Fastenal Analysts Boost Their Forecasts After Upbeat Earnings

Fastenal Company (NASDAQ:FAST) reported better-than-expected second-quarter earnings on Monday.

Fastenal reported quarterly earnings of 29 cents per share which beat the analyst consensus estimate of 28 cents per share. The company reported quarterly sales of $2.08 billion which beat the analyst consensus estimate of $2.07 billion.

Gross margin rose slightly to 45.3% of net sales, driven by modest price/cost benefits and improved fastener margins tied to product expansion and supplier programs. Operating income increased to 21% of sales, up from 20.2% in the second quarter of 2024.

For 2025, net capital outlays are expected to range from $250 million to $270 million, below earlier guidance but above 2024 levels. The increase reflects distribution center upgrades, delayed IT initiatives, and hardware deployments.

Fastenal shares gained 4.2% to close at $45.07 on Monday.

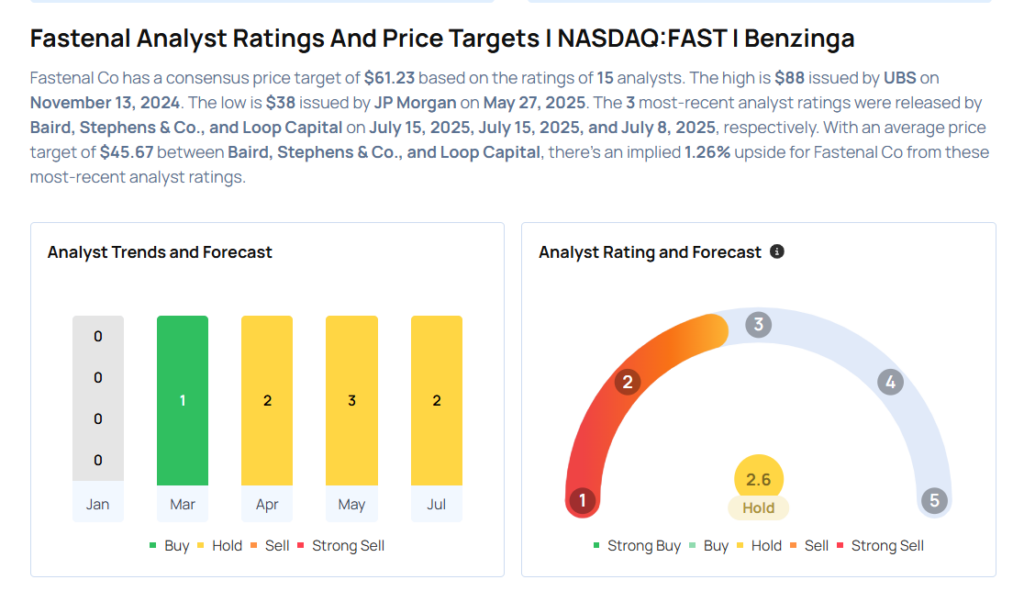

These analysts made changes to their price targets on Fastenal following earnings announcement.

- Stephens & Co. analyst Tommy Moll maintained Fastenal with an Equal-Weight rating and raised the price target from $40 to $45.

- Baird analyst David Manthey maintained the stock with a Neutral and raised the price target from $43 to $47.

Considering buying FAST stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for FAST

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Upgrades | Underweight | Equal-Weight |

| Jan 2022 | Morgan Stanley | Maintains | Underweight | |

| Jan 2022 | Morgan Stanley | Maintains | Underweight |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas