: Look at dollar stores, like Family Dollar (NYSE: FDO) or Dollar Tree (NASDAQ: DLTR) as consumers look to seriously ratchet down spending and become thriftier than ever. I favor Dollar Tree in this space.

Drug Companies: Big, boring, dependable drug companies tend to outperform in deflationary environments and a couple of names I like in this space are Merck (NYSE: MRK) and Johnson & Johnson (NYSE: JNJ). Merck just finished closing its acquisition of Schering Plough, which should strengthen its pipeline. Besides, Johnson & Johnson is one of the most dependable blue-chip stocks, with brands like Band-Aid, Tylenol, Clean & Clear and Neutrogena.

If the economic reports continue to get worse (and it doesn't look like things are getting better), these companies should provide a boost to your portfolio.

See Some of the Top Moving Indexes Here.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deflation Jobs ReportLong Ideas Trading Ideas