Atlantic City's Most Expensive Failure Re-Opens Its Doors This Week... Maybe

Eccentric and flamboyant Floridian entrepreneur Glenn Straub is taking one last crack at pointing Atlantic City in the right direction. This week, the $2.4 billion Revel casino resort re-opens in Atlantic City. Maybe.

The Revel originally opened in 2012 and was 90 percent financed by Morgan Stanley (NYSE: MS). Two years and two bankruptcies later, Revel closed its doors for good.

In April 2015, Straub scooped up Revel for $82 million and announced plans to re-open the resort in June of 2016. According to Bloomberg’s Romy Varghese, Straub has some creative ideas for the 6.3 million-square-foot resort, including a polo club with the ponies stabled in the parking garage, water parks and rope courses, an indoor ski run, a cryotherapy chamber and a university he refers to as the “tower of geniuses” that will explore pressing world problems such as nuclear waste disposal. And, of course, there will eventually be gambling.

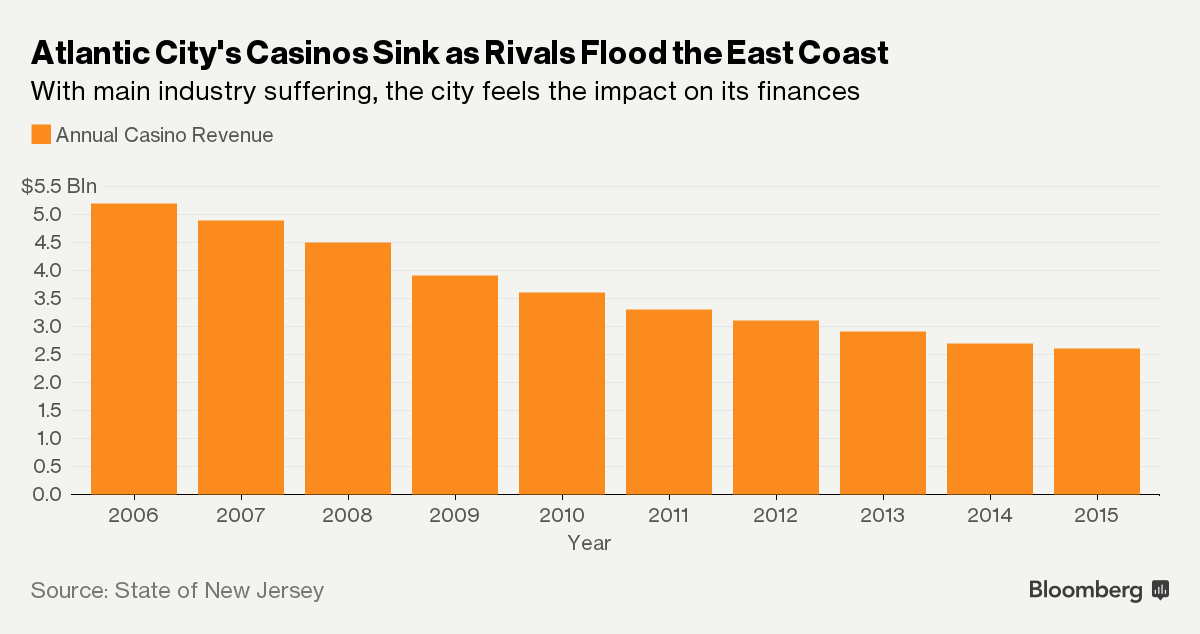

Atlantic City’s casino boom peaked back in 2006 when the city brought in a record $5.2 billion in gross gaming revenue. Since then, revenue has steadily declined as neighboring states opened up casinos of their own.

The city lost more than 8,000 jobs when four of the 12 Atlantic City casinos closed up shop in 2012. Roughly a third of Atlantic City’s residents now live below the poverty line.

However, Straub’s rebirth of the Revel is hitting some major bumps in the road. A spokeswoman for the New Jersey gaming regulator called Straub's casino license application “substantive but incomplete.”

Revel was supposed to re-open its doors on Wednesday, but as of 8 a.m. city officials report that the hotel has no sewage access.

For investors who still believe in an Atlantic City turnaround, the best stock play just might be MGM Resorts International (NYSE: MGM), which recently bought out Boyd Gaming Corporation (NYSE: BYD)’s 50 percent stake in the city’s largest casino, the Borgata.

Disclosure: The author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: atlantic cityLong Ideas News Topics Travel Events Trading Ideas General Best of Benzinga