Assessing MARA Holdings: Insights From 7 Financial Analysts

In the preceding three months, 7 analysts have released ratings for MARA Holdings (NASDAQ:MARA), presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 1 |

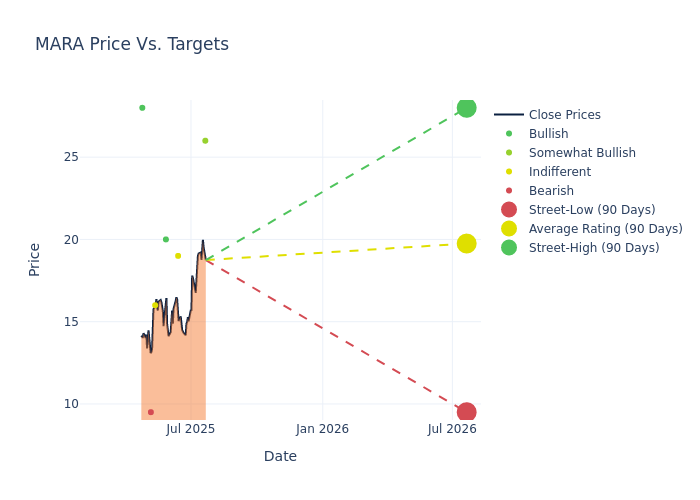

Insights from analysts' 12-month price targets are revealed, presenting an average target of $20.21, a high estimate of $28.00, and a low estimate of $9.50. Observing a downward trend, the current average is 8.72% lower than the prior average price target of $22.14.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive MARA Holdings. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Moley | Piper Sandler | Raises | Overweight | $26.00 | $23.00 |

| Reginald Smith | JP Morgan | Raises | Neutral | $19.00 | $18.00 |

| Chris Brendler | Rosenblatt | Raises | Buy | $20.00 | $17.00 |

| Ramsey El-Assal | Barclays | Raises | Equal-Weight | $16.00 | $14.00 |

| Joe Flynn | Compass Point | Lowers | Sell | $9.50 | $25.00 |

| Patrick Moley | Piper Sandler | Lowers | Overweight | $23.00 | $30.00 |

| Kevin Dede | HC Wainwright & Co. | Maintains | Buy | $28.00 | $28.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to MARA Holdings. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of MARA Holdings compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of MARA Holdings's stock. This analysis reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into MARA Holdings's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on MARA Holdings analyst ratings.

Delving into MARA Holdings's Background

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value. The company also offers technology solutions to optimize data center operations, including next-generation liquid immersion cooling and firmware for bitcoin miners. It is focused on computing for, acquiring, and holding digital assets as a long-term investment.

MARA Holdings's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3M period, MARA Holdings showcased positive performance, achieving a revenue growth rate of 29.47% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -249.29%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): MARA Holdings's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -13.58%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -8.05%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: MARA Holdings's debt-to-equity ratio stands notably higher than the industry average, reaching 0.71. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MARA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Compass Point | Maintains | Buy | |

| Jan 2022 | Jefferies | Initiates Coverage On | Buy | |

| Jan 2022 | BTIG | Initiates Coverage On | Buy |

Posted-In: BZI-AARAnalyst Ratings