West Fraser Timber Stock May Face Prolonged Weakness Ahead

West Fraser Timber (NYSE:WFG) has entered a no-action zone under the Adhishthana Principles, with both its weekly and monthly structures pointing to a prolonged period of consolidation. Here’s how the cycle is shaping up and why investors might want to steer clear for now.

West Fraser’s Guna Triads and the Slump

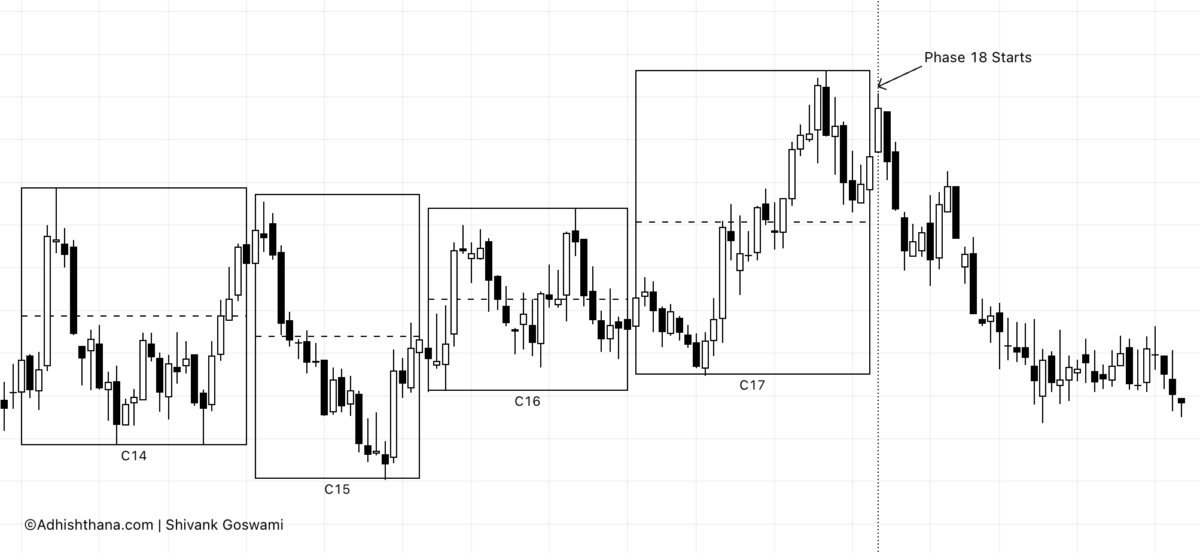

Under the Adhishthana Principles, phases 14, 15, and 16 are collectively referred to as the Guna Triads. These triads are key in determining whether a stock will attain its Nirvana in phase 18, which represents the highest point of the 18-phase cycle. For a Nirvana move to materialize, the triads must show the presence of Satoguna, which reflects a clean and strong bullish structure.

"A Lack of noticeable Satoguna in any of the triads leads to no Nirvana in Phase 18." -Adhishthana: The Principles That Govern Wealth, Time & Tragedy

In the case of West Fraser, the triads lacked the presence of Satoguna. This rules out the possibility of a Nirvana move, setting the stage for continued bearishness in phase 18. This has already played out to a large extent. Since entering phase 18, the stock has corrected by around 29 percent and has remained in a slump for over 245 days.

Phase 18 on the weekly chart ends on 25 May 2026. Until then, further weakness or sideways movement is likely. The monthly chart supports a similar outlook.

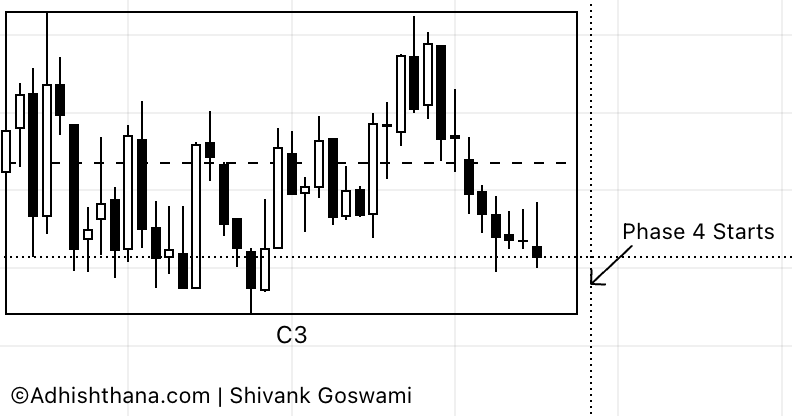

Monthly Chart and the Upcoming No-Action Phase 4

The stock is currently in phase 3 on the monthly chart and is forming the Adhishthana Yajya structure, which typically signals bearishness. This phase is set to end on 2 November 2025. After that, the stock will enter phase 4.

According to the principles, phase 4 is considered a no-action phase. This phase will last until late 2029, pointing to a multi-year period of consolidation and limited upside potential.

Investor Outlook

The combination of a Nirvana-devoid phase 18 on the weekly chart and the no-action phase 4 on the monthly chart suggests a prolonged phase of underperformance. Investors should avoid entering the stock at this time and wait until the structure begins to shift.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas