Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio This Month

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Interpublic Group of Companies Inc (NYSE:IPG)

- On April 24, Interpublic posted upbeat quarterly results. Philippe Krakowsky, CEO of Interpublic said, “Results in the first quarter were consistent with our expectations. As we previously indicated, account activity over the prior twelve-month period will weigh on this year, though that impact was lessened in the quarter by sound underlying performance, with notable growth at IPG Mediabrands, Deutsch and Golin, as well as growth at Acxiom. Financial discipline remained strong, evidenced by our 9.3% adjusted EBITA margin in our smallest seasonal quarter.” The company's stock fell around 10% over the past month and has a 52-week low of $22.51.

- RSI Value: 27.3

- IPG Price Action: Shares of Interpublic fell 3.2% to close at $22.87 on Monday.

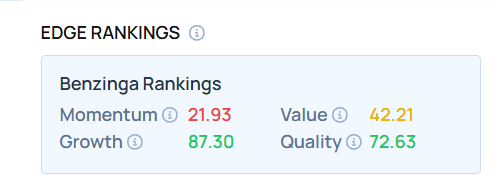

- Edge Stock Ratings: 21.93 Momentum score with Value at 42.21.

Omnicom Group Inc (NYSE:OMC)

- On April 15, Omnicom Group reported worse-than-expected first-quarter revenue results. “Organic revenue growth for the first quarter was 3.4%. We are assessing the implications of economic and market events to determine how they will affect our clients and business for the remainder of 2025. While uncertainty has increased, one thing hasn’t changed and will always be true – Omnicom is a trusted partner for our clients, offering strategic advice to grow their sales while delivering flexibility, value and performance,” said John Wren, Chairman and Chief Executive Officer of Omnicom. The company's stock fell around 9% over the past month and has a 52-week low of $69.13.

- RSI Value: 26.2

- OMC Price Action: Shares of Omnicom fell 4% to close at $70.49 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in OMC stock.

Stagwell Inc (NASDAQ:STGW)

- On May 22, Stagwell reported equity inducement grants under Nasdaq Listing Rule 5635(c)(4). The company's stock fell around 27% over the past month and has a 52-week low of $4.07.

- RSI Value: 26.3

- STGW Ltd Price Action: Shares of Stagwell dipped 6.7% to close at $4.16 on Friday.

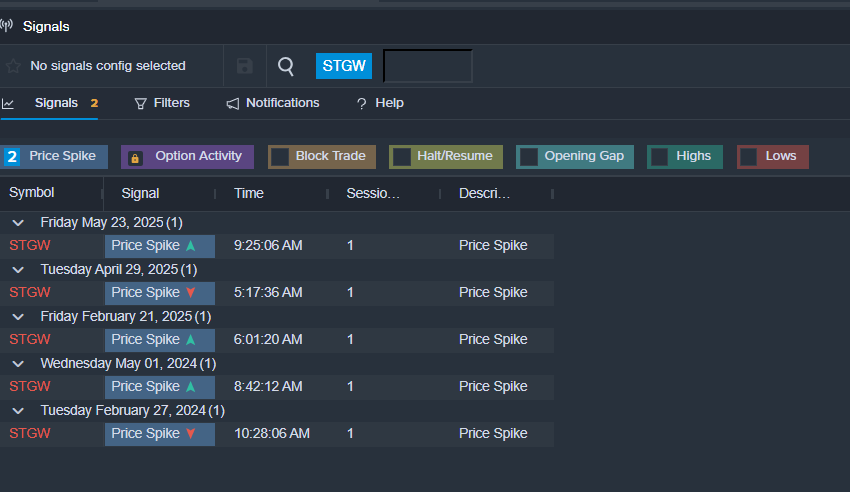

- Benzinga Pro’s signals feature notified of a potential breakout in STGW shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Posted-In: Expert Ideas Oversold Stocks Pro ProjectLong Ideas News Pre-Market Outlook Markets Trading Ideas