Evaluating Amazon.com Against Peers In Broadline Retail Industry

In today's rapidly evolving and fiercely competitive business landscape, it is crucial for investors and industry analysts to conduct comprehensive company evaluations. In this article, we will undertake an in-depth industry comparison, assessing Amazon.com (NASDAQ:AMZN) alongside its primary competitors in the Broadline Retail industry. By meticulously examining crucial financial indicators, market positioning, and growth potential, we aim to provide valuable insights to investors and shed light on company's performance within the industry.

Amazon.com Background

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Amazon.com Inc | 36.76 | 7.83 | 3.73 | 5.79% | $36.48 | $78.69 | 8.62% |

| Alibaba Group Holding Ltd | 14.47 | 1.83 | 1.88 | 1.23% | $21.8 | $90.83 | 6.57% |

| PDD Holdings Inc | 10.96 | 3.16 | 2.70 | 4.59% | $16.09 | $54.73 | 10.21% |

| MercadoLibre Inc | 58.55 | 24.12 | 5.39 | 10.56% | $0.92 | $2.77 | 36.97% |

| Coupang Inc | 218.64 | 12.71 | 1.81 | 2.53% | $0.36 | $2.32 | 11.16% |

| JD.com Inc | 7.48 | 1.36 | 0.28 | 4.6% | $14.27 | $47.85 | 15.78% |

| eBay Inc | 18.66 | 7.23 | 3.69 | 9.95% | $0.77 | $1.86 | 1.13% |

| Ollie's Bargain Outlet Holdings Inc | 39.46 | 4.55 | 3.39 | 2.78% | $0.07 | $0.24 | 13.35% |

| Vipshop Holdings Ltd | 7.79 | 1.39 | 0.54 | 4.85% | $2.45 | $6.08 | -4.98% |

| Dillard's Inc | 12.16 | 3.70 | 1.07 | 8.97% | $0.26 | $0.69 | -1.64% |

| MINISO Group Holding Ltd | 16.28 | 3.69 | 2.25 | 3.98% | $0.65 | $1.96 | 18.89% |

| Macy's Inc | 6.30 | 0.76 | 0.15 | 0.84% | $0.31 | $2.0 | -4.14% |

| Savers Value Village Inc | 73.79 | 3.87 | 1.10 | -1.13% | $0.03 | $0.2 | 4.51% |

| Kohl's Corp | 8.91 | 0.29 | 0.07 | -0.4% | $0.23 | $1.4 | -4.41% |

| Hour Loop Inc | 166 | 10.04 | 0.42 | 11.93% | $0.0 | $0.01 | 4.68% |

| Average | 47.1 | 5.62 | 1.77 | 4.66% | $4.16 | $15.21 | 7.72% |

By conducting a comprehensive analysis of Amazon.com, the following trends become evident:

-

With a Price to Earnings ratio of 36.76, which is 0.78x less than the industry average, the stock shows potential for growth at a reasonable price, making it an interesting consideration for market participants.

-

The elevated Price to Book ratio of 7.83 relative to the industry average by 1.39x suggests company might be overvalued based on its book value.

-

The stock's relatively high Price to Sales ratio of 3.73, surpassing the industry average by 2.11x, may indicate an aspect of overvaluation in terms of sales performance.

-

The company has a higher Return on Equity (ROE) of 5.79%, which is 1.13% above the industry average. This suggests efficient use of equity to generate profits and demonstrates profitability and growth potential.

-

The company has higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $36.48 Billion, which is 8.77x above the industry average, indicating stronger profitability and robust cash flow generation.

-

The gross profit of $78.69 Billion is 5.17x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

-

With a revenue growth of 8.62%, which surpasses the industry average of 7.72%, the company is demonstrating robust sales expansion and gaining market share.

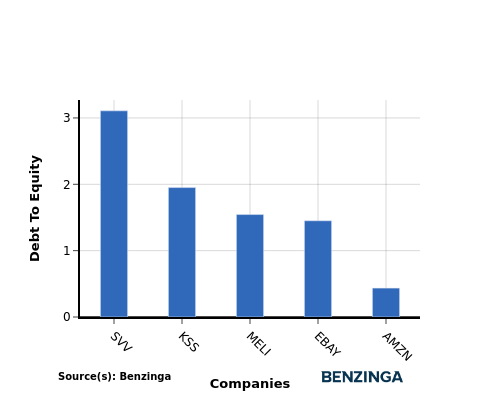

Debt To Equity Ratio

The debt-to-equity (D/E) ratio measures the financial leverage of a company by evaluating its debt relative to its equity.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Amazon.com stands in comparison with its top 4 peers, leading to the following comparisons:

-

Among its top 4 peers, Amazon.com has a stronger financial position with a lower debt-to-equity ratio of 0.44.

-

This indicates that the company relies less on debt financing and maintains a more favorable balance between debt and equity, which can be viewed positively by investors.

Key Takeaways

For Amazon.com, the PE ratio is low compared to its peers in the Broadline Retail industry, indicating potential undervaluation. The high PB and PS ratios suggest that the market values the company's assets and sales highly. Amazon.com's high ROE, EBITDA, gross profit, and revenue growth reflect strong financial performance relative to industry competitors. Overall, Amazon.com appears to be well-positioned in the Broadline Retail sector based on these valuation metrics.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-IANews Markets Trading Ideas