Robinhood Likely To Report Higher Q2 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Robinhood Markets, Inc. (NASDAQ:HOOD) will release earnings results for the second quarter, after the closing bell on Wednesday, July 30.

Analysts expect the Menlo Park, California-based company to report quarterly earnings at 35 cents per share, up from 30 cents per share in the year-ago period. Robinhood projects to report quarterly revenue at $913.33 million, compared to $682 million a year earlier, according to data from Benzinga Pro.

The company has beaten analyst estimates for revenue in two straight quarters and seven of the last 10 quarters overall.

Robinhood shares fell 3.2% to close at $103.32 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

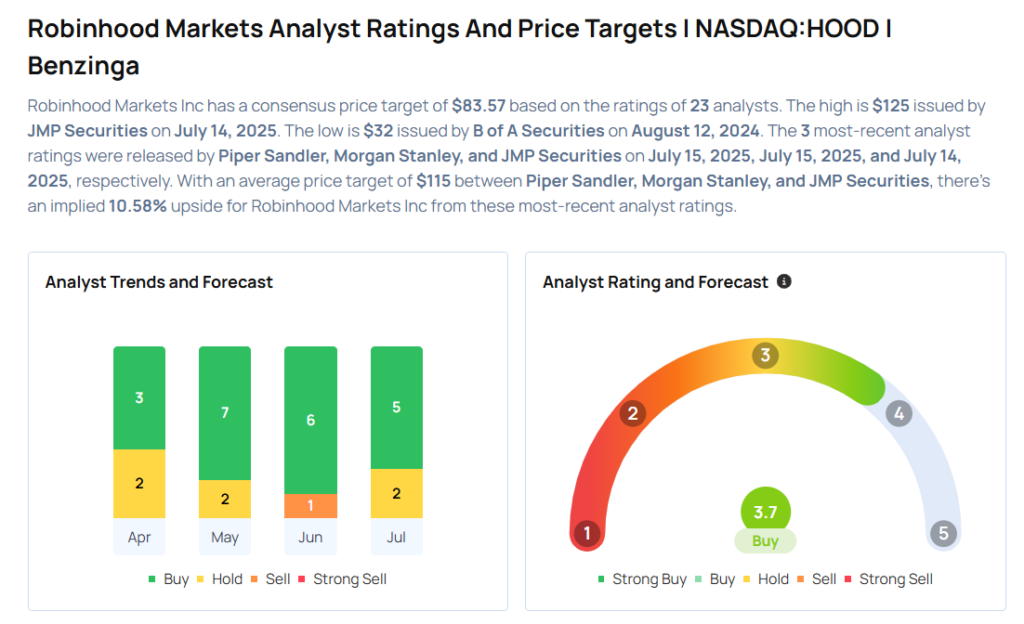

- Piper Sandler analyst Patrick Moley maintained an Overweight rating and increased the price target from $70 to $110 on July 15, 2025. This analyst has an accuracy rate of 89%.

- Morgan Stanley analyst Michael Cyprys maintained an Equal-Weight rating and raised the price target from $43 to $110 on July 15, 2025. This analyst has an accuracy rate of 68%.

- JMP Securities analyst Devin Ryan maintained a Market Outperform rating and increased the price target from $70 to $125 on July 14, 2025. This analyst has an accuracy rate of 85%.

- Barclays analyst Benjamin Budish maintained an Overweight rating and raised the price target from $57 to $102 on July 10, 2025. This analyst has an accuracy rate of 83%.

- Citigroup analyst Christopher Allen maintained a Neutral rating and increased the price target from $50 to $100 on July 7, 2025. This analyst has an accuracy rate of 78%.

Considering buying HOOD stock? Here’s what analysts think:

Read This Next:

Latest Ratings for HOOD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Deutsche Bank | Maintains | Hold | |

| Jan 2022 | Barclays | Maintains | Equal-Weight | |

| Jan 2022 | Rosenblatt | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Most Accurate AnalystsEarnings News Price Target Markets Analyst Ratings Trading Ideas