ETF Analysis: Is The Energy Sector (XLE) Still A Long-Term Buying Opportunity?

Following a record-breaking 2022, investors are wondering whether energy stocks still have untapped potential for long-term returns.

Oil prices have risen sharply in the last week, with WTI crude recording a 6% weekly gain and rising far above $70 per barrel on the back of lower-than-expected U.S. inventories and remarks from OPEC+ to maintain a tight supply throughout the year.

Commodities gains sent energy stocks higher, with the Energy Select Sector SPDR ETF (ARCA: XLE) outperforming other equity sectors.

Occidental Petroleum (NYSE: OXY), up 4% on the week, and Valero Energy Corp. (NYSE: VLO), up 3% on the week, are two of the top performers in the energy sector during the past week.

The sector's giants, including Exxon Mobil Corp (NYSE: XOM) and Chevron Corp (NYSE: CVX), have gained 10% and 6%, respectively, since the March lows.

Read more: Warren Buffett's Berkshire Hathaway Boosts Stake In Occidental Yet Again — Spends $1B This Month

The Reasons Why The Energy Sector Is a Good Pick for the Long Run

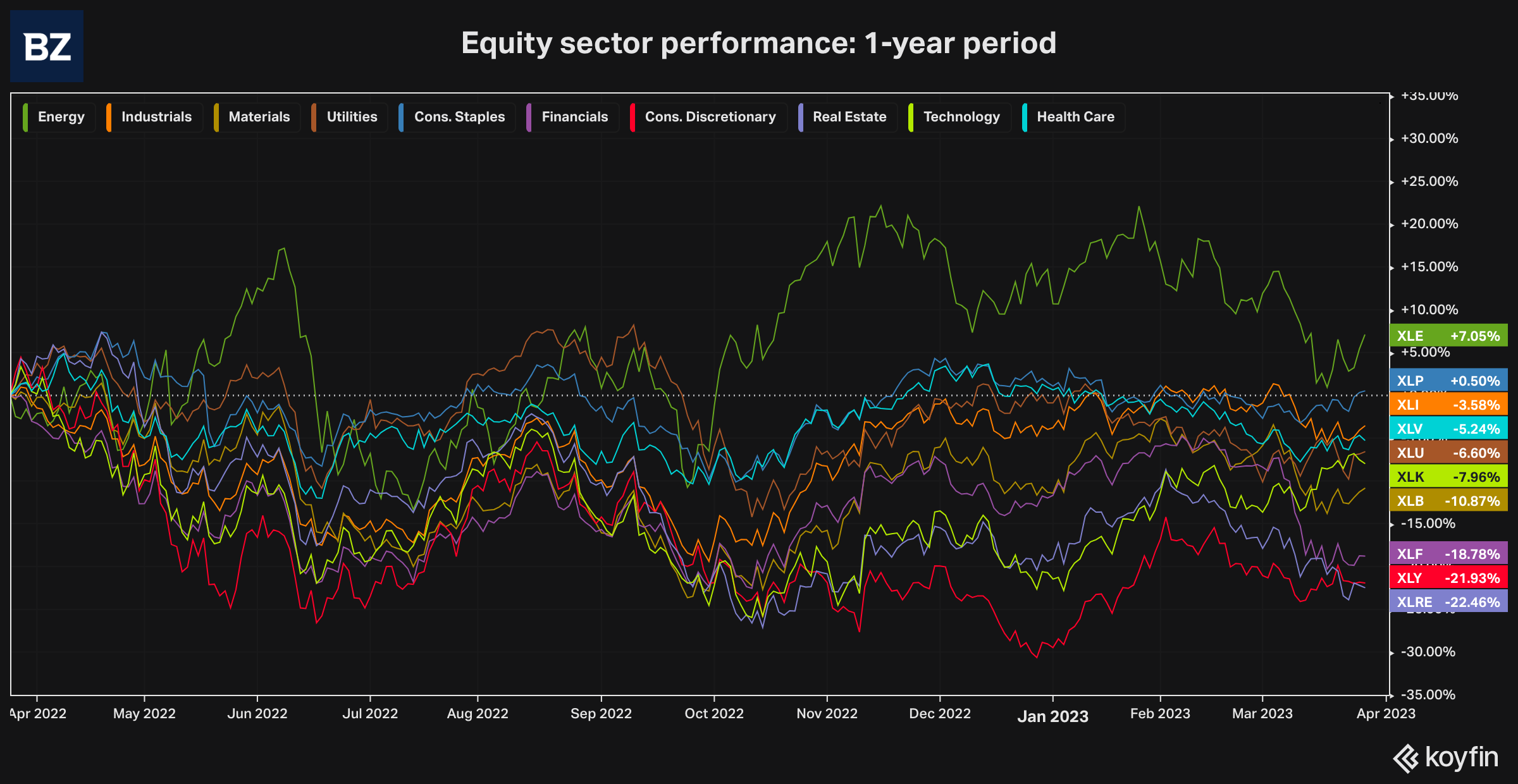

The energy sector (XLE) continues to screen the best sectoral performance in a one-year span, with a 7% gain.

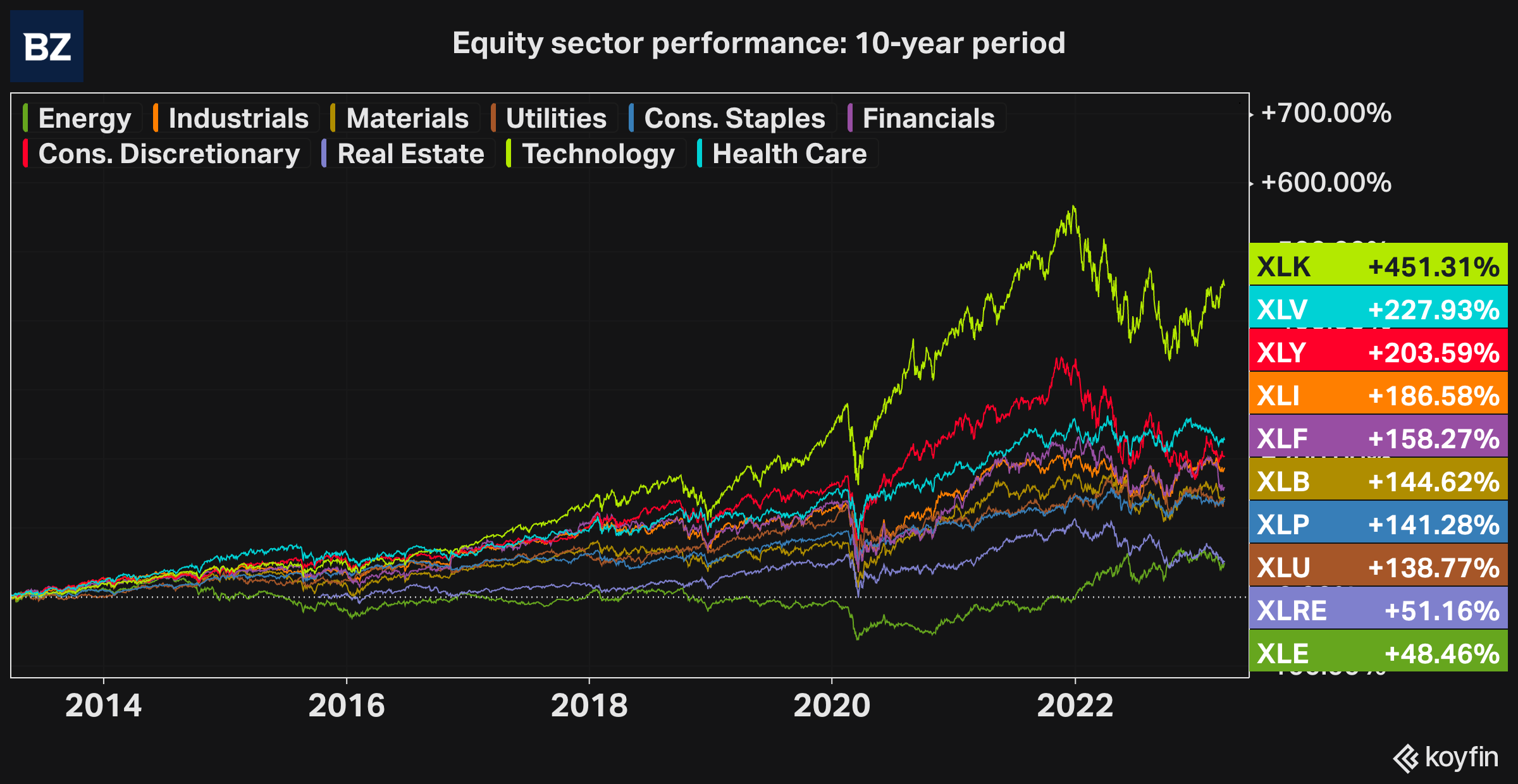

However, looking back at the past decade, the energy sector stands out as the poorest performer, trailing the technology sector by a staggering 353%.

Despite recent gains, the sector's considerable long-term underperformance makes it particularly attractive to long-term value investors.

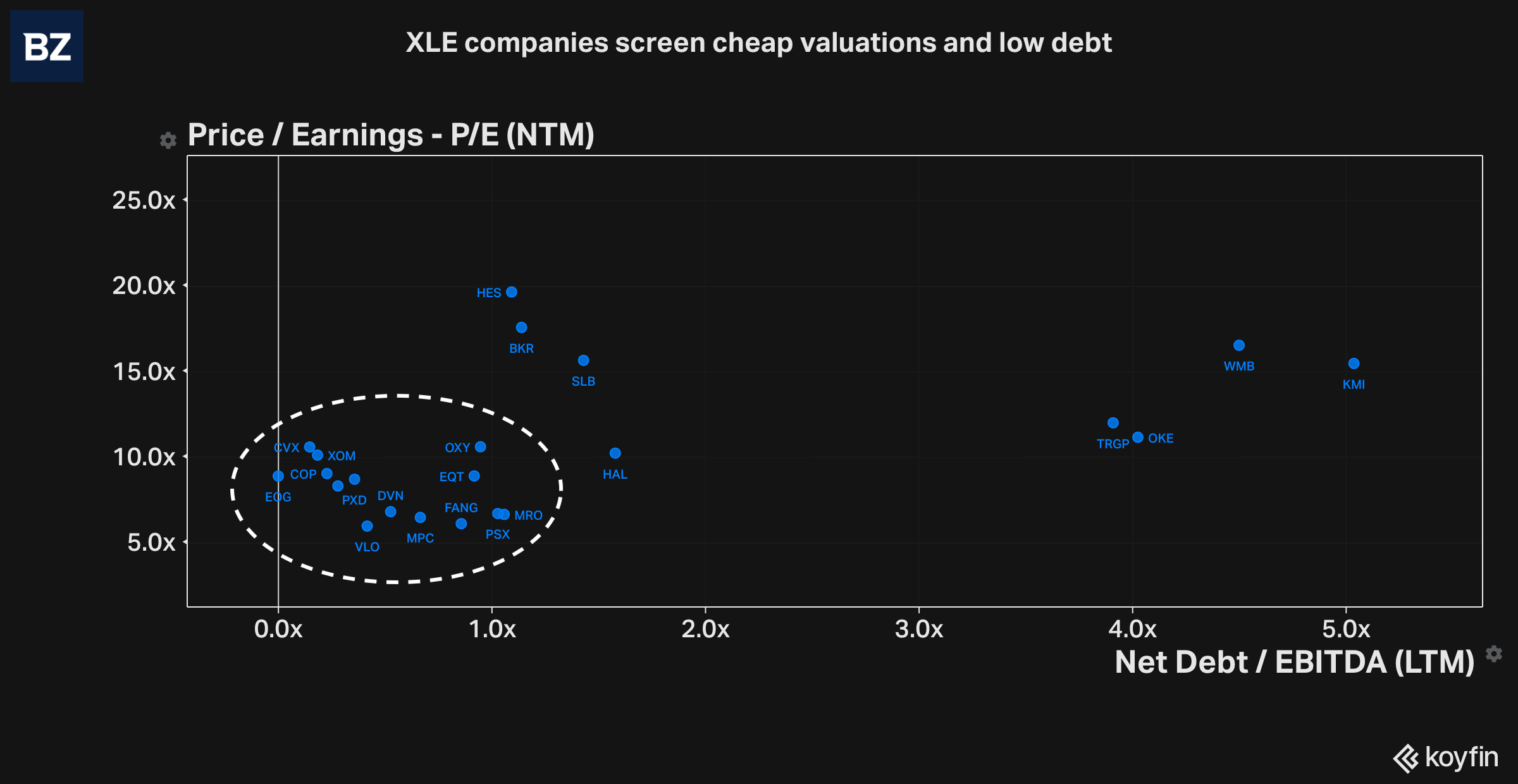

Currently, the majority of XLE holdings are exhibiting cheap valuations, based on the forward ratio and solid balance sheet fundamentals, as measured by the net debt/EBITDA ratio.

XLE Key Metrics:

- YTD Total Return: -6.7%

- 1-year Total Return: 7.05%

- 5-year Total Return: 54.11%

- 10-year Total Return: 48.46%

- Dividend yield: 3.48%

- P/E Ratio (Next Twelve Months): 7.44

Read next: Natural Gas Prices Hit 30-Month Low, But Cheniere Energy Is Trading Higher

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Crude Oil Energy SectorLong Ideas Sector ETFs Commodities Markets Trading Ideas ETFs