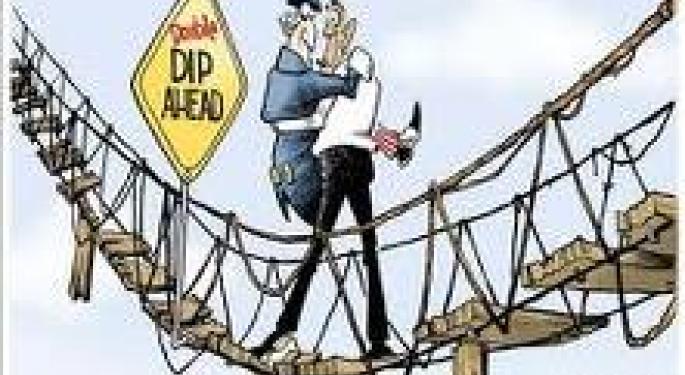

S&P Says Chances of Double Dip & Deflation are 20%

When you’re surrounded by the kind of market turbulence we saw last week, it’s always best to view the stock market with some context. S&P tried to provide it with an article that rates the chances of the U.S. having a Japanese style deflation, and double dip recession as being 20%, in the Aug. 18th, Outlook. Why didn’t they bother to separate the 2 variables out, as it’s possible to have a double dip recession without deflation, remains unanswered?

Here are some quotes from the report:

“The financial media is flush with prognosticators warning investors about the prospects for a double-dip recession, accompanied by deflation, or what I call

a 3-D economy. S&P Economics puts the potential of a 3-D economy at about 20%. In other words, it’s possible, but not probable.”

What does S&P recommend doing in case they're wrong? They recommend investing in companies with a lot of cash and little debt. What else is new?

An S&P analysis of Japan’s 10 year deflationary era from 1990 to 1999 showed these defensive sectors posted the best stock prices, which amounted to small positive gains: Consumer discretionary, consumer staples, health care, telecom services, and information technology recorded small positive gains. Energy, materials, utilities, financials, and industrials recorded negative returns.

Analyze Any Stock FREE! Click Here.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deflation Double dip recession S&PLong Ideas Economics Markets Personal Finance