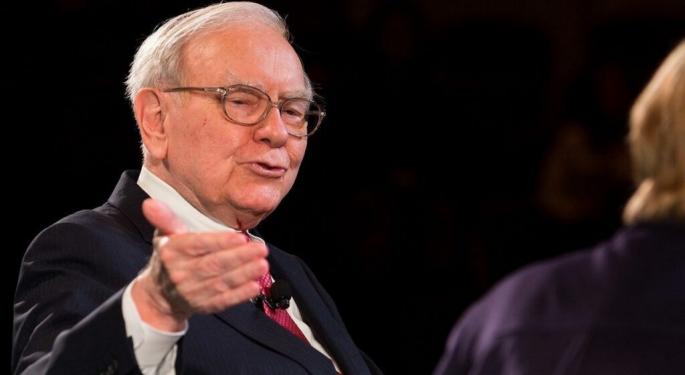

Warren Buffett Plans To Sell His Real Estate Brokerage, But It's 'Not… A Bet Against US Home Prices,' Says Analyst As Fed Expects To Keep Rates Unchanged

Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK) led by the Oracle of Omaha, Warren Buffett, is in talks to sell its real estate brokerage business to New York-based Compass Real Estate. While some experts view this as his levered bet against the U.S. home prices, others see it as a consolidation in the realty sector.

What Happened: Compass has offered to buy Berkshire’s realty business, HomeServices of America, including Real Living, for an undisclosed price, according to a WSJ report. The Berkshire business has about 820 offices and 270 franchises, whereas Compass is the second-largest U.S. brokerage.

After these reports emerged, billionaire investor Chamath Palihapitiya took to X and said that “The world's best investor is selling his bet levered to US home prices.”

However, there wasn’t a consensus on the fact that a bet against a traditional brokerage is the same as betting against the U.S. home prices. According to Amy Nixon, a DFW housing and economic analyst, the possible sale of Berkshire’s realty business to Compass was “not necessarily a bet against US home prices,” because Buffett could be betting on the real estate technology to reshape the industry further.

Why It Matters: Despite a sale of its business having any correlation with a bet on U.S. home prices, as mentioned by Nixon. The impact of higher interest rates does affect the housing market. Higher interest rates strain both homebuyers, facing increased monthly payments, and sellers, experiencing reduced demand and lower offers.

The Federal Reserve’s primary monetary policy-making body, the Federal Open Market Committee, is scheduled to meet on March 18 and 19 this week to decide on the course of interest rates.

According to the CME Group's FedWatch tool, there is a 99% chance that the Federal Reserve will keep interest rates unchanged for the March meeting. However, the probability of an ease increases from June 2025 onwards.

Furthermore, the U.S. real estate sector is consolidating, as Rocket Companies Inc. (NYSE:RKT) signed an acquisition deal worth $1.75 billion last week with Redfin Corp. (NASDAQ:RDFN).

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Friday. The SPY was advanced 2.07% to $562.81, and the QQQ also jumped 2.42% to $479.66, according to Benzinga Pro data.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Amy Nixon Chamath Palihapitiya Compass Real Estate HomeServices of America Housing Real EstateNews Markets