Anthony Scaramucci Says It'll Be A 'Big Deal' If Jamie Dimon-Led JPMorgan Allows Lending Against Bitcoin

Anthony Scaramucci, the founder of SkyBridge Capital, said Monday that JPMorgan Chase & Co.’s (NYSE:JPM) reported plan to allow clients to borrow against their Bitcoin (CRYPTO: BTC) holdings has the potential to change the financial dynamics of the leading cryptocurrency.

What Happened: In an X post, Scaramucci described the banking behemoth’s reported plans to offer loans backed by Bitcoin as a “big deal.” He said the current Bitcoin market hasn’t been fully tapped for traditional financial mechanisms such as loans.

“Imagine how much houses would be worth in a world with no mortgages. That's the reality we've been living in with Bitcoin, but that's about to change,” Scaramucci stated.

Scaramucci also highlighted the potential for large holders to swap Bitcoin for exchange-traded fund shares without realizing capital gains tax, should the SEC approve in-kind creation and redemption.

Journalist Andrew Feinberg questioned Scaramucci’s argument, suggesting that this benefits wealthy early adopters and rich whales more than average investors who lack liquidity to invest in Bitcoin.

Another X user, Mr. Yo, reminded everyone about the 2008 housing crisis, suggesting that leveraging Bitcoin could create a new bubble.

See Also: Ray Dalio Says 15% In Bitcoin Or Gold May Be Essential As Fiat Currencies Face Devaluation Risks

Why It Matters: JP Morgan is reportedly preparing to offer loans backed by cryptocurrencies such as Bitcoin and Ethereum (CRYPTO: ETH), although official announcements have yet to be made. This initiative could begin as early as next year, but details remain under review and subject to change.

Notably, CEO Jamie Dimon has been a vocal critic of Bitcoin, labeling the asset a “fraud.” Despite this criticism, he has indicated support for client liberty in digital asset investing.

Price Action: At the time of writing, BTC was exchanging hands at $118,213, down 0.81% in the last 24 hours, according to data from Benzinga Pro.

Shares of JPMorgan were down 0.06% in after-hours trading after closing 0.11% lower at $298.28 during Monday's regular trading session.

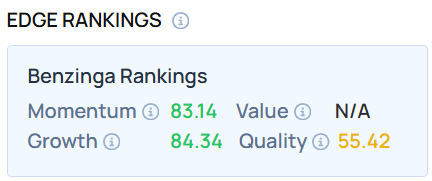

JPM ranked high on the Momentum and Growth metrics as of this writing. For similar information on other big banking stocks, check out the Benzinga Edge Stock Rankings.

Read Next:

Anthony Scaramucci | Photo courtesy: Al Teich / Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency