9 Top Sell Ideas From Oppenheimer's Technical Analysis Division

In a new report, Oppenheimer analyst Ari Wald discussed the firm’s top technical sell ideas in each of the nine market sectors. While Oppenheimer remains bullish on the market as a whole, the nine stocks mentioned in the report have shown technical indicators that suggest upside will be hard to come by.

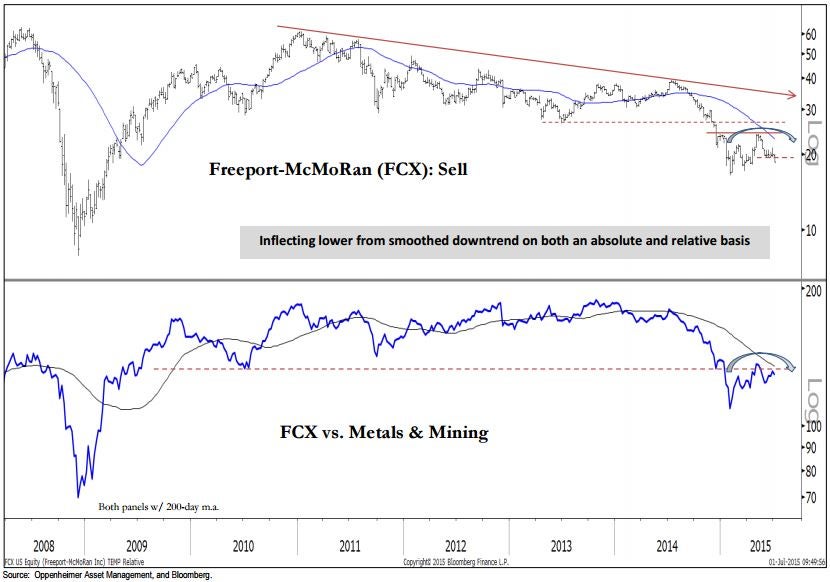

Freeport-McMoran Inc (NYSE: FCX)

Oppenheimer sees technical breakdowns for Freeport-McMoran on both an absolute basis and a chart versus metals & mining peers. The stock has generally been trending downward dating back to 2011.

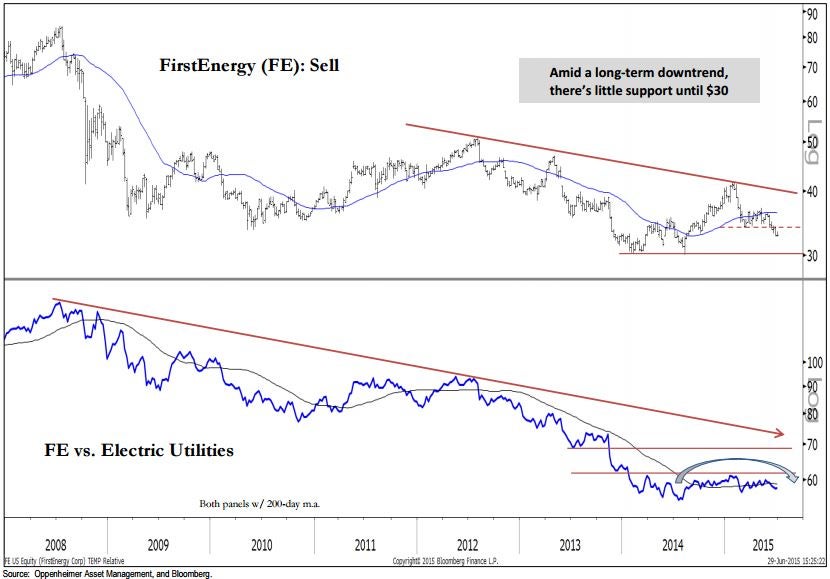

FirstEnergy Corp (NYSE: FE)

FirstEnergy has been unable to break above its downward-sloping resistance line since late-2011, and Oppenheimer sees little support for the stock until the $30 level.

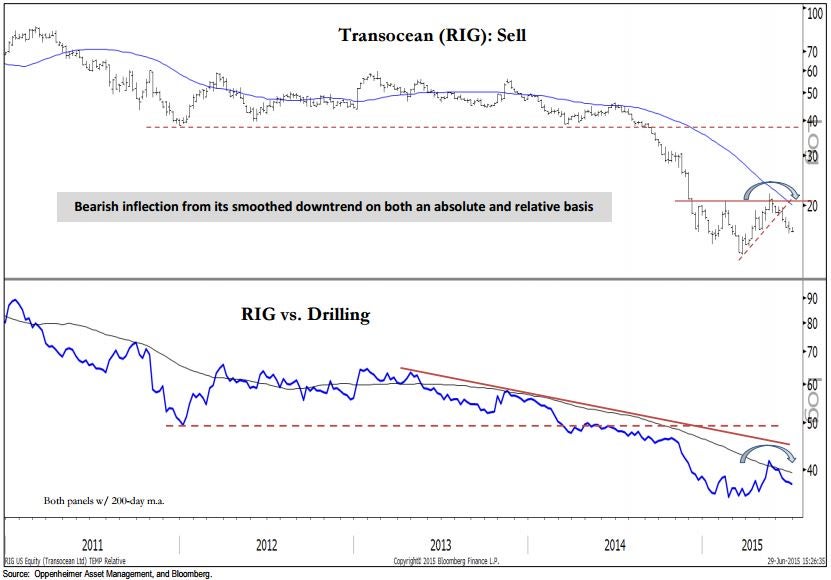

Transocean Ltd (NYSE: RIG)

Transocean has been trending downward versus other drilling names going back to 2013, and the stock recently failed for the second time to break above a resistance level that has been in place throughout 2015.

Jacobs Engineering Group Inc (NYSE: JEC)

Oppenheimer believes that a recent breakdown in Jacobs’ price versus other construction engineering stocks could be an indication that a more than two-year-old support level at just under $40 might soon fall.

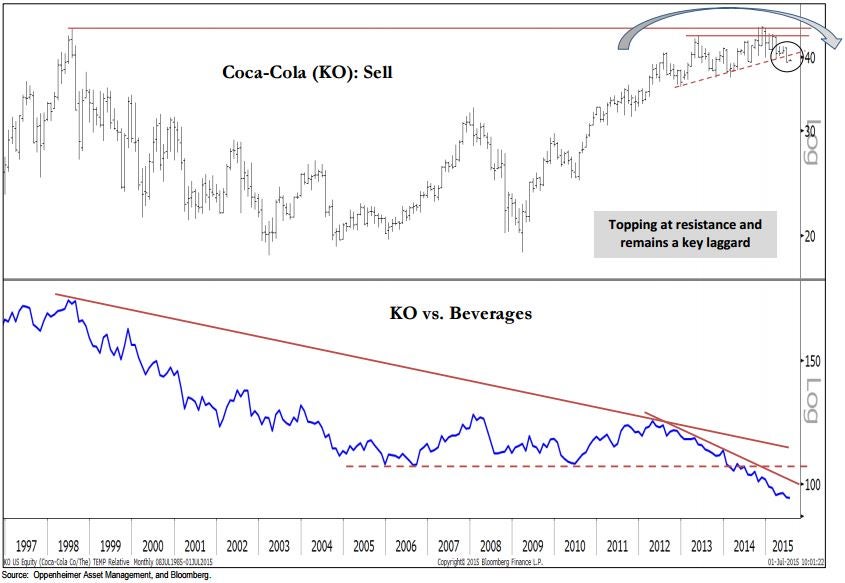

The Coca-Cola Co (NYSE: KO)

On a relative basis, Coca-Cola has been lagging other Beverage stocks going all the way back to 1998. After the stock was recently unable to break out to new all-time highs, Oppenheimer believes that there is significant downside remaining.

HCP Inc (NYSE: HCP)

While Oppenheimer believes that HCP is currently oversold, the stock's long-term underperformance versus other REITs indicates that any jumps in price should be seen as selling opportunities.

Qualcomm Inc (NASDAQ: QCOM)

Oppenheimer sees major recent technical breakdown on both Qualcomm’s absolute chart and its chart versus other communication equipment names.

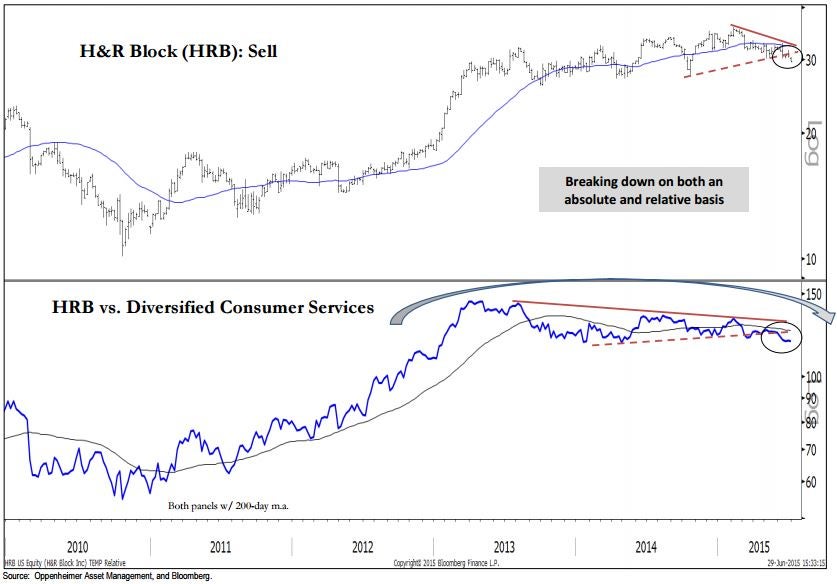

H&R Block Inc (NYSE: HRB)

Despite the relative strength in the Consumer Discretionary sector, H&R Block recently broke out to the downside from triangle patterns on both its relative and absolute charts.

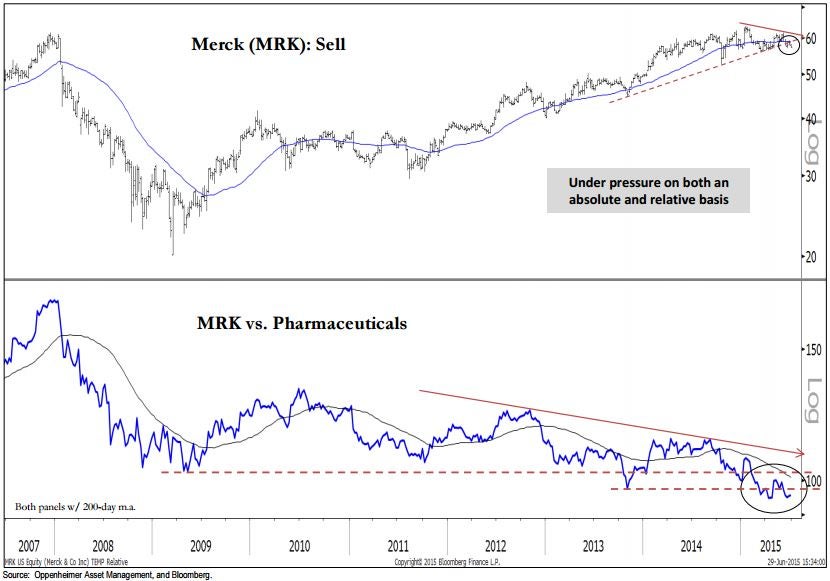

Merck & Co Inc (NYSE: MRK)

The Healthcare sector is Oppenheimer’s top sector pick at the moment, but recent technical breakdowns indicate that Merck will not be participating in any further upside in the space.

Latest Ratings for FCX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Mar 2022 | Jefferies | Maintains | Buy | |

| Jan 2022 | Deutsche Bank | Maintains | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Ari Wald OppenheimerAnalyst Color Short Ideas Technicals Top Stories Analyst Ratings Trading Ideas Best of Benzinga