Starbucks Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Starbucks Corporation (NASDAQ:SBUX) will release earnings results for the third quarter, after the closing bell on Tuesday, July 29.

Analysts expect the Seattle, Washington-based company to report quarterly earnings at 65 cents per share, down from 93 cents per share in the year-ago period. Starbucks projects to report quarterly revenue at $9.31 billion, compared to $9.11 billion a year earlier, according to data from Benzinga Pro.

The company missed analyst estimates for revenue last quarter and missed estimates in seven of the past 10 quarters.

Starbucks shares fell 0.8% to close at $93.67 on Monday.

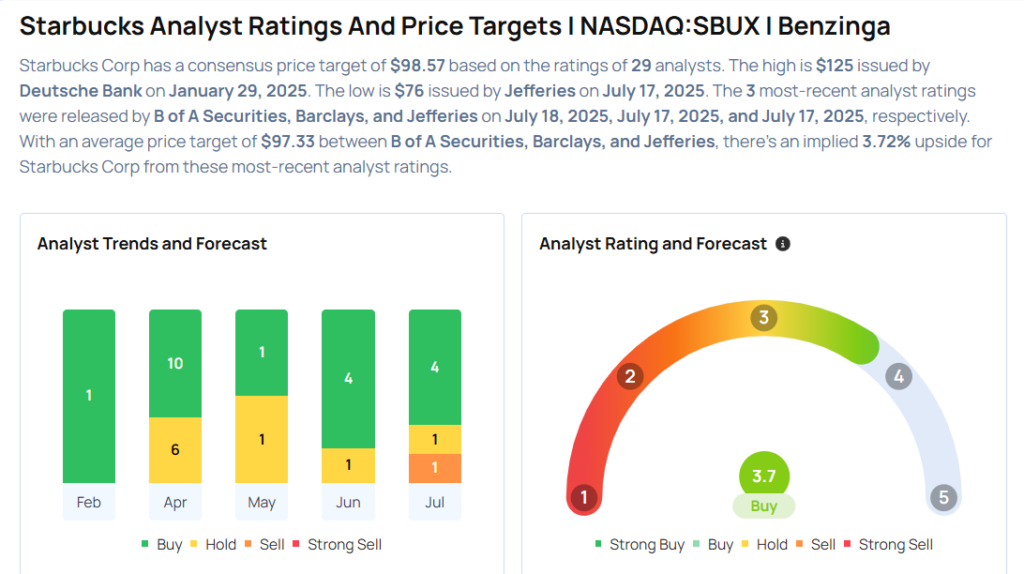

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Barclays analyst Jeffrey Bernstein maintained an Overweight rating and cut the price target from $108 to $106 on July 17, 2025. This analyst has an accuracy rate of 64%.

- Citigroup analyst Jon Tower maintained a Neutral rating and boosted the price target from $95 to $100 on July 14, 2025. This analyst has an accuracy rate of 70%.

- Stifel analyst Chris O'Cull maintained a Buy rating and increased the price target from $92 to $105 on July 11, 2025. This analyst has an accuracy rate of 76%.

- Bernstein analyst Richard Clarke maintained an Outperform rating and raised the price target from $90 to $100 on July 2, 2025. This analyst has an accuracy rate of 62%.

- Evercore ISI Group analyst David Palmer maintained an Outperform rating and increased the price target from $95 to $105 on June 24, 2025. This analyst has an accuracy rate of 61%.

Considering buying SBUX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstokc

Latest Ratings for SBUX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | MKM Partners | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas